I recently met Big Data in person.

In real life.

THE BIG DATA.

Yes, I did.

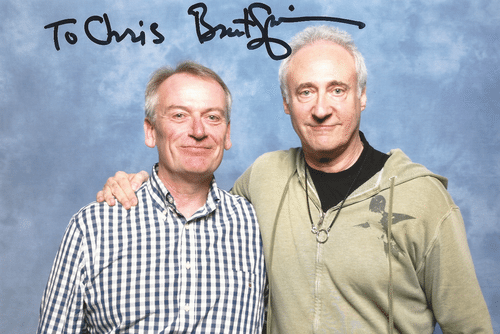

And here he is …

Do you recognise him?

No?

BIG DATA?

The guy.

No?

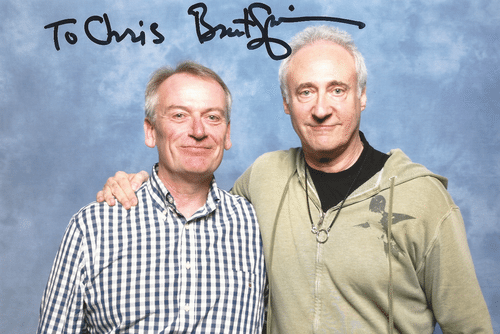

Maybe this will help you to remember.

Yes, Big Data.

The man, the legend, the person …

… ah, you thought I meant Big Data, the

idea.

Do you know where the term Big Data came

from?

According to some, the term was inspired by

Laurie Anderson’s album Big Science from 1982.

However, the term actually dates back to

World War II when the phrase Big Science was used to describe the rapid cycle of changes that occurred in scientific

disciplines during and after World War II.

A good example of this rapid cycle of

change during World War II was the invention of computing.

John W. Mauchly was a physicist working at

the Moore School of Electrical Engineering at Pennsylvania when the war began,

and he believed that an electronic computing device could be created to predict

the weather.

The idea was floated in August 1942 and, by

June 1943, funds were allocated to the project.

Unfortunately, by the time the system was

developed, the war was over. Nevertheless, the system that was developed

(called ENIAC, the Electronic Numerical Integrator And Computer) led to the creation of the industry I have spent all my life working with –

technology and information – as well as the weather forecasting service.

Ah well, you can’t win ‘em all.

The term Big Data was first used in the late 1990s and no-one can quite put

their finger on how it came about. It

appears to be through a combination of academic papers and META Group (now Gartner) who say that:

“Big Data are high-volume, high-velocity, and/or high-variety information

assets that require new forms of processing to enable enhanced decision making,

insight discovery and process optimization.”

Yea, yea, yea … surely it’s simpler to say

that Big Data is just this phenomenon we have today, where every person on the planet

is creating digital records such that we are drowning in data.

This is well illustrated by Google’s CEO

Eric Schmidt who stated:

“There were 5 exabytes of information created by the

entire world between the dawn of civilization and 2003. Now that same amount is

created every two days”

during a Techonomy debate in 2010.

An exabyte is a 1 with 18 zeroes after it –

or 1,000,000,000,000,000,000 bytes – an incomprehensibly large number.

Drowning in data.

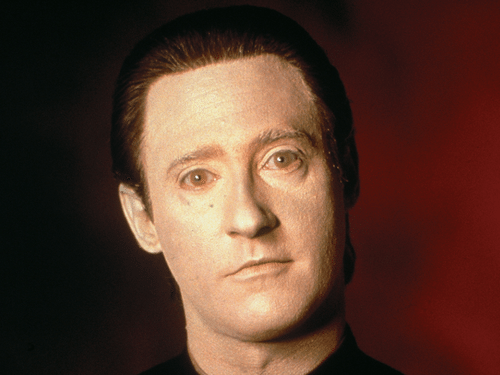

Some call it a tsunami – not an appropriate

term – whilst others call it oil. It doesn’t matter what you call it,

it’s a big amount and is illustrated by the amazing growth of unlimited

bandwidth and unlimited storage., combined with device ubiquity and cheap

chips.

Source: IEEE

Why is this important?

Because those who make sense of Big Data

will win.

Data is the new source of competitive warfare, and

data mining will be the weapon of mass destruction of the competition.

Many industries get this, particularly the

new tech players like Amazon, Apple, Google and Facebook.

It is the reason why banks fear these

players because these players know how to sift the data and make sense of it.

As one bank Chief Executive recently

stated: “Our peers I can handle. We’re

in the same boat. But if Google opens a

bank, with all their data – then we’re in big trouble.”

And you should because Eran Fiegenbaum,

Director of Security for Google Apps, has already made it clear that Google is “a bank for your data”.

And the biggest issue for a bank is one

that I’ve raised many times, but it is easiest to illustrate by just repeating

a little from an earlier blog.

It

amazed me to see the back office of one of the largest operations in the world

in action today.

Yes,

I’m talking about Amazon.

A

place you would think would be a seamless operation of high technology but, in

reality, is a bit of a mess.

The

book division doesn’t talk to the music division. The music division

won’t talk with the electronics division. The retail business won’t talk with

the wholesale business. The wholesale business won’t talk with the cloud

business. Oh, and the Kindle division won’t even talk with the book division!

None

of them will share customer information with each other and, as a result,

no-one knows what customers buy from Amazon as a group, when or with what sort

of payment type.

Yes,

the silo divisions of banks mean that they ignore their greatest competitive

weapon: data, and let others potentially gain this opportunity at their

expense.

Something’s

gotta change.

Meantime,

if you want to hear what Big

Science sounds like, have a listen …

p.s. if you didn't recognise him, the actor with me in the photograph is Brent Spiner, who plays the character Data in Star Trek.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...