I’ve talked a lot on this blog about P2P or social lending, mainly because I’ve been involved with Zopa since its launch and followed its siblings: Boober, Smava, Prosper, Lending Club, Ratesetter, Cashare, Loanio …

Suffice to say there is a world of direct social lending out there and it’s now big business (Zopa recently gained over two percent market share for all UK personal retail credit lending).

But the parallel phenomenon has been crowdfunding.

Crowdfunding differs to social lending in that it is investing for returns in new business start-ups and, like crowdsourcing, it pools the money of the masses into a nice venture fund to get things started.

Much of the focus of crowdfunding has been around Kickstarter, the American leader in this space.

Kickstarter provides a platform for funding by pre-selling your idea, rather than providign equity in the business.

So, for example, you have a conceptual music idea, and you pre-sell the idea through Kickstarter with the hope of getting enough monies to fund the implementation of the idea (unlike other sites where you get an equity stake in the business).

Kickstarter kicked off in business in April 2009 and, three years later, had seeded $200 million in funds across 50,000 projects.

Most of these projects are related to entertainment and the arts (about sixty percent of all projects), although some are technology and related fields.

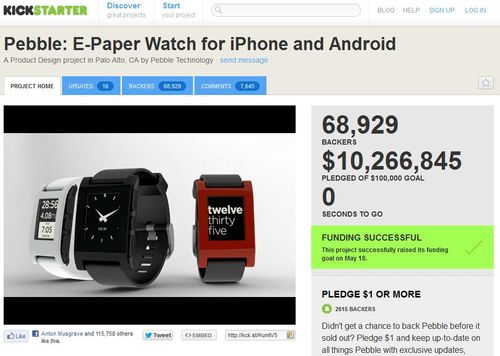

For example, in their most recent success, Kickstarter generated $10 million in funding for a new venture called Pebble.

Pebble is a smartwatch that will connect to a smartphone.

According to the Wall Street Journal, it raised more than $1 million in its FIRST DAY on Kickstarter (April 17 2012).

The offer was to pledge $115 to pre-order the watch.

By mid-May, Pebble had achieved its goal of raising $10.27 million. The funds were gained from 68,929 people, making it the most crowdfunded start-up ever in dollar terms.

Nothing like a cool gadget to get people excited.

Nevertheless, as mentioned, most of the projects are related to music, film, art, theatre, design and publishing, and these provide some interesting stats.

For example, of the platform's 7,388 successful music projects in June 2012, 6,446 of them (87.3%) had raised $10,000 or less; 238 of them raised more than $20,000; 8 raised more than $100,000; and one (Amanda Palmer) raised more than $1 million (stats from Billboard).

Similarly, not all projects succeed in raising the funding required. In fact, about 41% of the projects listed fail with only half getting the funding needed.

However, crowdfunding is big business – Kickstarter had $100 million of pledges by May 2011 increasing to $250 million by May 2012 – and now the service is coming to the UK.

From autumn 2012, the service will offer crowdfunding outside the USA for the first time.

That’s an important development, but it’s not a clear space. There are other crowdfunding services like Indiegogo, crowdrise, razoo and more, and even specialist sites for vertical markets like MedStartr for start-ups in Medicines.

And the UK already has some crowdfunding sites – like Funding Circle, CrowdCube, Seedrs and ThinCats – so it’s a hot market space to watch right now.

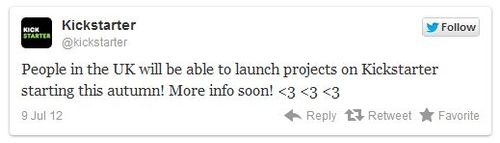

According to Massolution, a research firm specializing in crowdsourcing and crowdfunding solutions, crowdfunding platforms raised almost $1.5 billion worldwide in 2011, with a growth rate of 63% CAGR. The report forecasts that the funding figres will double in 2012 to near $3 billion raised from 530 platforms, uip from 452 in 2011.

Source: Marketing Charts

So this is already a serious alternative to bank credit for business and small start-ups.

Watch this space very carefully.

How Crowdfunding Works, infographic from Mashable (doubleclick image to enlarge)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...