After discussing the economic backdrop, with a hot South America countering a consumerising Asia, it’s time to move

on to looking specifically at the banking outlook, which is grim.

Or is it?

Obviously there’s a major flow of regulatory change with

ring fencing, Volcker and Dodd-Frank all rumbling onwards and upwards, whilst European

Market Infrastructure Regulation (EMIR), the Liikanen Report,

a European Banking Union, a new regulator (the PRA and FCA under the Bank oif England) and more comes

into play.

So this will be the major focal point for 2013 with implementation,

change, rule setting and compliance being the top order of thinking.

Add a sprinkle of insider trading, rogue traders, rate

fixers, whistle blowers and witch hunters and you’ll see the other side of the

coin: banks running scared.

Banks are particularly weakened in 2012 as even the mighty

JPMorgan and Jamie Dimon showed weakness in light of the London Whale incident.

If 2012 was the year that banks were exposed to scandal and

shame, 2013 will be the year that banks attempt to reform and rally.

One of my wild predictions for 2013 from last week included the tongue-in-cheek reference

to banks becoming moral, but I actually think some of that will happen in

2013. Banks will try to show a much

cleaner break from the past, with a real will to reform and prove that although

they’re not whiter than white, they’re certainly not pigs in pooh (ed: somewhere in the middle of that must be

fat cats in cream?).

It’s also key to remember, as it’s often so easily forgotten

by the media, that 99.9% of bank staff are not gluttonous bonus guzzling hedonistic

arseholes, but real honest-to-goodness hard-working people like any other industry.

So here are five banking predictions for 2013:

- A major bank (not Goldman Sachs) will show they are

doing God’s Work - A Chinese bank will make a play in the USA

- Many banks will announce radical mobile offers

- Another bank will be severely embarrassed by

their technology - RBS and Lloyds will become stable bets for the

future

A major bank (not Goldman Sachs) will show they are doing God’s Work

Goldman Sachs CEO Lloyd Blankfein was seriously lambasted

for saying that the bank was doing God’s

Work three years ago, but this is a key theme that revolves around the industry on a

regular basis. We often talk about banks

needing to find their moral compass and

that the governance, ethics and structure of banking needs to go back to its

basic roots: helping people and companies to achieve their economic goals and ambitions.

We want to go back to the basics of banking and get back to

the roots, which is where we come back to what the essence of banking should

be.

In this context, a major bank – maybe JPMorgan but more

likely a bank like Barclays – will champion the idea of bank basics. The reason I

say Barclays is that new CEO Antony Jenkins is already working on this

restructuring. From the complex

structure of Bob Diamond’s regime where BarCap became the lead essence of the

bank, Jenkins is turning the focus back to banking basics. As a result, if any bank would want to take a

lead in showing how banks could and should structure themselves back to basics,

then Barclays is the bank to do it.

A Chinese bank will

make a play in the USA

Back in 2006, I predicted that one of the major Chinese

Banks would acquire Citigroup or a similar sized Western bank within the next

decade. It hasn’t happened which some

attribute to a fear of cultural clashes,

but I think it still will, particularly as the Federal Reserve approved plans

for Chinese bank expansion in the USA last year. So, who would they buy?

Well, they won’t but, with bank stocks in America at a cheap

ticket today,

banks like the Industrial and Commercial Bank of China (ICBC) or China Construction

Bank (CCB) will form strategic alliances to begin with. A strategic alliance would be where ICBC take

a reverse stake in Goldman Sachs for example (Goldman’s bought almost 6% of

ICBC’s stock in 2006) or CCB in Bank of America (BoA bought 9% of CCB’s stock

in 2005, although they sold it in 2011).

And don’t be mistaken, a strategic alliance is just the

first step towards a strategic acquisition, so watch that space carefully.

Banks will announce

radical mobile offers

It’s been pretty dull in the mobile space so far. Sure, we’ve seen things gradually appearing

on the horizon, from Barclays Pingit to Kenya’s M-PESA, but there has yet to be

a major bank play in the mobile space in the US or Europe. A major bank play would be where they tell

customers that mobile is their primary channel.

Asian banks have made these commitments, as mobile is far more widely

adopted as the primary play in Asia, but European and American banks have so

far dallied with mobile. I don’t think they’ve

been truly committed.

What is truly committed?

