More interesting dialogue about banking yesterday, and this time about financial inclusion.

The fact that mobile phone ubiquity is creating a wirelessly connected planet, is a key part of changing our world for more inclusion.

First, six billion people now have 1:1, P2P connections.

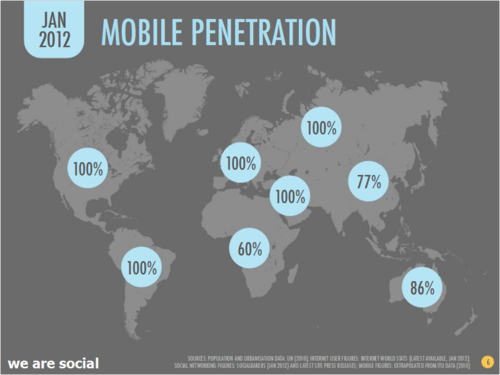

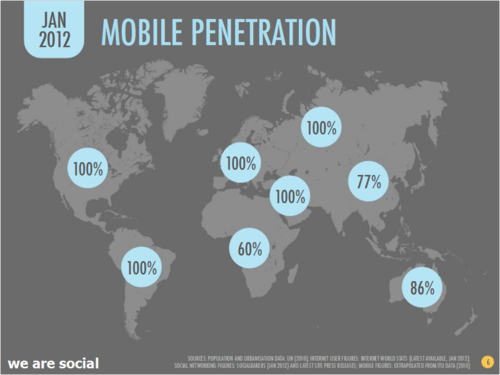

You only need to look at mobile densities by continent to realise how ubiquitous these devices have become.

According to a 2012 survey by the Gates Foundation, the World Bank and Gallup, more than 10% of adults said they had used mobile money in the last year and, of the 20 countries surveyed, 15 were in Africa.

This is illustrated particularly well by Somalia, a country which lacks a functioning government but 34% of adults use mobile money (often to receive remittances from family members abroad)

The fact is anyone, anywhere can now send and receive money anywhere, anytime.

I was first struck by this when I saw a video from the World Food Programme about providing aid to emergency relief areas by delivering food stamps as text messages...

And was struck by it again when talking to Vodafone Safaricom recently.

The mobile carrier informed me that when M-PESA launched in 2007, there were 2.5 million people with bank accounts in a country of over 40 million people, around 23 million over 15 years old.

So about 1 in 10 people.

Now there are nine million banked people in Kenya, about 2 in 5, so the numbers have improved dramatically.

This is down to a continent where, when you can send and receive money, you can show creditworthiness and, thanks to mobile technologies, Africa is now a continent where anyone and everyone can send and receive money wirelessly.

Hence, the massive change from a fear of mobile money to one where the banks can embrace this change as it is good for business.

But this revolution is not just down to emerging or developing economies, but also to developed economies.

The European Union is encouraging financial inclusion, as is the USA where varying numbers report anything from 17 million adults being underbanked or unbanked (FDIC) to as many as 73 million or more.

So it's around 10% to 40% or more of the adult population.

Whatever the number, P2P mobile money will make a difference but it’s more than this. In economies where social media through mobile connects everyone, the possibility exists to include people who have never even touched money.

A youngster who shows incredibly engaging behaviour on facebook, has hundreds or thousands of Likes, influences their community and is a model citizen, could easily be a credit worthy person, even though they have never had any financial credit.

The same might be true of hobos, tramps, drug users, criminals and others, who have got caught in a trap where there’s no escape, purely because of a mark on their record.

The social connection will change all of these things, and the mobile social connection already is.

Has your financial institution thought of the change this makes to your business and future business?

Maybe you should as this social mobile revolution will soon make financial inclusion a basic human right and governments will encourage inclusion from whichever quarter it can, including banks and mobile carriers.

Better to be there before the regulator gets there.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...