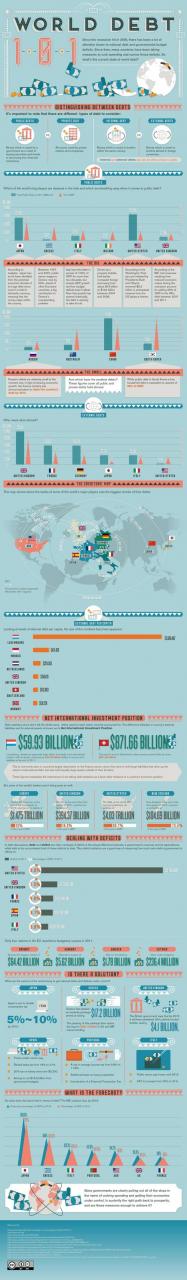

Back to reality and what’s happening in the world today.

I received a bunch of stats and facts from one of my readers

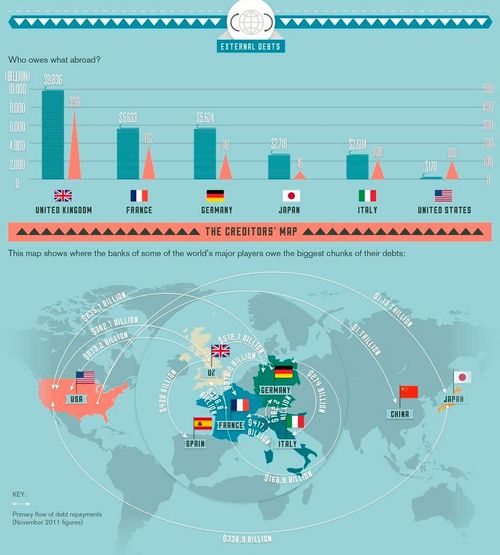

last week lookiing at public (governmental) debt across various countries and geographies, and comparing internal debt (money

borrowed within country) with external debt (money borrowed from overseas).

Here’s the low-down.

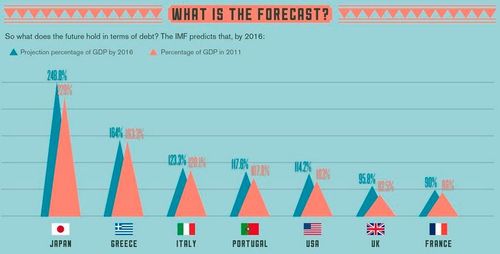

Surprisingly or not, Japan and Greece are the worst

government borrowers with public debt at 229% and 163% of GDP respectively,

although America owes more than it produces too, with government borrowing

running at 103% of GDP.

The good news for the UK is not only that Public Debt is not

bad – 62% of GDP – but most of it is borrowed from overseas.

Our near £10 trillion of borrowing is all coming from other

countries, which is near twice the levels of France and Germany and way more

than the USA who hardly borrow anything overseas by comparison.

However, it’s not all good news as debts are likely to

increase over the next few years, with borrowing increasing from the current level

of 62% of GDP to over 95% by 2016. This

is due to the lack of economic growth more than anything else, along with other

issues related to benefits and pensions.

Unfortunately, many of our European brethren are in the same

boat.

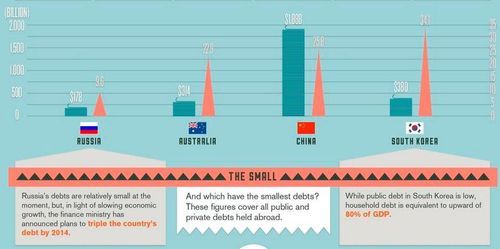

So which government borrows the littlest?

Russia.

Russia’s public debt is just 9.6% of GDP.

Russia’s closely followed by China and Australia, with debts

running at 25.8% and 22.9% of GDP respectively.

The full infographic provides more analysis around the net international

investment positions of nations, debt per capita, annual deficit levels and more,

so check it out.

Oh, and thanks to Liam Fisher at IronFX for the infographic.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...