Every now and again I fall into the position of writing an episode of today’s issues set in a classic British sitcom. Monty Python and Yes Minister are the two comedies that set much of my outlook on life and so, to celebrate the events in the City of the past week, here is this week’s Yes Minister.

Friday 29th June 2012

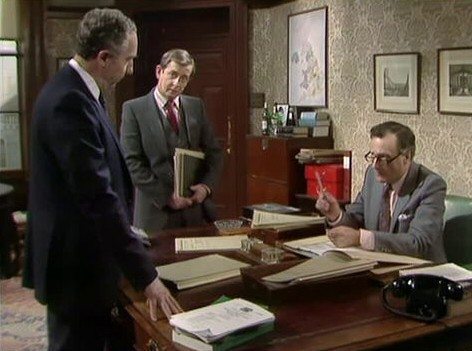

Jim Hacker (Prime Minister) is sitting at his desk with a frown, tapping irritatingly on his laptop keyboard, as his Permanent Secretary Sir Humphrey enters the room.

Jim: Ah, Humphrey, I’m a little bit concerned about this banking scandal.

Humphrey: What, the LIBOR thing?

Jim: No, the fact that I can’t get into my NatWest account. What’s this LIBOR thing?

Humphrey: Oh, nothing. It will go away.

Jim: Yes, but what is it?

Humphrey: Just a small scandal in the City, sir. It will go away.

Jim: This is not being very helpful Humphrey. If there’s a scandal out there, I want to know about it. Now, what is it?

Humphrey: Oh well. Barclays bank just got fined over fixing interest rates.

Jim: That’s good isn’t it? I’ve got a fixed rate mortgage. What’s the problem?

Humphrey: No Minister, not like that. They’ve been caught working with the other banks to set the interbank borrowing rates in their favour.

Jim (frowning again): Ahhh. Does it look bad?

Humphrey: I don’t think so. Caveat emptor and all that.

Jim: What, it was the buyers who should beware of the banks interest rates?

Humphrey: Exactly sir. Anyway, I will be meeting my opposite number at the Bank very shortly to ensure that this is all battened down.

Jim: Good. Meantime, can you ask Bernard to get that Hester chap’s PA on the phone. I’m trying to pay this darned gas bill and online banking seems not to be working today.

Humphrey: What a glitch!

Jim: Actually Humphrey, I think her name is Patricia and I’m not sure she’d appreciate you talking to her that way.

Scene fades out.

Monday 2nd July 2012

At the Saint Stephen’s Club, the private rooms where Sir Humphrey does most of his dealing, Humphrey is sitting having enjoyed lunch with his good friend Sir Mark Royal of the Bank of England, who is sitting in an equally sumptuous red leather armchair with a large brandy in hand.

Humphrey: Tell me Mark, we’re hearing on the QT that there was a little bit more background to this Barclays boring lies story than has come out in the press. Can you tell me any more?

Mark: Oh nothing to worry about old chap, it was just usual.

Humphrey: What do you mean, ‘usual’?

Mark: You know, business as usual. It was the way the City worked. We’ll sort it out.

Humphrey: The way the City worked? But Barclays just got fined half a billion dollars! Surely, they did something wrong.

Mark: Well, that’s what everyone is saying now, but it wasn’t that bad. Just the way the City worked.

Humphrey: Look, I’ve had dealings with the City and know how it worked Mark, but rate rigging, fines, an apparent culture of buck the system and screw everyone doesn’t go down well these days. So how are we going to sort this out?

Mark: Well, I’ve had a word with the Diamond chap and he’s not going to co-operate. Luckily, Marcus and I go way back to Trinity, Cambridge, and he owes me a few favours, so we’ll get it sorted out.

Humphrey: But I thought Marcus had resigned as Chair of Barclays this morning?

Mark: He did, but he’s going to retract his resignation.

Humphrey: That seems a bit silly. Why would he do that?

Mark: Because I told him to.

Humphrey: Why would you do that?

Mark: Because the Diamond was going to snitch.

Humphrey: Look you’re losing me now Mark. What is really going on here?

