I mentioned that I’d just attended the branding in banking

conference this week. It was organised

by the Banker Magazine, and is in its seventh year of operation.

The headlines this year are:

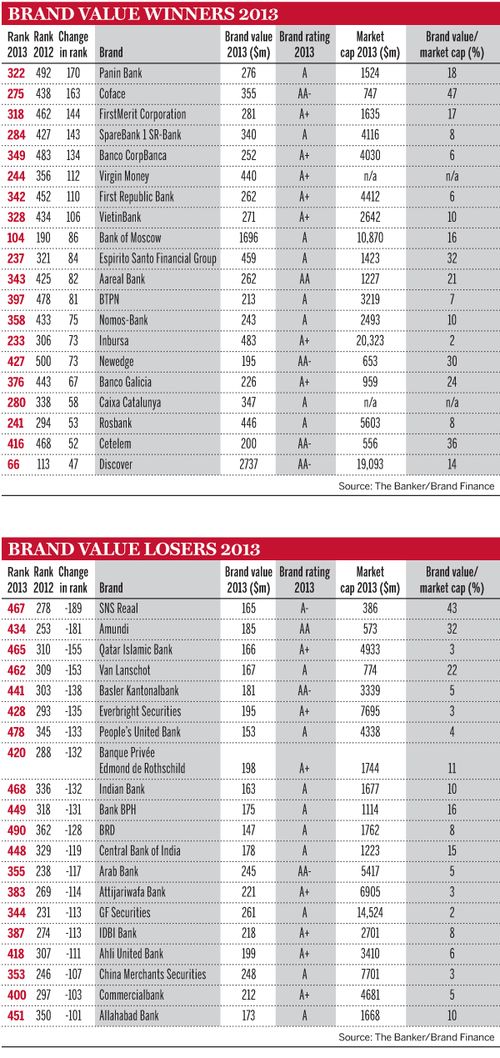

- The UK is the only top 10 country in The Banker

/ BrandFinance® Banking 500 to see the total value of its bank brands fall with

a net loss of $1.5 billion

particularly badly, with brand values falling $4 billion, a drop of 29%

allegations, has lost 17% of its value and lost the global top spot to US bank,

Wells Fargo

money-laundering scandal, and Barclays, taking the heat over Libor-fixing, have

lost 8% and 1% of their respective brand values

-RBS, Lloyds TSB and NatWest all show considerable increases in brand

value;34%, 19%, 22% respectively

$746.8bn in 2012 to $860.7bn in 2013, driven by impressive growth in emerging

markets, in particular China

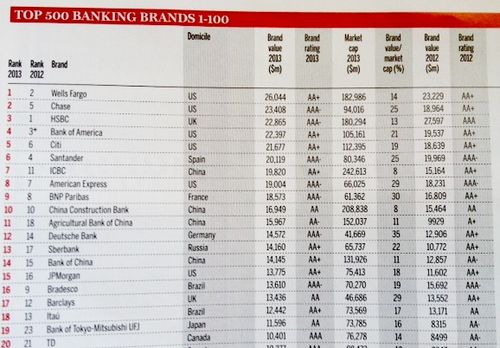

And the Top 10 bank brands are:

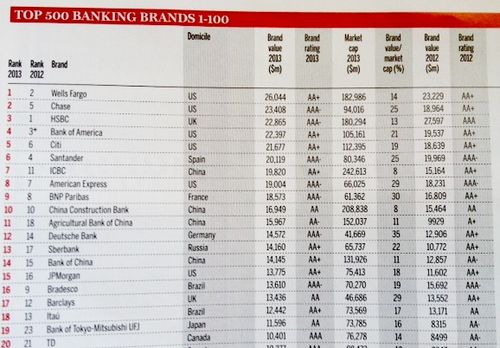

The biggest winners and losers are:

Even with all the scandal we see every day here in the UK,

bank brands globally have performed really well over the last year, with total

brand value rising 15% from $746.8bn in 2012 to $860.7bn this year, a new high

and a big difference from last year when the total fell from $855bn, the 2011

total.

US bank brands are performing particularly well, with Wells

Fargo replacing HSBC as the world’s most valuable bank brand. Wells Fargo gained $2.8bn to give it a brand

value of $26bn and so recovering some, but not all, of last year’s $5.7bn loss.

And while 2012’s drop in value did not dislodge Wells Fargo from the second

spot, this year’s increase was enough to give it the top position.

US banks hold four of the top five places in the ranking –

up from three last year – and overall they account for 93 brands – five more

than last year – with a total value of $230.6bn. This is an increase of $24.6bn

on 2012’s figure and keeps them well ahead of their nearest rival China, whose

23 brands increased in value by $16bn. In fact, the total brand value of US

banks is larger than the next three biggest countries – China, the UK and

Canada – combined.

Meanwhile, China and Brazil have also done well. In fact,

the only major market that took a dive is the UK, where the overall valuation

dropped as a result of brand value losses by leading players such as HSBC and

Standard Chartered.

Reflecting on the changes in the brand survey since it

started in 2007, Brand Finance Chief executive David Haigh notes that, in 2007,

the brand value to market cap percentage of the US banks in the top 100 was 12%

and has been rising ever since to reach 15% in 2013. The brand value over the

same period has been much more constant, in the $160bn to $200bn range, with

the exception of 2009 during the worst of the crisis. This suggests that

markets have moved from overvaluing US banks to undervaluing them.

By contrast some emerging markets have seen huge increases

in brand value over the past five years, reflecting the fast growth and more

dynamic performance of their banks and the better establishment of their

brands. Russian brand values have performed the best with a 453% uplift since

2008, followed by Indonesia (443%), the Philippines (412%), Colombia (377%) and

China (335%).

Chinese banks brand value reached $95.7bn, and Agricultural

Bank of China recorded the highest leap in brand value of any bank – $6.04bn

which sent it up from 18th to 11th place. ICBC notched up the second highest

value rise with $4.66bn, taking it up from 11th to seventh place. In a table of

the highest number of places climbed, Indonesia’s Panin bank claims the top

spot, rising from 492nd to 322nd.

Another good performances has come from Russia’s Sberbank,

which increased its brand value by $3.39bn and rose from 17th to 13th position.

It also occupies second position in the top brand value in Europe table, helped

by the fact that all of its $14.2bn brand value is concentrated in the region.

In Latin America, the biggest gainer is state-owned Banco do

Brasil, which saw its brand value rise by $2.62bn – the ninth highest overall –

closing the gap on its Brazilian rivals Itaú and Bradesco, and giving it 22nd

position in the main table.

In country terms, Brazil has the sixth largest sector brand

value – $38bn – on the back of only eight brands, the lowest number of any of

the top 10 countries. This illustrates the dominant position held by the major

Brazilian banks.

In the Middle East, the four top rated banks held their

places in the table – QNB, Al-Rajhi, National Bank of Abu Dhabi and Emirates

NBD – but only QNB was able to increase its brand value, from $12.6bn to

$13.1bn.

In Africa, Standard Bank takes the top spot from Citi, while

ABSA moves to second from third and Nedbank from sixth to fourth.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...