There’s a buzz that’s started about Facebook banking asCommonwealth Bank of Australia and ICICI Bank get into Facebook banking apps, with Citibank fast to follow.

What’s going on?

Originally, we all though Facebook would take over bank functions through stealth creep via Facebook credits.

Facebook credits are in fact worth around $1.5 billon a year in revenue at 2011, about 15% of Facebook’s revenues, and are predicted to reach almost $50 billion by 2014.

So why did Facebook drop the credit system?

Because they didn’t.

They just switecherood from having something customers didn’t understand – a credit – to something they do understand – a dollar.

You still work with Facebook in pretty much the same way – register your credit or debit card details and then you can buy add-ins to games, apps and other media.

In other words, they’ve decided to take the iTunes route to payments, where everyone is registered with an account profile and all they have to do then is ‘confirm’.

From there, it’s a one-step beyond to consider the idea that ‘Facebook connect’ for a secure logon (and it is) becomes ‘pay with Facebook’ for a secure payment.

At that point, Facebook has both an iTunes card aggregation capability (currently expected to be for around 50 million people this year from 15 million last year) growing into a full PayPal style payments service shortly thereafter.

As Techcrunch noted: “And then, what’s to stop Facebook from introducing a Facebook Credit Card? Facebook could be bigger than PayPal and become Visa or MasterCard as well. Facebook has the potential to become a universal wallet for both online and offline purchases.”

So Facebook is still a serous payments player, credits or no credits.

That is why banks are starting to jump on the Facebook payments and banking train.

Noteworthy has been Commonwealth Bank of Australia’s (CBA) jump into the Facebook banking space.

CBA is building a Facebook app that will make it possible for customers to make payments to third parties and to their friends through the social network.

Transactions are secured using the bank’s own authentication system and the bank's chief marketing and online officer, Andy Lark, said the institution was not seeking to reinvent banking rather that “help people manage their money and their lives” in ways that suited them, The Sydney Morning Herald reports. “We as a society have migrated to Facebook [...] social banking is here”, Lark said.

PC Advisor provides more details quoting David Lindberg, executive general manager of card payments and retail strategy, on the aspects of Facebook banking and the lack of privacy and security of Facebook .

“We know that there are customers who just do not want their financial information sitting on Facebook,” he said. “For those customers, of course, there is no reason to use [the application]. At the same time, we know that there is a segment of customers who are very comfortable with using Facebook for a number of private things, one of which is for financial services. So, in terms of the privacy, our view of privacy is that it is something which is completely up to the consumer.”

CBA is not the only bank on Facebook. ICICI bank in India has been there for a while.

According to CNN’s IBN service, ICICI Bank launched its Facebook banking application earlier this year to give customers the ability to carry out a number of banking related tasks such as checking account details, getting account statements, upgrading debit card and cheque book enquiry.

The bank claims that using the ‘ICICI Bank App’ on Facebook is completely safe and secure due to features such as “Secure SSL connection, two-factor authentication process (and) activity details not (being) published on Facebook Wall … there is no charge for this application. ICICI Facebook banking application is totally secured. All communication between the app and ICICI server is encrypted. No data is stored on Facebook. All communication is secured and encrypted,” the bank says.

As part of the security features, registration is subject to Debit Card and PIN authentication and access to the application is subject to a separate PIN authentication generated by the user.

The bank goes on to claim that a customer’s account details would remain secure even if the Facebook ID is hacked: “Since your account data is not stored on Facebook, your bank account is completely safe. Even if your Facebook ID is hacked, the hacker will not be able to access the application unless you have shared your application password with the hacker,” ICICI Bank says on its Facebook page.

And, in yet another move towards Facebook banking, Citigroup asked the social stratosphere if they would be interested in banking on Facebook the other day.

This immediately got everyone thinking that Citi would follow on the heels of CBA and ICICI to soon launch Facebook banking.

You never know, although Citi have not confimed such plans yet.

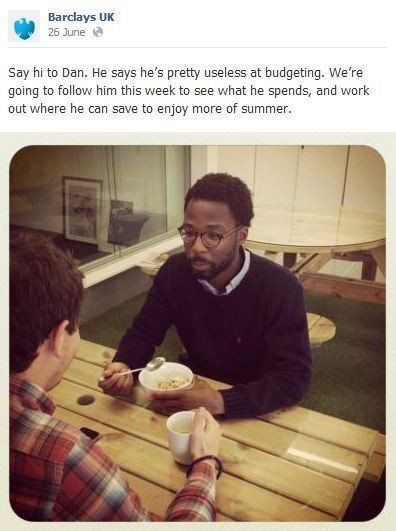

Meanwhile, at least these banks didn’t have the epic Facebook fail that Barclays achieved the other day.

Barclays launched a new viral media campaign on Facebook the day before the LIBOR scandal broke and it’s not gone down well.

The campaign is based around Dan, a fictional character who the bank was following to see how the guy spends and lives his life.

Soon the campaign fell into pointed comments and attacks, along with several in the social sphere poking fun.

A few examples:

Dan moves all his accounts from Barclays to financial institutions that pay him interest. Suddenly he can afford to fund his condom habit, thus avoiding the unnecessary expenses of unwanted babies by ex-girlfriends.

Is Dan into fraud and larceny? Or being ripped off as a customer? If not I doubt Barclays are that interested in him. Hang on, is Dan black? Does he know barclays used to invest in apartheid? He should move his account sharpish.

Bob’s a CEO and spends £5,000 a day on Bollinger. That’s about £155,000 a month; enough to buy a classic Ferrari at the vintage car festival he really wants to go to in August. Rigging LIBOR for a couple of months would mean a more memorable end to the summer. Haha :)

No wonder the campaign ended early, with the official response from Linzi on 8th July:

Thank you all for your comments over the past week. We have read them all and provided your feedback to the rest of the business. However, under the terms of the settlement we cannot discuss this matter in any further detail, but you can read our official statements here http://group.barclays.com/news/news-article/1329925891776/navigation-1330349053975. If you would like to speak to us directly, you can email wr@barclays.com.

Related articles:

- The Future Bank: Augmented, Social and Mobile

- Social media platforms are not the same as social media

- Fidor Bank use Facebook Likes to set interest rates

- Australian Bank launches mobile innovation

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...