It’s Friday, it’s summertime and it’s the day the London 2012 Olympics begin.

Fantastic.

Tonight’s opening ceremony should be amazing and so, rather than talking about banking today, I thought I would talk about banking Olympians.

Lloyds Bank were one of the first to sponsor the London Olympics.

They have an official bank sponsor website ...

... and spent £80 million to secure their Olympian status.

This was back in 2007 of course, before the financial crisis.

Since then, there’s been a long and winding road to get from a secure, boring old retail bank to being one of the UK’s leading fruitcake banks.

This was of course prompted or caused by Gordon Brown and Alastair Darling forcing the hand of Eric Daniels and Viktor Blank, the then CEO and Chairman of Lloyds TSB, to takeover HBOS.

Since then, the bank has tumbled into an abyss of issues which led to the government taking an initial 43% stake in the bank, lowered to 39% today.

The bank found itself in a quagmire of a mess, particularly with the commercial lending portfolio of HBOS, leading to consistent losses for the past few years.

The worst of these was in 2008-2009, when the bank wrote off £24 billion in debt, although the year-on-year results are not particularly impressive.

The bank posted an operating loss of:

- £6.7 billion in 2008;

- £6.3 billion in 2009;

- £281 million profit in 2010; and

- £3.5 billion loss in 2011.

The 2008 – 2009 losses are attributable to the mistake of taking over HBOS, which cost the bank around £42 billion in costs, compared to the mere £8 billion acquisition price.

But more worryingly they have other challenges today as the leading UK bank embroiled in the PPI scandal.

This is the insurance that was sold without customers being aware they were buying it, and Lloyds originally estimated the cost would be about £3.2 billion in claims.

They’ve now upped that to £4.3 billion so far, with £1 billion of this just the cost of processing the claims, half of which are fictional.

Then they’ve got burnt by the European Competition Commission forcing the sale of 632 branches in Project Verde.

This decision was forced upon the bank as they gained over thirty percent market share of UK current accounts when they acquired HBOS.

Trouble is that selling branches today is not easy, as there aren’t many buyers.

In the end, they sold the package to the Co-operative Bank in a deal that was daylight robbery.

Just look at the numbers:

Lloyds deal with the Co-operative

Price paid: £350 million + £400 million promised

Number of branches: 632

Virgin deal with Northern Rock

Price paid: £747 million + £538 million

Number of branches: 75

And some people thought the Northern Rock sale was a bad deal.

Lloyds was a real humdinger.

For example, they got way less than their original £2 billion estimate for the branch deal value and it cost them £1.8 billion to get rid of the branches. This was admitted yesterday when the bank stated that it had cost them around £1 billion to organise the branch sale and they had lost £800 million on the deal value.

Hmmm … doesn’t sound like good business logic to me.

Finally, there’s another small matter of LIBOR.

The bank also stated yesterday that they were involved in the scandal as defendants in several law suits that analysts estimate will cost them at least £1.5 billion or more.

All in all, between Verde, LIBOR and PPI, the bank still has a long road to run before they get out of the woods.

An Olympic marathon, you might say.

For those interested, here’s a summary of yesterday’s news stories about Lloyds:

Lloyds Banking Group has posted a half-year loss and has increased provision for payment protection insurance (PPI) claims by £700m.

It is the second time this year Lloyds, which is 39% taxpayer-owned, increased the provision for PPI claims taking the total cost to £4.3bn in 18 months from an original £3.2bn. The new provision drove the bank to a half-year loss of £439m, down from a loss of £3.3bn in the first half of last year when PPI also drove the bank into the red.

A regular critic of the claims management companies that put in claims for PPI mis-selling on behalf of customers the bank’s CEO, Antonio Horta-Osório, revealed that the bank had deployed 1,000 staff to tackle erroneous claims. He said 50% of claims put in by these firms are false, double the level three months ago. Redress payments made and expenses incurred for PPI by the end of June 2012 had reached £3bn.

Lloyds is shrinking.

Non-core assets declined from £140.7 billion at year-end to £117.5 billion and it expects to reduce non-core assets to £90bn by the end of next year, a year ahead of its target, and a negligible £70 billion by the end of 2014.

Lloyds is a defendant in several Libor-related lawsuits. Research from Liberum Capital has suggested it could have to pay out up to 1.5 billion pounds ($2.3 billion).

On a conference call with reporters, Finance Director George Culmer said there was no need for the bank to set aside funds for potential litigation arising from the Libor affair.

"We are still part of an ongoing investigation and until the regulator is satisfied that that investigation is complete there is no point at this stage in thinking about or putting down a number," Culmer said.

Horta-Osório admitted that the bank could lose up to £800m from the sale of 632 branches to the Co-op but that this would be negated by a reduction in capital needed. But creating the branch network, required by the EU as a result of the £20bn of taxpayer money used to prop up the bank during the banking crisis, had cost £1bn.

The impairment charge of £3.1bn for customers missing loan repayments was down 42%.

Some 45,000 jobs are expected to be lost as a result of the rescue takeover of HBOS in 2008 and a new cost-reduction programme implemented by Horta-Osório when he arrived. Some 4,555 full-time equivalent role reductions were announced in the first half of 2012 taking the total to 6,653 since the start of the new cost reduction programme.

If we look at the core operations of the bank, income is falling by 11% while costs only improved by 4%. Even the near-halving of the impairment charges couldn't help, as management profit slipped 5% from the first half of last year. Overall, the underlying revenue of the bank fell 17 per cent to £9.25bn, as the bank suffered subdued demand for new lending and shrunk its non-core asset pool.

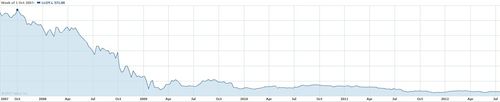

The shares were flat at 29.3p yesterday, down from £5.70 before the crisis hit and under half the 63 pence the government paid, representing a paper loss of around £11bn on the taxpayer's stake in the bank.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...