I recently co-authored an article on banks for a better

I recently co-authored an article on banks for a better

planet with Doctor Carolyn Stephens of the Institute of Health Equity at

University College, London (UCL).

The article was published in the January issue of the

Journal of Environmental Development, and here’s the basic version:

Banks for a better

planet? The challenge of sustainable social and environmental development and

the emerging response of the banking sector

by Carolyn Stephens

and Chris Skinner

In mid 2012, the world’s political leaders, and a multitude

of scientific, UN, governmental and non-governmental agencies, met in Rio to

discuss the world’s environmental crisis, and to agree policies and ways

forward—20 years on from the first Rio Summit, and in the context of escalating,

not diminishing, environmental destruction. Two months later, there was another

huge meeting in Davos of another group of political leaders, UN and economic

agencies and NGOs: the annual World Economic Forum, to discuss the world

economic crisis and how to get the global economy back on track. And in October

2012, over 6000 representatives of the international financial and banking

sector came to their own biggest annual sector meeting, SIBOS 2012 in Osaka,

organised by the SWIFT banking network, to discuss the role of their sector in

the world today (SIBOS, 2012).

What do these three meetings have in common? Or perhaps a

better question: why do these three important meetings have no links that show

their mutually dependent agendas for the planet and its peoples? This is not a

trivial question. Environmental Development is a journal that aims to bridge

sectoral and disciplinary silos in pursuit of sustainable development. And it

was thus that a member of the editorial board of Environmental Development,

Carolyn Stephens, went straight from the SCOPE annual meeting discussing the

environmental crisis, to the banker’s summit, to speak alongside bankers about

the financial sector role in protection of the planet and its peoples.

Banks are highly important for the agenda of sustainable

social and environmental development. The current international economic crisis

is thought by many to be, in part, linked to the lending and investment culture

of the international banking and financial sector, in the context of widespread

speculation and under-regulation at national and international levels. Bank

investment in the arms and mining industries, and other industries linked to

climate change and environmental damage, has also come under criticism.

Alongside this, the banking and financial sector has become the object of

widespread public distrust, verging on disgust, partly aimed at the reward and

incentive systems within the sector, in the context of growing international

inequality and a need for sustainable,

equitable development. These combined forces have led to an

emphasis on increased regulation of the banking and financial sector by state

and international actors, and an emphasis on recuperation of trust by banks

(Donaldson and Dunfee, 2002; Hausman, 2002; Rose-Ackerman, 2002; Renneboog et

al., 2008; Derwall et al., 2011).

It is with this backdrop that SWIFT, a major financial sector

cooperative supporting more than 10,000 financial institutions and corporations

in 212 countries, proposed an ambitious, and for many unlikely, idea: ‘‘Banks

for a Better World’’ (known as B4BW). The initiative is led by SWIFT’s

innovation team, Innotribe (http://innotribe.com), and essentially it is about

making the banking community contribute to a sustainable development in the

financial sector including:

- Bridging traditional and social finance, a kind

of ‘‘fair trade’’ but for financial products and services. - Connecting the unbanked—the people who are not

part of the financial system because they do not have any bank relationship or

account. In many developing countries, the unbanked form the majority of the

people. - Establishing a community, or movement, to

influence the governments and global companies for more transparency in the way

they invest.

The challenge is enormous.

Taking the objectives in turn, a fair trade in financial and

social finance might mean developing financial products that support small and

medium scale enterprises (SMEs), and supporting ‘‘social business’’, as the

Grameen Bank and the micro-credit movement have done for some years (Amin et

al., 1998; Bond, 2007). But it could also mean supporting only SMEs which have

no negative environmental consequences, or more ambitiously, supporting SMEs

which actively work on moving the world towards environmental sustainability

(Dorfleitner and Wimmer, 2010). For example, as a 2008 analysis of banking and

climate change by the CERES group argued: ‘‘Banks are the backbone of the

global economy, providing capital for innovation, infrastructure, job creation

and overall prosperity. Banks also play an integral role in society, affecting

not only spending by individual consumers, but also the growth of entire

industries. As the impacts of global warming from the heat- trapping gases

released by power plants, vehicles and other sources take root in everyday

life, banks have never been more important to chart the future. The companies

that banks decide to finance will be a linchpin in slowing Earth’s warming and

moving the world economy away from fossil fuels and into cleaner technologies’’

(Cogan, 2008).

