2012 didn’t really see any new technology outcomes. I look

around the house today and see an iPad, iPhone and other things, but nothing

essentially radically new from 2012 that’s big and different. But something is about to happen that will

change things fundamentally.

3D Printing.

Like most people, 3D Printing is something that’s been

discussed for some time and the natural view is to say: what’s it good for?

It appears to be a solution looking for a problem, although that’s

not the view of Chris Anderson at Wired Magazine, the man who coined the phrase

The Long Tail and his latest book is

all about 3D Printing.

It’s called Makers:

The New Industrial Revolution and talks about the fact that as 3D Printing brings manufacturing capabilities

to every desktop in the world it will be as revolutionary as the invention of

the computer.

Hmmm … not so sure.

Could I print a car?

Urmm .. yes!

This car ...

... was printed on a 3D printer ...

.... and tested on a race track ...

... where it accelerated from 0 to 60 miles per hour in four seconds.

Oh!

That’s useful.

So I could pretty much print anything that I buy today?

Yes, and there’s the reason why it is revolutionary, in that

just as you download music, films and software for free if you want to and know

how, you will soon be able to do the same with physical goods.

This turns the patent issue of replicating digitised goods

and services into the core domain of replicating physical products. Dangerous and exciting.

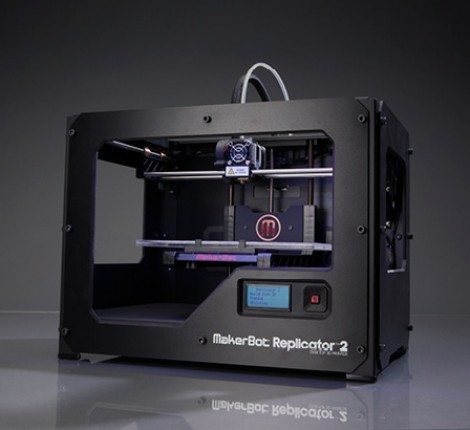

Oh, and if you’re not sure about 3D Printing being

mainstream, here’s the MakerBot 3D Printer:

It’s just over $2,000 and will allow you to print nearly anything

if you have the designs.

What’s that got to do with banking tech?

Not much.

Print a bank branch maybe.

After all, banks have little to do with physical space

anymore, it’s all digitised. So what

technologies will disrupt banking in 2013?

Well, mobile will continue to change things. As Qualcomm’s CEO Paul Jacobs said at this

week’s Consumer Electronics Show (CES): “There are almost as many mobile

connections as people on earth. Pretty soon mobile connections will outnumber

us”.

Yep.

But I made that point yesterday when I said that banks would

properly commit to mobile this year.

In addition, as the Guardian notes,

CES as a tradeshow is becoming increasingly irrelevant.

“Sceptics say that the world has changed faster than CES,

that the pre-eminence of the internet and software has marginalised an event still

tethered mainly to hardware.”

Yep.

That’s why data analytics – Big Data if you prefer – will still

be the key area of competitive technology battles in 2013, along with cloud.

I made this point in my 2012 roundup: “Mobile allows anyone to socialise with anyone

on the planet, whilst cloud allows companies and government

agencies to sift through the massive amounts of data that the mobile,

social world is creating.”

This perfect technology storm will continue to radically

disrupt the banking markets in 2013, as banks adopt and incorporate the mobile

social world into their core offers, leveraging their data analytics through

the cloud.

This will change banking fundamentally as Personal Financial

Management becomes Personally Predictive Financial Management, with alerts and

offers relevant to your lifestyle as you live.

Think of an alert appearing as you walk past a TV shop: “Buy

this TV now, and ABC Bank can give you a loan at a low APR of just 4.9%”.

The alert appears because you Googled that TV last night on

Amazon and the electronics store has a deal with ABC Bank to give you

incentives to visit.

ABC Bank has a data agreement with Google, and all of this analytical

capability is tied together through the cloud.

That’s pretty much what Google Wallet does today, but it’s

going to get into a real frenzy in 2013 as banks and their partners really

start to digest these capabilities.

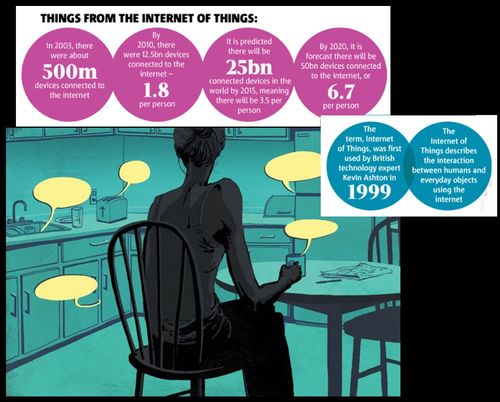

The final area that will be disruptive in 2013 is the

gradual encroachment of the internet of everything.

I remember a bank talking about using branch windows to broadcast

personalised adverts a few years ago, and that additional layer of personalisation

is what the internet of everything brings to the table in 2013.

Instead of getting a text alert or in-app advert for the TV

in the store, I don’t need a TV anymore.

That’s old technology.

Instead, my internet-enabled viewing system auto records any

program that is associated with my preferences and present them to me on a menu

system when I get home.

That pretty much happens today, except that I have to set up

the pre-record. By the end of 2013, preference

based recording by a bot will be the order of the day.

The bot will learn my tastes and preferences and will

automatically configure itself to suit my style.

I can’t wait.

How will that disrupt banking?

Well, maybe the proliferation of so many capabilities from

printing my viewing system at home from my desktop to renting movies for 50

cents a view via an automated bot will see the rise of money through every

breathing moment of the day.

I will literally be dripping dollars and cents through the

day without noticing, as all the payments are made wirelessly through chip-enabled

devices.

Take this story from

Wired magazine in

December about the internet of everything:

Steve Sande’s

household fan is now self-aware. Sande, a Colorado-based tech writer, had

noticed that his cat, Ruby, was suffering on hot summer days. His house doesn’t

have air-conditioning, and he wasn’t always around to turn on the fan.

So Sande bought a new

gizmo called the WeMo Switch, which connects to the Internet so you can turn on

an outlet remotely. It’s also programmable. Using the free web service If This

Then That, Sande created a script that monitors information from Yahoo Weather.

If the temperature in his neighborhood hits 85 degrees, the fan turns itself on

and cools the house. “This entire thing,” he says, “revolves around a

17-year-old cat.”

Great story, but think about it: the intelligent or smart

world of the internet of everything will have billions of tiny transactions taking

place every nanosecond of the day.

Those billions of transactions will need aggregating,

accounting, clearing and settling

So we now have gazillions of transactions to monitor and

deal with, rather than the olden days of a few transactions per hour or minute.

Just as stock markets have seen trades explode through

automated systems, banks will see transactions explode through wireless systems

as consumers and corporations adopt the internet of everything.

That’s what excites me the most for banking technology disruption

in 2013.

Meanwhile, I’m off to print a fan for my cat.

Oh, and if you missed it, my key prediction for banking

technology disruption in 2013 is that banks will be challenged in 2013. They are struggling to evolve from their old

branch models to the current mobile world and, just as they’re getting there,

the world is moving on to the internet of everything.

What fun!

And the five key technology trends of 2013 are: Big Data Analytics in the Cloud deliver amazing capabilities to Mobile devices, which are now exploding

into The Internet of Everything, which

even allows me to 3D Print a bank

branch in my home.

Postscript: reading through the 2013 trends and forecasts, I

found the BBC website’s summary of predictions particularly fascinating and noted that Trendwatching have one that banks really need to note: the rise of Presumers and Custowners.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...