Mark: Well, you know how the previous government believed the economy would boom forever?

Humphrey: Yes.

Mark: And you know how the economy eventually bust, with Northern Rock failing and a year later RBS and HBOS.

Humphrey: Yes. And …

Mark: Well, Gordon Brown’s Permanent Secretary, you know that academic chappie Don Teacher, would regularly meet me, like we are now, and we would talk about things.

Humphrey: Yes. So.

Mark: Well, you know how it goes …

Humphrey: I see.

Humphrey sits for a while thinking.

Humphrey: So the situation is that we’re all in this together.

Mark: That’s the one.

Scene fades and returns to Hacker’s private chambers where Jim is in an animated conversation with Bernard, both of them bent over Hacker’s laptop.

Jim: I’m sure I entered the details correctly.

Bernard: Well, it looks like you added an extra zero or two sir.

Jim: Not at all Bernard. I entered £162.78p. How that translates to £162,780 I have no idea.

Bernard: Well, it seems to be the case sir, although I did say that I would handle your gas bill.

Jim: I know that Bernard, but this is on my fifth home – you know the one no-one’s supposed to know about – and therefore I have to do it.

Door opens without announcement and Sir Humphrey enters the room breathing heavily.

Humphrey: Minister, we have a problem.

Bernard sighs, picks up the papers from the desk and moves to the door.

Bernard: Don’t worry sir, I’ll sort out the gas bill.

Jim: Thank you Bernard. Now Humphrey, what seems to be the problem?

Humphrey: Well that LIBOR thing.

Jim: Oh yes. Good jokes going around on that one btw. I particularly liked this advert for Barclays …

Humphrey: Stop it Prime Minister. We need to act and act fast.

Jim, now trying to be serious: Oh. What’s happening?

Humphrey: Well, it appears we are all in this together.

Jim: What do you mean Humphrey, I’m not in this at all.

Humphrey: Yes you are Prime Minister.

Jim: No I’m not. I’ve never been near a live boar, let alone a LIBOR.

Jim starts to chuckle until he sees Sir Humphrey’s face starting to turn a shade of purple.

Humphrey: I’ve just found out that the last government were instructing the Bank of England to tell the UK banks what policy to use when they were setting the interbank interest rates.

Jim: So.

Humphrey: Well, this means that Barclays got a fine, but there’s much more to it than that.

Jim, resignedly: OK, Humphrey, tell me everything.

Humphrey: Well, as we all know, the City has always worked closely with the Government to manage the economy.

Jim: Yes.

Humphrey: Over the fullness of time, and with all of the right conditions, that relationship became a little too close apparently.

Jim: Aha. But that’s good isn’t it, as we can nobble the last government and make ourselves look good.

Humphrey: Yes, we could do that … except many of those in office are still around in the service and have a few stories about the previous government before that one.

Jim: But that’s history Humphrey, whereas the 2008 crisis is still news.

Humphrey: Yes, but there are a few stories about how your party is funded that go back to then, before and are still around now.

Jim: What do you mean?

Humphrey: Well your election campaign for example, was part funded by several donations from top figures at the banks.

Jim: You mean …

Humphrey: Yes.

Tuesday 3rd July 2012

Final scene opens with a loud Parliamentary debate where the leader of the opposition party, Ned Chillihand, is speaking.

Ned: Why won’t the Prime Minister call for a public inquiry, when it is obvious that we all need to know what happened here from a truly independent committee.

Jim: Well, as my esteemed colleague is fully aware, a parliamentary investigation into the LIBOR rate fixing row is more than warranted. However, I cannot see the value of a full public inquiry, given the expense and time involved. What we need to focus upon today is growth in the economy and getting this country back on track. No one wants to spend time shilly shallying around trying to dig up skeletons in closets that were closed long ago.

No. No-one does, do the y?

Hence, the reason for a cross-party parliamentary investigation of the LIBOR rates fixing scandal rather than a full public inquiry.

MPs vote for parliamentary inquiry into Libor scandal

If you want to know more about this 1980s TV series there's loads out there, and the stage play revival has been playing since 2010. Well worth a view.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...