I kinda thought that some of the things that have happened in banking in the past – like the collapse of Lehmans and Barings Bank; Jerome Kerviel, Henry Blodgett and Frank Quattrone; insider trading and Ponzi schemes; and more – were pretty bad, but someone asked me to make a list of the top five most embarrassing mistakes made by banks and, as I pondered the list, they all appeared to be recent ones.

Sure, I could put in things like Chuck Prince having to apologise in person before the Japanese FSA about Citigroup’s private banking failings or Goldman Sachs calling their clients muppets, but these things are mild compared to the five here.

So, as it’s summertime and things are changing, here are the top five most embarrassing mistakes made by banks, and they all happened within the last twelve months:

#5: Bank of America’s social media gaffe

There were a number of major PR gaffes in the last year, where banks were caught short over social media usage. The biggest one was from Bank of America, who tried to introduce a charge of $5 a month to use debit cards in October 2011, in response to the Durbin amendment to the Dodd-Frank Act that limits debit card transaction charges to 12 cents per transaction. Customers didn’t like the new fee and one – Molly Katchpole, a 22-year old nanny – forced the bank to change its position purely by using Change.org to create a petition that garnered over 300,000 signatures. The fact that BoA retracted the fee was then rewarded with the award for the worst PR gaffe of 2011 and a 20 percent increase in account closures in Q4 2011.

You can have issues over reputation but the #1 reason why customers close accounts is when mistakes are made. In this case, the RBS glitch was huge, with customers at Ulster Bank closed out of their accounts for almost a month. The mistake was made by an update to CA-7, a core payments program, which corrupted the payments files. The issue has been that no matter how hard RBS try, they cannot recreate the issue to find out what caused it, or so I hear.

#3: Citibank’s mortgage mistake

When the head of mortgage Quality Control sues her employer over their mortgage processing system, you know something’s wrong. When Sherry Hunt did this, claiming that three out of five mortgage applications were missing key pieces of information including signatures and proof of salary, you know something’s really wrong. Especially when her employer told her to fudge it and stop complaining. That’s why, when the Department of Justice backed her case, she received $31 million for being the whistle-blower her blew the whistle on Citigroup and succeeded in bringing them to justice as the first test of the new Dodd-Frank whistle-blower rules.

#2: HSBC’s money laundering scheme

You would think that with global AML controls in place, a bank of HSBC’s size and breadth could handle a little tracking of terrorist cash. David Bagley, Global Head of Compliance for HSBC, has been co-chair of the Wolfsberg Group that set the rules for Anti-Money Laundering worldwide for banks since 2005, so they should know something about it. However, he and the bank got caught out as accounts in Mexico enabled drug cartels to gain monetary movements via the Cayman Islands, and terrorists were engaged in similar activities via the Saudi bank division and its counterparty Al-Rajhi Bank. The result is that he stepped down from his position in the bank, even though he wrote emails warning of the Mexican banks lack of a “recognisable compliance or money- laundering function.” The lesson learned is that when business leaders see billion dollar accounts, they ride rough-shod over their risk, audit and compliance folks. The balance has to shift the other way around so that when risk, audit and compliance folks see businesses they don’t like, they can tell the business leaders that when the going gets stuffed, the stuffed get going.

[Read the full senate hearing on AML and HSBC here]

It’s not so much that LIBOR had faults so that rates could be rigged, which we all now know, but more that the messenger got shot. Barclays were the messenger who blew the whistle on LIBOR rate rigging. That’s why they got the first massive fine, as they have been co-operating with the authorities. Meanwhile, all the other banks have now been drawn into the crossfire with HSBC, RBS, Lloyds, Deutsche, Mitsubishi and more being investigated with multimillion dollar fines. So what’s the problem here? That Barclays allowed the release of the LIBOR news to make them look like the sole bad guys. Result: Diamond, del Missier, Agius and more all go and the bank becomes a headless mess. How did it happen? Well, apparently the day the news came out about Barclays fine was the first day of a brand spanking new Head of Corporate Communications joining the bank. Not a bad day’s induction training to find yourself in the middle of the biggest comms crisis of all time and #epicfail for not dealing with it effectively.

So there you have it.

Five massively embarrassing moments for five megabanks.

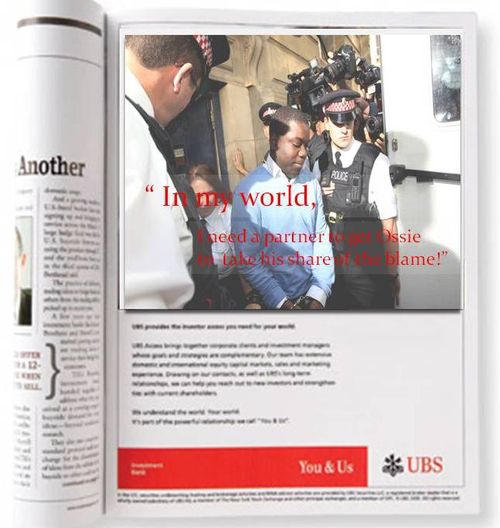

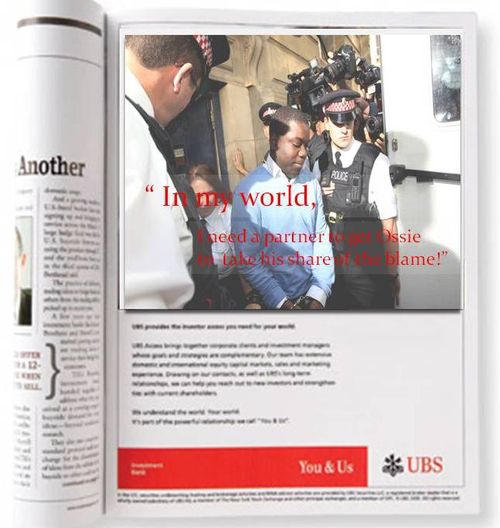

Nevertheless, my award for the bank with the all-time brownest stuff dripping off its fan has to go to UBS.

Yes, UBS.

UBS – the bank that changes management more often than Shameless star Frank Gallagher changes underpants.

UBS – the bank with the multibillion dollar loser.

UBS – the bank that tells their staff how to dress and not dress.

UBS – the bank that trains their staff in how to avoid the FBI and US Customs.

UBS – the bank that has employees willing to go the extra mile, like doing illegal activities on behalf of their clients.

UBS – the bank that received one of the largest Federal Reserve fines in history in 2004 for peddling dollar bills to Saddam Hussein, something that HSBC copied this year.

Need I go on?

Oh yes, but it’s still a very good, reputable bank.

Pictures sourced from WHYDTINOGO and Flickr

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...