As mentioned yesterday, the regulator tries to keep up with

the banks who try to keep up with customer, and I said that banks often

innovate too slowly.

There are many examples of this, but the one that I come

back to regularly is Chip & PIN.

Chip & PIN has been an enormous success, lauded and

applauded by the Payments Council and now emulated worldwide with just the USA

to follow.

The program was agreed in principle back in 2000 through

APACS, the Association of Payments Clearing Services, and the implementation

plan sorted out in 2003. The EMV-based

Chip & PIN program was introduced to the UK in 2005 and made mandatory in

February 2006.

The great news is that after Chip & PIN was introduced card

fraud decreased considerably, with lost and stolen cards down over half …

... but

the criminals just moved to targeting other areas where card not present and online

fraud gave opportunity:

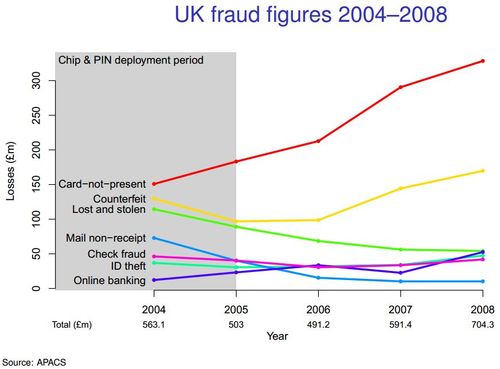

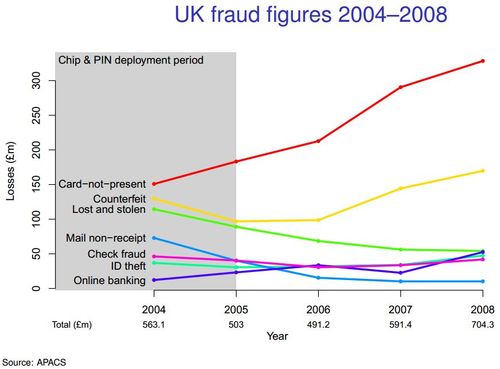

Key trends in UK cards from 2004 to

2008

Abuse of authentic

cards:

- Lost and stolen: down 53% to $54.1m

- Mail non-receipt: down 86% to $10.2m

Counterfeit: up

31% to $169.8m

Non-card security:

- Card-not-present: up 118% to $328.4m

- ID theft: up 28% to $47.4m

- Online: up 330% to $52.5m

- Check: down 9% to $41.9m

Total: dip in

2005–2006, but up 25% to $704.3m

Slide and detail from a presentation by Stephen Murdoch of

Cambridge University, 2009

Admittedly this was the case after Chip & PIN was introduced

but, as retailers and banks cracked down on the Card Not Present fraud too, the

UK example is held up by one and all as the best illustration of security.

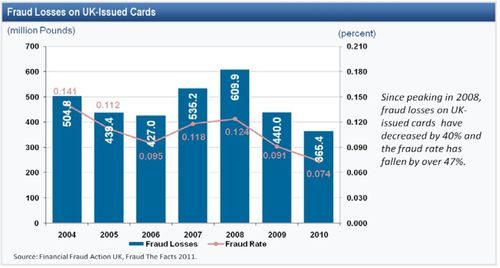

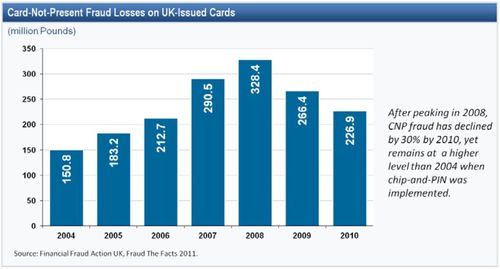

For example, here are a few charts from Douglas King of the US Federal Reserve Bank of Atlanta who, along with many colleagues, is

trying to convince the USA to incorporate Chip & PIN.

Fraud Losses on UK-issued Cards (doubeclick image to enlarge)

Card-Not-Present Fraud Losses on UK-issued Cards (doubeclick image to enlarge)

So Chip & PIN is fandabadoozy and the best thing since

sliced bread, yes?

Maybe not.

In fact, Chip & PIN is an example fo an industry moving

at a snail’s pace and hten slapping each other on the back on how effecigtve it

has been.

Rewind to my opening paragraphs and you realise it took the

UK Payments Council six years to determine, agree and then implement Chip &

PIN.

Six years.

