I recently joined my friends at Anthemis – the guys

investing in Fidor, Simple and Moven – for a chat.

They gave me a nice leaflet on the trends in remittances

which I thought worth sharing with y’all, as it’s a great read with many useful

charts and stats.

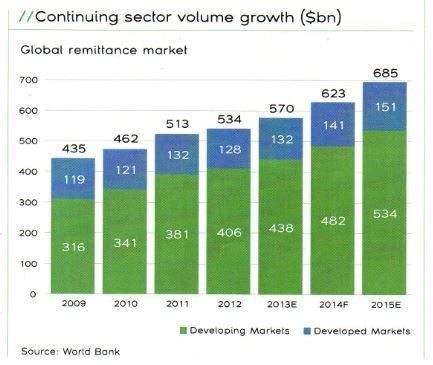

The first chart shows the growth of remittances …

… with the World Bank estimating that remittances are

growing at 11% CAGR from $234 billion in 2004 to $534 billion in 2012, growing

to $685 billion by 2015.

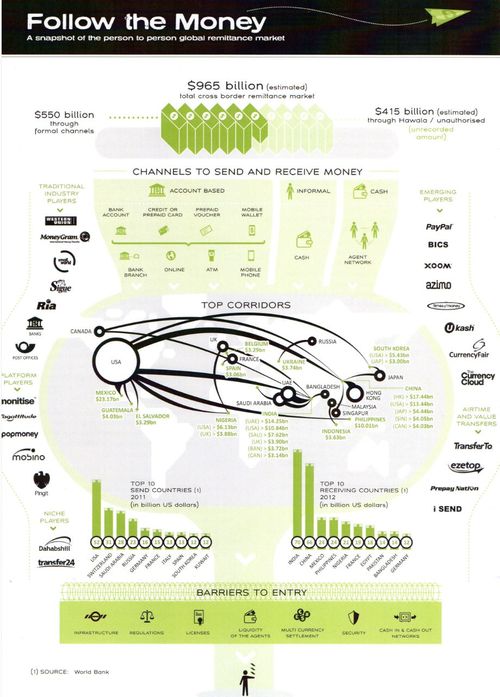

That does not take account of the informal remittances market

however, such as Hawala, which some estimate would add a further 40% of funds value to this

marketplace.

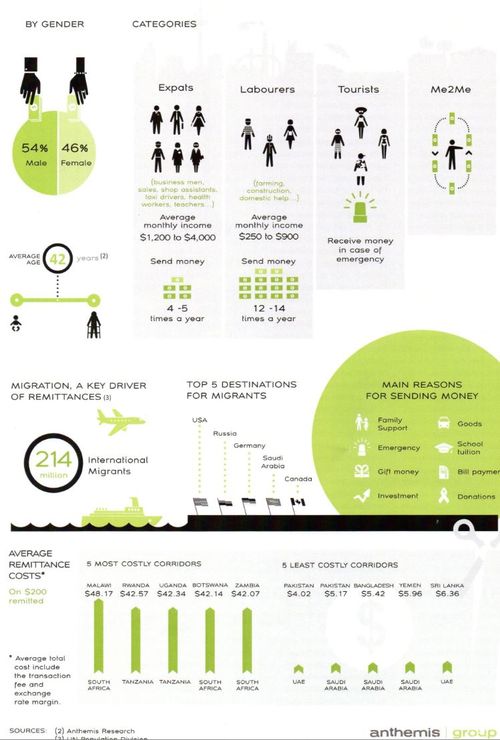

It’s not surprising that the market is so effervescent when

over 200 million people work in a country they weren’t born in, and over 40 million

immigrants in the USA alone in 2010, accounting for 13% of the population (up

from 11% in 2000).

It is also a market that is seeing big changes thanks to

mobile money transfer, even though costs are still high with an average fee of

9% or higher to make a transfer. This is

down to the domination of the two largest players Western Union and MoneyGram,

who own 20% of the global market.

Western Union’s revenues for 2011 were $5.5 billion,

driven by 510,000 agent locations. MoneyGram’s revenues were $1.2 billion in

2011, with 284,000 agent locations. Ria,

a subsidiary of Euronet, came third with $244.7 million revenues in 2010 and

107,000 agents.

America is the top remittance sending country, with $52

billion of outbound remittances in 2011.

India is the top receiving country, with $70 billion received in 2012

(estimate) although Tajikistan is the top receiver based upon percentage of

GDP. 47% of Tajikistan’s GDP is based upon

remittances received.

There’s a load more in there, with two great infographics

in the centrefold, but it’s notable that this is all taking place as HSBC and Barclays close down their money transfer network support due to money laundering (I said

they would do this three years ago).

A further drive into Hawala and informal transfers, or an

opportunity for a new mobile money transfer system?

Anyways, here are the two infographics from Anthemis (doubleclick image to enlarge).

Here's the full newsletter btw, and you can download it too!

Trends in Remittances, June 2013 [The Anthemis Newsletter] by anthemisgroup

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...