I liked what Hillary Clinton said about data in yesterday's blog: “Data not only measures progress, it inspires it.”

The reason I liked it is that it brought me back to the basics of what I do in banking: data leverage.

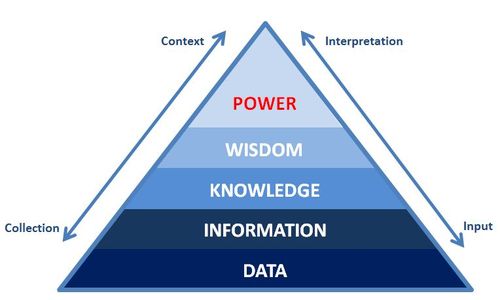

There’s an old chart we used to knock around about data creating power:

The whole idea is that the more humans add context and interpretation to raw data, the more powerful you become.

By human interpretation, it can be programmed too, but it’s the human spin on data that creates leverage.

It’s what I’ve blogged about regularly:

- Data is a currency … we just haven’t realised its value yet

- Why banks should worry about Google, Apple, Facebook ...

- The future competitive battleground

- Banks should follow Google's approach to privacy

- A big know know

And continue to do so.

You see, the thing that we keep coming back to is: why don’t banks get it?

Some do get it, but most don’t?

Get what?

Leveraging data of course.

In the 1990s, I was working with one megabank on a re-engineering of processes project. We wanted to tackle the mortgage process as it was the easiest way to get quick wins. But no, we ended up doing the money transmissions process.

Why?

Because mortgages cut across divisions and money transmissions did not.

In other words, we were avoiding stepping on the toes of the baronial leaders of each silo of the bank.

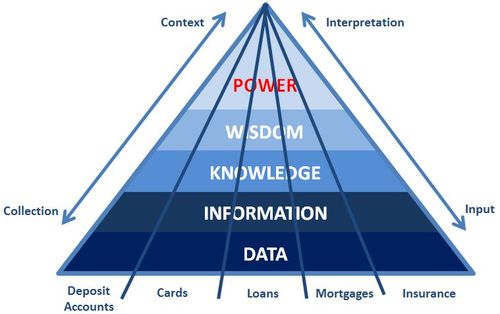

These silos of the bank cut the data cake into pieces and the more pieces, the less powerful the data becomes.

The separation of information means that the information is a lot less meaningful than the picture you would gain from the whole.

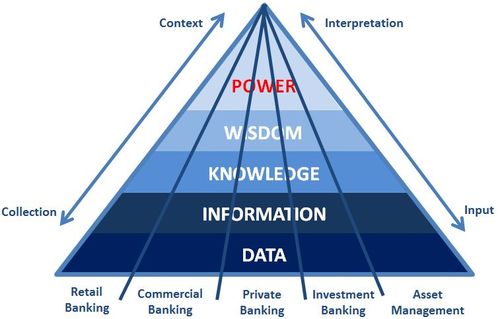

But an enterprise view is not easy.

Again, it’s something I was heavily involved in the late 1990s, as we pushed data mining and propensity modelling to banks.

Leverage the data for a single customer view.

A wonderful idea, but the baronial silos stopped it again.

I’m not sharing my data with Joe’s division as I’m targeted on sales of my product, not his.

There’s the rub of the issue.

Each baronial head is protecting their turf and pay.

As Hillary Clinton also said in my blog yesterday: “what gets measured gets done”.

Yes, and what gets measured and rewarded, gets done first.

So if you measure a division on their sales performance, and they worry that they might underperform if another division had access to their customer, then they naturally block the sharing of knowledge and data with the other divisions.

That’s why banks have these silos.

But Amazon and Apple don’t.

If Amazon and Apple were run like a bank – something I explored a while ago – they would separate customer data.

The would organised themselves so that they have a book division, a music division, a film division and more, all competing against each other for share of customer wallet.

This means they would separate customer data, and keep it protected.

They would only know what books you buy and, separately, what films you buy and, separately, what films you buy and so on.

They might know you downloaded the latest One Direction tune, but would fail to grasp the sales leverage opportunities to also sell you the One Direction ebook and the One Direction video download.

It just wouldn’t happen.

But in banking it does and it still does today.

For example, when I saw the same bank recently, I asked if they ever did tackle the mortgage process.

The answer was no, for the same reason.

And even if they did create an enterprise customer view, could they use it?

I’m not sure.

I’m not sure in part, as the legal separation of some activities is always raised.

The Data Protection Act is often an easy way to say ah no, don’t go there and try that.

Alternatively, the rules about Chinese Walls across the bank are put forward as the challenge.

Admittedly, with the Vickers and Volcker Rules coming into force about separation of bank activities, the latter may be a real challenge.

But it's not the real barrier however.

The real barrier is getting rid of the silos and re-engineering the legacy.

The legacy that is not only the retail bank silos, but the bank silos overall.

And this is where new banks have opportunity.

If you can create a new bank on a single data set, integrated with an enterprise view, then you really do have power.

Now I wonder who might do that?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...