Truly committed would be where a major European or American

bank said that they were closing branches in a determined move to transition customers

from human space to mobile space. That

would be radical and it’s something that Michael Nuciforo, a mobile banking expert, has called for

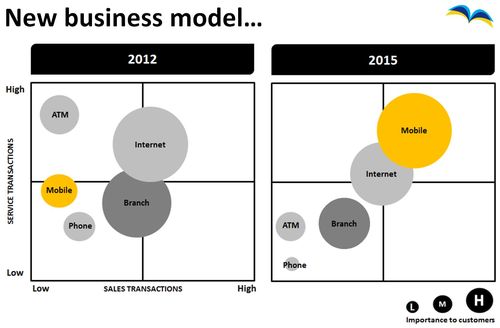

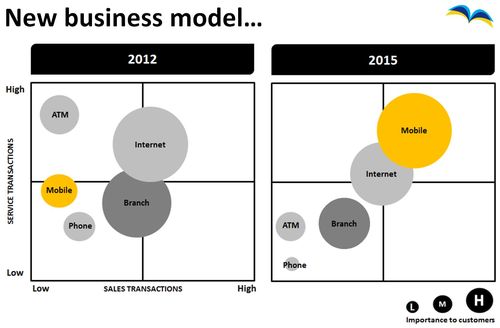

many times. In fact, here’s Michaels'slide to make the point:

When 95% of interaction between a customer and their bank is

through mobile contact, banks will need to seriously consider their structures

of delivery and I think 2013 will see some banks making a true commitment to move

from branch to mobile space.

Oh and just in case this doesn’t happen another mate of mine, Brett King (author of Bank 3.0), is going to make it

happen with Movenbank. Launching in Q1

2013 in the USA, Movenbank is a mobile-only bank. That’s slightly to the other extreme, but it

does make the point that the time is ripe for a mobile play with true

commitment.

Source: Movenbank home page

Another bank will be

severely embarrassed by their technology

As a consequence of the pressure to be more mobile centric,

banks will be forced into wholesale reconstruction of their back office systems

and processes. It will no longer be good

enough to place sticking plaster over legacy systems. Therefore, many banks will embark upon or

continue the process of consolidation, rationalisation and migration of core

systems. Then, as noted regularly on the

blog, this will seriously challenge many financial institutions.

Unsurprisingly, having seen so many mistakes made in 2012 by

Australian, European and American banks in migrations to new systems, we will

see more mistakes made in 2013. In fact,

system outages will occur at an increasing rate as legacy bank systems fail to

keep up with the changes demanded by consumers and corporates at the front end.

Therefore, like the Royal Bank of Scotland’s 2012 glitch, we can fully expect to see two or more occurrences of major outages this

year.

RBS and Lloyds will

become stable bets for the future

This leads me to my final prediction, or bet, for 2013 which

is that RBS and Lloyds become good investments by the end of the year. In fact, they’re not bad investments right

now.

For example, the UK government used £65 billion of taxpayer

funds in 2009 to ensure the banks survival, taking an 83% stake in RBS and just

over 40% in Lloyds. At the time, the

government paid 50.2p per share for RBS shares and 73.6p for Lloyds.

The press enjoy talking about the taxpayer losses on these investments,

and regularly say we’ve lost billions.

For example, at the end of 2011, the Guardian reported that we had lost £40 billion on

RBS and Lloyds, as their share prices languished at 20.1p and 25.09p

respectively. They didn’t report that

these shares are trading at 338.7p and 50.76p today.

Source: Yahoo! Finance, Lloyds share price performance for the last six months

The RBS share price has jumped the most, but much of that is

down to a share consolidation of ten to one in summer 2012. Even so, that means the RBS share price would

33.87p under the old figures, a 75% increase in value over the same time 2011. Lloyds share price has doubled.

In other words, these banks are getting better. Confidence in these banks is coming back and

at some point, these banks will be ready for privatisation once more.

When?

Who knows, but it still wouldn’t surprise me if it was not

sometime before the next election when we see some of the value being extracted

back from these banks.

I look forward to the day.

So there you go, five bank predictions for 2013:

- A major bank (not Goldman Sachs) will show they are

doing God’s Work - A Chinese bank will make a play in the USA

- Many banks will announce radical mobile offers

- Another bank will be severely embarrassed by

their technology - RBS and Lloyds will become stable bets for the

future

Tomorrow, I’ll give you five technology ones, and then back

to business as usual.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...