During those six years another technology blossomed and matured:

mobile technologies.

Pre-Chip & PIN, in 1997, a Hungarian bank had proven

that mobile technology was just as good at reducing fraud as Chip & PIN, if

not better.

The bank is OTP Bank, and was one of the first to use text

message SMS alerts to inform customers of potentially fraudulent transactions.

Their experience proved that fraud could be reduced from over twice the

market average at that time, to a third of the average within a year.

And it was by using a simple text message.

Cheap and easy and, oh yes, the customer pays.

Why?

Because they want to.

The customer sets the payment alert for transactions at the level

that suits their risk appetitie. Each

text costs 30 cents, but they don’t mind paying as it allows them control over

their account.

The idea took off rapidly in Eastern European and Russian

markets.

When I asked one of the bankers who made the decision to go

Chip & PIN rather than mobile text alerts in 2007, seven years after the decision

was taken, he said: “because we did not believe then that mobile technologies

were secure enough.”

He also said they would have made a different decision in retrospect but, as they committed to the Chip & PIN, this is their direction.

Six years, seven years, a decade (in the case of SEPA) …

things change rapidly.

Take eight years ago.

Eight years ago, 2004, the things we talked most about were

second homes, buy to lets, easy mortgages and easy credit. We talked a lot about European harmonisation,

the start of EU directives to create a single financial market, and the early

draft text of MiFID and the plans for SEPA.

There was no Facebook or iPhone, just Nokia and Friends Reunited. George W Bush had started his campaign for

his second term in office and Justin Bieber was a ten year old boy (still is

really).

Eight years is a long time and a lot changes.

In 2007, my first book: “the future of banking in a

globalised world” appeared, and the index makes no mention of subprime or liquidity risk.

Today, all we talk about is subprime and liquidity risk. We avoid discussions of re-mortgaging and

credit markets, and instead focus upon regulations to avoid further collapse of

the financial house of cards. The EU

dream has turned into a bit of a nightmare, and commitments to further

harmonisation are on hold for many. Nokia has been joined by Microsoft to try

to beat off the Apple and Google war, and no-one talks about reuniting with

friends other than on Facebook.

Eight years is a long time, and it is far too long to make

industry-wide strategic decisions to change.

Instead, countries, banks and institutions need to take

steps to future-proof themselves from this march of consumer-led change.

A final thought.

I recently held up Poland as an example of how to get

contactless right.

Poland

is Europe’s leading market for contactless payments, with over 54,000 terminals

and 5.7 million Visa contactless cards deployed as of March 2012.

All

of the acquirers and key merchants were on board from the start and, between

December 2010 and December 2011:

- The number of cards in use increased

five-fold; - The number of contactless

transactions increased forty-fold; - The value of transactions increased

by a factor of 43.1 times; and - Poland’s use of contactless payments

has overtaken the UK’s usage in just one year.

Why?

- Because the issuance of contactless

cards in Poland was coordinated across the industry (the UK was uncoordinated); - The rollout was national, whereas the

UK had a partial rollout; - Poland’s program focused upon Tier 1

merchants first, rather than Tier 2 in the UK; - Transaction limits were appropriate

for the Polish markets, whereas the UK’s limit was too low at the start; - The commercial framework was based

upon the payment value for each transaction in Poland, rather than the UK

program which used the same interchange structures as higher value payments;

and - The technologies for the POS systems

in Poland were proven and reliable, rather than a pilot terminal that was unproven

in the UK at launch.

All

in all, by entering into contactless later rather than sooner, the Polish

deployment has seen far more success than the UK.

So when I start talking about NFC and contactless being well

past its sell-by date,

they took a little offence and asked me if I really believed this and, if so,

what should they do about it?

And here’s where I take a different tack, as the fact they

did something innovative and early is a good thing.

The UK has been pushing contactless in an uncoordinated way

for over four years. It’s too long and

too slow such that, now, the opportunity they could have grasped has been

missed.

The investment to make contactless work in the UK now is not

going to payback in time, as other technologies like QR codes and Proximity

Payment Apps have taken over.

However, the fact that Poland acted fast and did something

early in a co-ordinated way within commitment, means that they made the appropriate

investment at the appropriate time with the right level of commitment.

The net:net of that comment is that: if you are going to innovate and take a lead, commit to it and make it

happen before the timescale opportunity is lost.

And that comment applies equally to the UK Chip & PIN project, e.g. doing something is better than doing nothing at all.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...