As some of you will have gathered, I spent most of last week

in Brussels at the EFMA Distribution Week,

a grand affair with almost 100 speakers on the hot topics in retail financial

services over a three day period.

I was there to join a panel discussion at the starting plenary

on how to get close to the customer as well as presenting a specific session on information security.

But it’s been a while since I attended a good retail finance

conference, and this proved to be a very good one when you’ve been away for a

while, including case studies from Asia, America, Africa, Middle East and yes,

Europe.

The week was also split into a variety of sessions and

themes covering the impact of social media, mobile and other developments on distribution

and the insecurities therein.

Obviously with so much content I’m not going to blog about

it all, but I did want to pick out a couple of highlights.

So I’ll start with social media in banking.

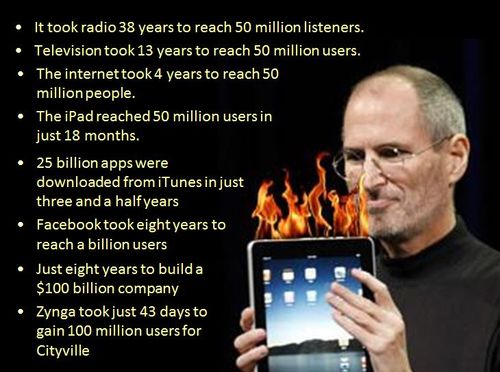

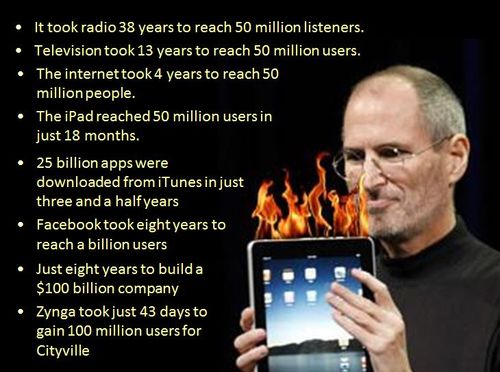

This was the session that typically began with a slide that

said: it took 38 years for radio to gain 50 million listeners whilst the iPad

had 50 million consumers in just 18 months; if Facebook were a country it would

be the third largest country in the world; etc.

Oh that’s one of my slides but I must admit, when it was

used for about the eighth time in the same conference, I’ve decided to drop it

and use two new ones stats:

It took 13 years to get two million customers using Internet

banking; it took just two months to reach that number for mobile banking.

[Barclays Bank]

It took 10 years to get twenty million contacts per month

through Internet banking. It took 18 months for mobile.[Société Générale]

Yep, that speaks volumes.

Anyways, back to social media in banking, and there were two

specific presentations on this from ICICI Bank, India, and DenizBank, Turkey,

that showed that some banks have finally realised that Facebook is now a

browser to internet and internet banking, rather than some flaky social media

service.

Both banks showed their Facebook Banking apps, and there’s

the critical word: ‘app’.

As Sujit Ganguli, Head of Brand and Corporate Communications

at ICICI Bank, said: “our customers were worried about going inot their bank

services from Facebook but, as we made clear to them, you leave Facebook and are

using our usual secure servers once you accept and install our Facebook app.”

In other words, Facebook apps are like mobile apps for banking:

it’s just another app-based banking service.

I’m not sure many have got that point yet but ICICI Bank certainly

have as Sujit talked specifically about how they use it to engage the customer

by providing content, care, communication and creativity.

In ICICI's case, they offer gaming and more, to engage the customer.

Is cricket popular in India? Do bears in the woods ...

Launched in February 2012, they achieved a million likes in

just over ten months, and now have almost 2.2 million after just fifteen months (there are 65 million

Facebook users in India).

The Facebook Page offers full service banking as well as

lots of other services of customer engagement.

The most recent innovation of the bank has been a service called iWish ...

... a smart

savings tool that works a little like SmartyPig (not surprising

as they’ve partnered with SmartyPig to do this). So you set a goal and then share with friends

and family to raise funds for your target.

Neat.

But the neatest and nicest part of Sujit’s presentation was

the last slide where he showed the impact of social media engagement with the banks

clientele.

Before using Facebook for customer engagement, 24% of the

online mentions of ICICI were negative and only 19% positive. Now, 49% are positive and just 6% negative. That’s a massive change and shows that a key

part of the use of Facebook banking is for customer servicing, not just engagement.

Just goes to show that most of our major innovations are coming from the BRICs, Asia and Africa, rather than the old suspects.

More on this tomorrow.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...