Connecting the unbanked is also linked to the experience of

the microcredit sector, and the banking sector in SIBOS 2012, see this a

significant future opportunity for banking, tapping into a new market of

customers (SIBOS 2012). This is possibly the least painful or controversial

objective of the B4BW initiative, as it speaks to an agenda of market growth.

But there is a major environmental double edged sword here, and it links to the

third objective of the B4BW initiative: if banks and financial institutions

continue as they have done with investments of their customer’s money, the

newly banked may simply contribute to a worse environmental situation.

Additionally, banking the unbanked must have a different ethical approach to

the ‘‘customer’’—it almost certainly means a model of micro-credit on low

interest, and needs a very different customer–bank relationship. Banks are

already discussing renewed customer care for their current clients in an

attempt to renew trust in banks and banking, but extending banking to the

excluded, often disenfranchised, majority in Asia, Africa and Latin America is

a significantly more complex ethical challenge (Karlan and Zinman, 2011;

Schurmann and Johnston 2009).

The third objective of the initiative is perhaps the biggest

Pandora’s box for the sector and for sustainable social and environmental

development. Banks and associated financial services are a critical part of the

engine of the current global economy, and could be part the solution for global

economic poverty. But paradoxically, the contemporary model of the financial

sector and global economy is the fundamental driver of environmental

destruction. Global human well-being depends on the resources we use, but

current and future well-being also depends on sustainable use of resources and

the elimination, if humanly possible, of destructive human activities. Taking

one example of a particularly destructive human activity, two European NGOs,

Fairfin and IKV Pax Christi, have been working for years to persuade the global

banking community to stop their support for the arms trade, particularly the

trade in cluster munitions, which have massive social and environmental

consequences. Cluster munitions have killed and injured thousands of civilians

during the last 40 years and continue to do so. They cause widespread harm on

impact, and continue to remain dangerous for decades, killing and injuring

civilians, wildlife, and affecting agriculture long after a conflict has ended.

In 2012, Fairfin and IKV Pax Christi published their regular analysis of

financial institutions, and their support for the industry or their moves away

from the industry. They report that every year more financial institutions are

moving away from the industry—since 2009,

48 financial institutions have ceased investments in cluster

munitions. 27 financial institutions have a far-reaching policy ending all

investments in cluster munitions producers, including seven government-managed

pension funds, three ethical banks and 17 private financial institutions.

However, in 2012, 137 financial institutions still invested almost US$43 billion

in the eight cluster munitions producers included in their analysis (Fairfin and

IKV Pax Christi, 2012).

Taking another major environmental challenge, two groups

have analysed the climate change policies and actions of the world’s largest

banks (Cogan, 2008, Furrer et al., 2009). A CERES study of 40 major banks found

that ‘‘European banks are at the forefront of integrating climate change into

environmental policies, risk management and product development. The majority

of other banks in this study, including many of the leading US banks, are

working towards better disclosure of climate risks as an essential first step

toward embracing a changing regulatory and economic environment’’. In addition,

‘‘21 of the banks evaluated offer climate-related products, including 10 with

climate specific funds and index offerings. Many of these products have been

launched in 2007, and most are coming out of European banks. Twenty-two of the

banks examined offer climate-related retail products—from preferred-rate

‘‘green’’ mortgages to climate-focused credit card programs and “green car

loans” (Cogan, 2008).

This commentary hopes to begin to bridge the gulf that

exists between disciplines and sectors in pursuit of sustainable social and

environmental development. Perhaps we should conclude with the blog of the

banking sector co-author of this commentary. Chris Skinner chairs the Financial

Services Club, a forum where bankers, regulators and insurers discuss the

future of the financial sector. Chris is a regular participant in SIBOS. This

year he used the mask and action of the banking sectors most active critics,

the Occupy Movement, to argue that ‘‘these guys are now the industry’s

regulatory so stop being upset by a mask and go and talk to the people. Just as

I talked to the people last year about bankers, and they equally ignored my

message, this rift of the bankers versus the people is caused more by prejudice

than understanding’’ (Skinner, 2012).

