The #1 buzz phrase that everyone has grown to hate (especially Ron Shevlin) is Big Data. Sure, you may hate it, but it is still pretty

important, as I blogged a wee while ago.

A second area that has become so over debated that it is

dull is Mobile.

Add Cloud and Social to the mix and you have the

perfect storm of overheated technobabble.

It is not to say that these things are unimportant

however. The very fact that we are

talking about mobile social in a cloud of big data (stop it Chris, I’m

feeling sick) is because this stuff is fundamentally transforming banking,

finance, government and the world.

I’ve spent a lot of this year debating these points, but here

are a few illustrations as to why they are such transformational technologies.

Mobile is

truly transformational as it has moved us from having to go somewhere to do

something – a physical place or a DESKtop

screen – to having connectivity in all of our pockets and purses. This means the 24*7 availability of service is

now the optimal state rather than the dream.

It goes beyond that however, as mobile delivers two further

transformational moments.

First, it gives everyone

on the planet the ability to communicate.

In the farthest reaches of the world, people are communicating

wirelessly in a way they never could before.

And you may think that these remote corners of the world

just have simple dumb 2G phones, but you would be wrong. The fact that most affluent consumers change

their mobiles every eighteen months

means that emerging markets are getting smartphones sooner than you think. For example, here’s a guy in the village of

Kisama, Nagaland, India taking a photograph on his mobile.

In other words, everyone is socialising via mobile. Anyone, anywhere can now relate socially and communicate globally.

Seven billion people globally are connecting one-to-one, person-to-person,

peer-to-peer.

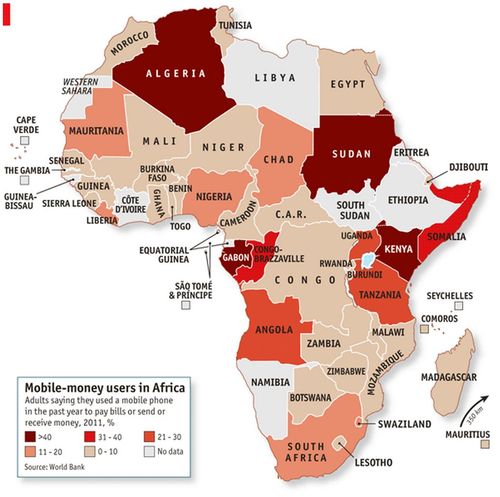

Second, mobile provides a transactional

infrastructure that was non-existent just a few years ago. It is the reason why Africa has seen the most

rapid transformation through mobile,

with M-PESA n Kenya cited as the most revolutionary change.

Source: The Economist

This means that communities that only had physical

connectivity now have digital connectivity. Communities have exploded from local to global, and the wireless

transmittance of anything to anyone, anywhere is a reality.

Mobile is part of

the reason why Social is now a major

shift.

After all, communicating with friends and family is what

most people use a mobile telephone for,

and the ability to create and share photographs, updates, news, links and more

via mobile is the truly social hemisphere of tech change.

Add on to this that mobile

allows you to locate anyone, anywhere, anytime, provides a further dimension of

change, and brings in the importance of Big

Data and Cloud.

Geolocating targeted consumers with offers at their point of

consumption is a big piece of change.

This is the dream of marketers, and is now a reality. Forget mailing coupons in the post, you just say

at the point of retailing: “here’s the deal”.

But you cannot do that without having massive analytical

capability of data to dig out what is relevant to whom at what point of time.

Big Data, Cloud and Mobile brings all of this together and

delivers.

Obviously, Big Data

and Cloud also does a lot more than

this. After all, Cloud provides the ability to analyse unlimited amounts of data for

any purpose. It is the antidote to Big

Data. Big Data is all about drowning in exabytes of bytes, whilst Cloud provides the magic capability to

gain access to unlimited power and storage to analyse that data.

So these four technology shifts are centrifugal forces of

change in 2012, as they are massively complementary.

Mobile allows

anyone to socialise with anyone on

the planet, whilst cloud allows

companies and government agencies to sift through the massive amounts of data that the mobile, social world is creating.

The perfect technology storm.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...