It's interesting that some of us present and present and present, talk

and talk and talk, blog and blog and blog and more about the future of money,

payments, banking, society, the world and so on such that, by the time it arrives, you’re

bored with it.

I find this with mobile banking and payments, which I do find dull - if you've seen me present lately, you'll know that I've moved on and past this - but some are just catching up.

Some have not even caught up yet, and I had this experience of shock at the lack of knowledge in some quarters of banking twice in the past few days.

Both

times people who are involved in mapping the future landscape of banking came up to me and said: “wow! You would think they would know

about that by now, wouldn’t you?” but they didn't and don't.

The first meeting where this happened was focused upon the future of banking and I

mentioned M-PESA.

It occured to me that this is old news for most but, just in case, I said: “I’m sure you all know about M-PESA but, just in

case, has anyone not heard about it?”

The majority of hands went up.

Oh! M-PESA, a radical

story of innovation in money that is now six years old … but it’s still new

news to some in banking (this was an audience of bankers).

One of the guys came up to afterwards and said: “wow, I

thought everyone knew about M-PESA so that was a shock.”

This was followed by another discussion on the future of

payments with a gentleman from the Bitcoin Foundation speaking, as well as

others.

At the end, all the questions from the floor were directed

at the Bitcoin guy, with the first being: “forgive my ignorance but I have not

heard of Bitcoin before, can you explain to me how it works?”

The Bitcoin presenter had assumed at the start that people

knew about it, so this was a surprise question for him and he went on to talk

about how it works.

That opened the floodgates for question after question

thereafter.

Fascinating stuff.

The lesson for me is that, if it is so obvious, why didn't I invest in it?

In fact, in my office, I have a bucket called the if it's so

obvous, why didn’t I invest in it bucket.

I bought it in 2006 after reading this book ...

... and it's for every time I don't invest in something so obvious that it's stupid not to.

The first time I threw up a name in this bucket was Microsoft.

Back in the early 1990s, several friends ran off and joined

this fast growing tech firm and I thought: it’s

been around so long, it’s now worth as much as it ever will be, so I didn’t invest in Microsoft

stock.

Ten years later, I would have made a million or two but hey

ho, the merrio.

I did the same with Google and, a short time later, the same

with Apple.

I was about to say, I did the same with Faecebook (mistyped but reads better that way), but

that’s one I did invest in … and halved my investment overnight but hey ho, the

merrio-oh-oh.

Nevertheless, I’m looking at these things and thinking that

if it’s obvious that there is a game-changer out there, then we should invest in

that game-changer.

That’s why I put money into Facebook and am now putting some

into Bitcoins.

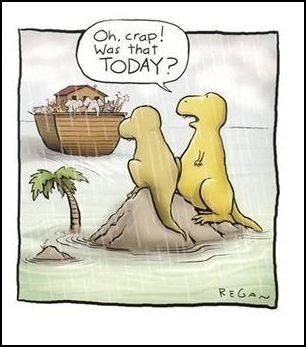

These are gamechangers and is proven by the fact that if you

haven’t heard of it, and I’ve been talking about it for years, then more fool

me for not investing in what was obvious to me years ago and for missing the

boat.

Images from MySpace and Working Girl

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...