‘‘Banks for a Better

World’’ sounds an improbable idea, but also a necessary one. But the banking

sector alone cannot change the whole system towards sustainable social and

environmental development. The whole system needs to be engaged in radical

change, and to an extent the banking crisis itself has led to more ambitious

long view debates within the banking community, than were found in the World

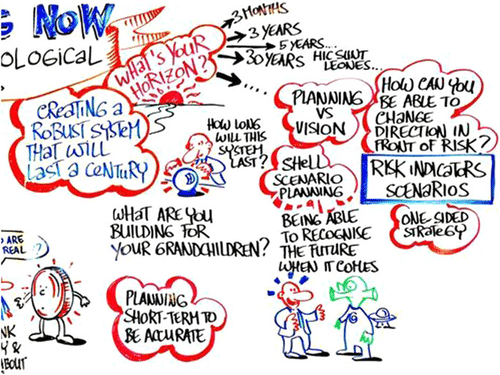

Economic Forum or Rio 2012. Bankers at SIBOS 2012 talked about themes related

to the reconstruction of the financial system from meltdown, discussing huge themes

such as the future of money, the future of organisations, the future of doing

good, and the very nature of the future.

At the very least, despite the inertia in the system, there

is a sense in the banking world that business as usual is not an option.

Perhaps this gives us a lesson: we need less business as usual across all

sectors and disciplines: less short-termism, less silos of understanding and

policy, less individualism, and more futurism. As one of the bankers at SIBOS

2012 commented: ‘‘We all have created this. But we all owe the future a legacy

of good, not just one of problems’’.

Out of the environmental, social and economic crisis of

today, we need, painfully but creatively, and very urgently, to construct a new

world from meltdown, to protect our planet, its peoples and environment, now

and for the future.

Download PDF version of the full article

References

Amin, R., Becker, S.,

Bayes, A., 1998. NGO-promoted

microcredit programs and women’s empowerment

in rural Bangladesh: quantitative and qualitative evidence. Journal of

Developing Areas 32 (2),

221–236.

Bond, P., 2007. The

meaning of the 2006 Nobel Peace Prize.

Microcredit evangelism, health, and social policy. International Journal

of Health Services 37 (2), 229–249.

Cogan, D.G., 2008.

Corporate governance and climate change: the banking sector. CERES. Boston,

Ceres, Inc./http://www.

ceres.org/resources/reports/corporate-governance-banking-sectorS.

Derwall, J., Koedijk, K., Ter Horst, J., 2011. A tale of values-driven and

profit-seeking social investors. Journal of Banking & Finance 35 (8),

2137–2147.

Donaldson, T., Dunfee, T.W., 2002. Ties that bind in

business ethics: social contracts and why they matter. Journal of Banking &

Finance 26 (9), 1853–1865.

Dorfleitner, G., Wimmer, M., 2010. The pricing of temperature

futures at the Chicago mercantile exchange. Journal of Banking & Finance

34 (6),

1360–1370.

Fairfin and IKV Pax Christi, 2012. Key Findings from the

June 2012 update of "Worldwide

Investments in Cluster Munitions; a shared responsibility". I. P. Christi.

Brussels, IKV Pax Christi.

/http://www.ikvpaxchristi.nl/stopexplosiveinvestments.

Furrer, B., V. Hoffman, Swoboda, M., 2009. Banks and climate change: opportunities and

risks. An analysis of climate strategies

in more than 100 banks worldwide. Brussel, European

Commission, Zurich University of Applied Sciences, ETH Zurich, SAM Sustainable

Asset Management.

/http://ec.europa.eu/enterprise/policies/sustainable-business/corporate-social-responsibility/reporting-disclosure/Swedish-presidency/files/surveys_and_reports/banking_and_climate_change_-_sam_

group_en.pdf

Hausman, D.M., 2002. Trustworthiness and self-interest.

Journal of Banking & Finance 26

(9), 1767–1783.

Karlan, D., Zinman, J., 2011. Microcredit in theory and

practice: using randomized credit scoring for impact evaluation. Science

332 (6035), 1278–1284.

Renneboog, L., Ter

Horst, J., Zhang, C., 2008. ‘‘Socially

responsible investments: Institutional aspects, performance, and investor

behavior.’’. Journal of Banking & Finance 32 (9),

1723–1742.

Rose-Ackerman,

S., 2002. ‘‘Grand’’ corruption and the ethics of

global business. Journal of Banking &

Finance 26 (9), 1889–1918.

Schurmann, A.T., Johnston, H.B., 2009. The group-lending model and social closure:

microcredit, exclusion, and health in Bangladesh. Journal of Health,

Population, and Nutrition 27 (4), 518–527.

SIBOS, 2012. SIBOS 2012 Osaka, Available at

/http://www.sibos.com/news_12112012_sibosissueswrapup.page. (accessed 30

10 12).

Skinner, C., 2012. The

man behind the mask. Financial Services Club Blog (accessed 15 11 12).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...