I keep thinking I should stop blogging about Bitcoin, as I’ve written so much about it already:

- Is Bitcoin the future of money … or are we smoking dope? (October 2011)

- Bitcoin: immersive or subversive? (January 2012)

- You should take Bitcoin seriously (September 2012)

- A new currency payment system is about to explode (February 2013)

- The latest stats on Bitcoin (February 2013)

- The real cause of the Bitcoin bubble and burst (April 2013)

But there’s always more to say about this strange but burgeoning economy.

Recently, in my presentations, I’ve added a lot more about why Bitcoin matters and how easy it is to use.

To buy Bitcoins you just transfer money electronically to Mt.Gox, the exchange with the most liquidity, or a similar exchange such as Bitcoin-24 or Intersango (note: these exchanges are now talking to the UK regulators to be recognised as official trading venues).

Once you’ve transferred the coins you can buy all sorts of stuff from pizzas to babies.

Often people think Bitcoins are some sort of dodgy Ponzi scheme used for money laundering and drugs, but that’s just because they don’t understand what’s going on.

You see Bitcoin is the Wikicoin for the Wikileaks world.

It is disruptive because it has no central issuing authority or control, and that’s where governments have a big issue.

It needs to be controlled and this is why some governments, particularly the US government, spread views that Bitcoins are all about subversive disruption.

For example, the State of California sent the Bitcoin Foundation a ‘cease and desist’ order, which Financial Services Club friend and Q4 2013 speaker Jon Matonis highlighted at the end of last month, in his Forbes blog:

Directly following last month’s Bitcoin 2013 conference event in San Jose, CA that brought decent revenue into the state, California’s Department of Financial Institutions decided to issue a cease and desist warning to conference organizer Bitcoin Foundation for allegedly engaging in the business of money transmission without a license or proper authorization.

If found to be in violation of California Financial Code, penalties can be severe ranging from $1,000 to $2,500 per violation per day plus criminal prosecution which could result in fines and/or imprisonment. Additionally, it is a felony violation of federal law to engage in the business of money transmission without the appropriate state license or failure to register with the U.S. Treasury Department. Convictions under the federal statute are punishable by up to 5 years in prison and a $250,000 fine.

CA State Cease and Desist May 30 by Jon Matonis

The Bitcoin Foundation, a not for profit organisation, replied on July 1st by sending a letter drafted by J. Dax Hansen, an attorney at Perkins Coie representing the foundation, as detailed in American Bankerthis week.

Hansen notes that his client has no operations in the state (its offices are in Seattle) and that it primarily engages in advocacy and software development.

Furthermore, the state law defines money transmitters as firms that sell or issue “payment instruments” or “stored value” or “receive money for transmission.”

Hansen cited a 2001 ruling in which the department said it defines an instrument as a written, signed document … similar in nature to a check or a draft.

“This confirms that a product can only be an instrument if it involves a writing, and since Bitcoins are digital they aren't instruments.

Stored value is defined under California law as “a claim against the issuer that is stored on an electronic or digital medium,” but Bitcoin has no issuer.

He also cited a 2011 opinion in which the department said a firm that exchanges dollars for pesos or vice versa without holding customer funds for future transmission is not a money transmitter.

“The same rationale that applied to the sale of a peso should prevail under the California statute with regard to the sale of a Bitcoin,” Hansen wrote.

Bitcoin Foundation Response to California DFI by Jon Matonis

In fact, the reason why Bitcoins are viewed as dangerous by governments is for exactly the reasons cited above, and there will be a long and arduous battle between controllers and the uncontrolled.

This is the nature of the Wikiconomy.

And it is this Wikiconomy that we should now take even more seriously when the co-creators of Facebook start building platforms to encourage its exchange. Yes, you heard me. From today's Daily Telegraph:

In a move that could come to mark a major new era for the virtual currency, Tyler and Cameron Winklevoss have filed to float their stash of Bitcoins on a conventional stock exchange. The former Olympic rowers have lodged papers for a $20m initial public offering of the Winklevoss Bitcoin Trust, which holds their Bitcoin wealth, and would be managed by the Winklevoss' investment fund, Math-Based Asset Services.

The flotation has yet to be approved by US authorities, which have already voiced their scepticism about the legitimacy of Bitcoins, but if they give the Winklevoss' plan the green light, it could help to clean up the virtual currencyメs image and put it within reach of many more investors.

Finally, back to what can you do with a Bitcoin once you have one, if you really want to know then checkout this interesting Kickstarter project, where a couple of newlyweds are making a film about trying to live exclusively on Bitcoin for three months (you can follow their progress here).

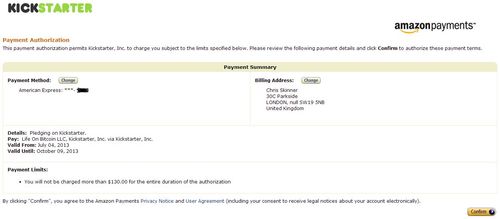

Strangely enough, I decided to back this and discovered that I was paying with real money, not Bitcoins.

Yes, I signed up for the project and was transferred to Amazon to pay with my credit card.

Nothing like innovation.

Postscript: if you still don’t know what Bitcoin is or how it works and want a seven minute introduction, you can do no better than to watch this clip from the BBC Click! News program.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...