This is a question that comes up more and more, and there’s

an easy answer: it’s very important; and a harder answer: it’s not always

important; and this is a key discussion in the context of immediate payments, something

that is getting talked about more and more.

In fact, my friends over at Glenbrook covered this at the

recent NACHA Conference in San Diego. They ran a panel with

guests from Bankgirot in

Sweden, KIR in

Poland, VocaLink in the U.K.

and the Banco de México,

with these infrastructures all outlining their offers and strengths.

Purely for objectivity, here’s one slide from each that

speaks volumes.

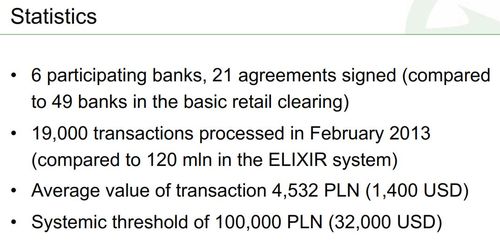

KIR in Poland developed real-time payments and settlement a

year ago (this is different ot most other systems, where it’s just real-time payment

with settlement following at a later time) but, interestingly, it’s a lightly

used system right now.

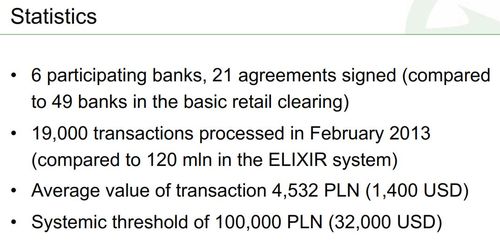

In Sweden, they do real-time payments 24*7*365 in 15

seconds, but have taken this one step further by launching the Swish app.

Swish was developed on top of Bankgirot’s real-time payments

service thorugh a cooperation between Sweden’s six largest banks: Danske Bank,

Handelsbanken, Länsförsäkringar Älvsborg, Nordea, SEB and Swedbank. The app

allows immediate payments using mobile apps and internet banking.

Perhaps the easiest way to understand it is through the words

used during its launch in the Swedish journal, The Local.

“Imagine you want to

sell a bike,” Danske Bank spokesman

Erik Kristow told The Local. “But you don’t want to hand it over until you see

the money. Well, I could simply ‘Swish’ you the amount with my phone,

you could see it enter your account in

real time. Then I could cycle off with my new bike.”

Swish, a mobile payment service launched

last week, is even a world first according to Head of Channels at Danske Bank,

Daniel Wahlstrom.

"This is unique

because of the collaboration of the banks, and the fact that the money is

instantly transferred from one bank account to the

other,” he said.

"Many of the

other systems around the world rely on a credit card platform,

whereas Swish works via your own salary account, and you can see the

transaction as soon as it's happened."

The app was developed in collaboration between the six largest banks in Sweden:

Danske Bank, Handelsbanken, Länsförsäkringar Bank, Nordea, SEB and Swedbank, their

biggest cooperation in 50 years.

According to Nordea

spokesman Ragnar Roos, Swish thrives in person-to-person transactions where an

exact cash figure is needed.

“People have smaller

amounts of money to transfer and often don’t want to use cash. Swish is more

useful than cash, especially in situations where you find yourself splitting

the bill at dinner, for example," he told The Local.

“It’s not a service

for shops, it’s strictly between people. It even works for transactions on

sites like Blocket,” he

said, referring to the popular Swedish buy-sell site.

Users simply need to

connect their mobile number with their internet banking service, and then

download the Swish service to their phones using Mobile Bank-ID.

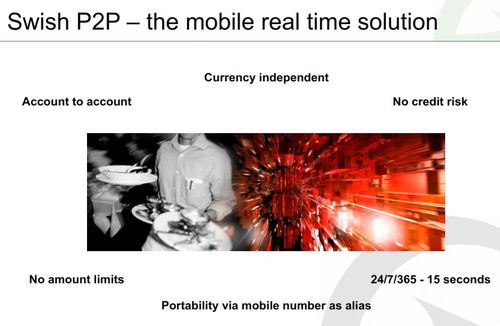

The UK will be getting a similar app next year, as the banks

launch their mobile payments service for P2P real-time payments via VocaLink.

VocaLink has had faster payments for five years now, and my favourite slide from their deck is this one (doubleclick image to enlarge):

All you need to know about VocaLink in one slide.

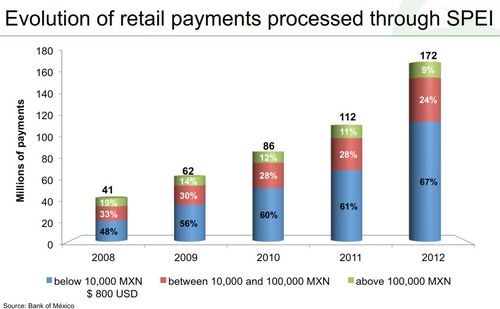

Finally, the Bank of Mexico has a hybrid real-time payments

system for high and low value payments called SPEI. Launched in 2008, its now processing around

200 million transactions per annum.

As can be seen, immediate payments is becoming a de facto

backbone for many transaction processing infrastructures.

Anyways, in preparing for the NACHA debate, Glenbrook preformed

a short online survey of how important is real-time for payments, and the

results are intriguing.

Admittedly, only 89 people responded, but Elizabeth McQuerry

from Glenbrook summarises the results as follows:

How fast is fast enough?

Nearly half (49%) responded that immediate funds transfer (faster

or real-time payments if you prefer) should have immediate messaging and

settlement, just over a third (36%) said immediate messaging and batched

settlement several times a day was fast enough while 15% said immediate

messaging with next day settlement would do just fine.

74% thought that person-to-person payments were most important

for growth but, notably, respondents felt that real-time was similarly important

for growth in Point of Sale (70%) payments and Remote payments (69%) like

e-commerce. On the other hand, only 41% of respondents felt that faster

payments were important for bill payments.

The biggest obstacle to faster payments is financial

institution opposition due to operational issues/demands (67% of respondents)

along with financial institution opposition due to cannibalization of existing

revenues (28%).

You can get a free copy of the ACH presentations and

Glenbrook survey results here.

Finally, a good example of how important real-time is in my

daily life.

I have a car that is now five years old with inbuilt

satellite navigation that is meant to get real-time updates of live traffic

flows.

It somewhat surprises me therefore, the number of times I’m

stuck in traffic. I think it’s because

it only gets updates of major traffic disruptions on the freeways rather than

on the backroads.

So I was driving the other day and picked up google maps on

my smartphone, to double check the route my car was directing me. Amazingly, and before I knew it, the phone

was using the car’s Bluetooth link to tell me to turn left and right, against

the direction of my car’s satellite navigation.

Sure enough, I reached my destination 15 minutes earlier

than I would have if I had followed the car’s near real-time service.

In other words, if the early bird catches the worm, you’re

far better being real-time as you’ll always be earlier.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...