I got a copy of a fascinating survey by ING yesterday on

mobile social banking. The survey asked 12,000 people in 12 countries in Europe about banking in the digital age, and here’s their summary of the main conclusions:

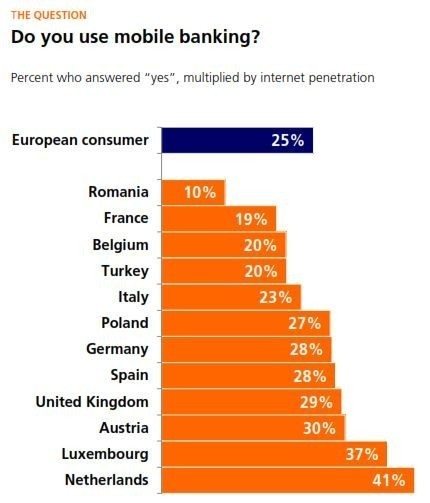

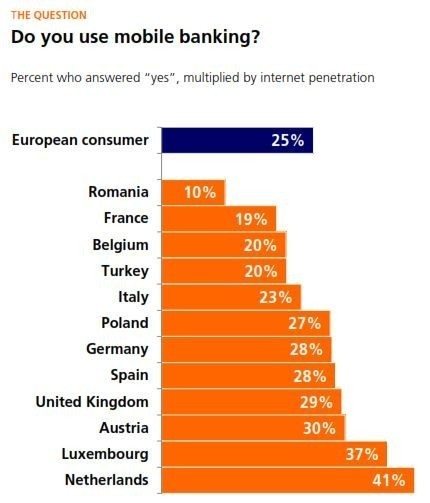

1. More than a third – or 37% – of consumers already use mobile banking. The Netherlands

is the most developed mobile banking spot, based upon the measure that takes

internet penetration into account. Turkey is the mobile banking hotspot, with

the largest share of internet users who use mobile banking.

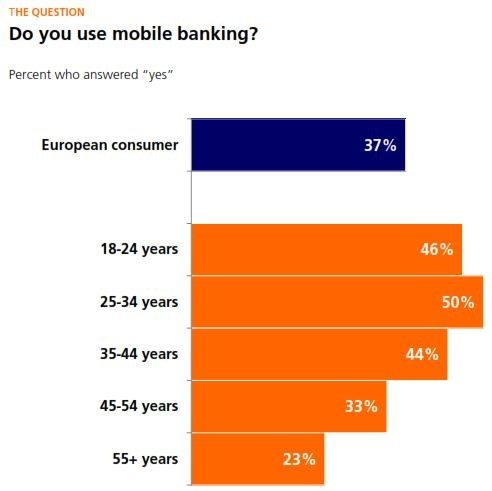

2. The uptake of mobile banking is much stronger for under

35s and for people who frequently use social media, groups seen to indicate

future trends. It suggests mobile

banking will become increasingly popular.

3. People who use mobile banking say they are managing their money differently.

Most report feeling more “in control” of their money, checking their account

more frequently, paying bills on time more often and being overdrawn less

often. These insights into changing behaviour are, however, based on what

people say they are doing rather than actual, transaction-based evidence (and

the two can differ).

4. The security of contactless

payments is still a concern to the majority in four of the countries surveyed

– namely France, Luxembourg, Germany and Austria – and almost a fifth of

European consumers don’t know if they are confident in the security. Younger

people are more comfortable with contactless payments, again suggesting this form

of payment may become increasingly popular.

5. Even as technology advances, traditional, printed cash is still a popular device to monitor and

keep control of spending. Half of European consumers agree they prefer to

use cash when shopping because it is easier to see when they are spending too

much. This rises to a high of 61% in Spain. It is popular among under 25s as

well, with 64% agreeing. It is a fascinating insight against the backdrop of

the rise of “cashless” bank cards and contactless payments and the apparent

contrast with their widespread acceptance by younger people.

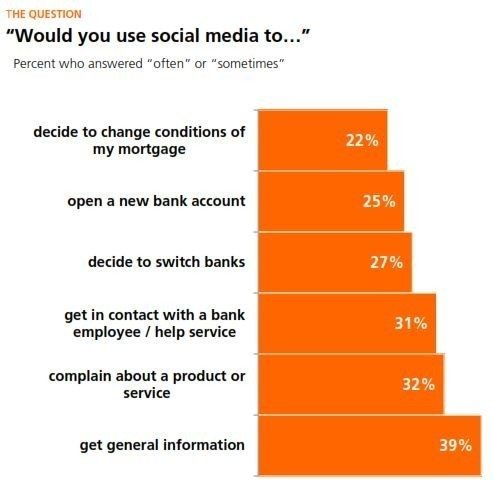

6. Social media plays

a role in the way people interact with their bank but traditional word-of-mouth

still tends to be the most powerful force for recommendations. People are most interested in finding information about and getting tips

from their bank via social media. They are

less interested in offers of products and services.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...