I gave a presentation the other day and, as usual, concluded

that banks should position themselves as data vaults. One person then asked: what data should a bank make secure? which is a good question to

ask, as it led to a healthy debate and improvement of clarity of view.

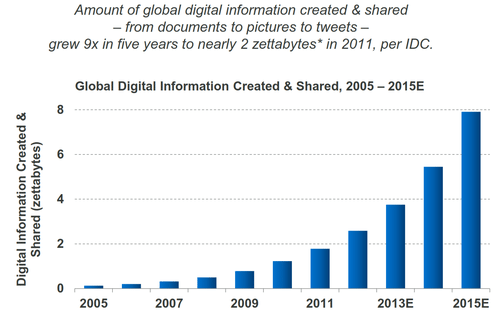

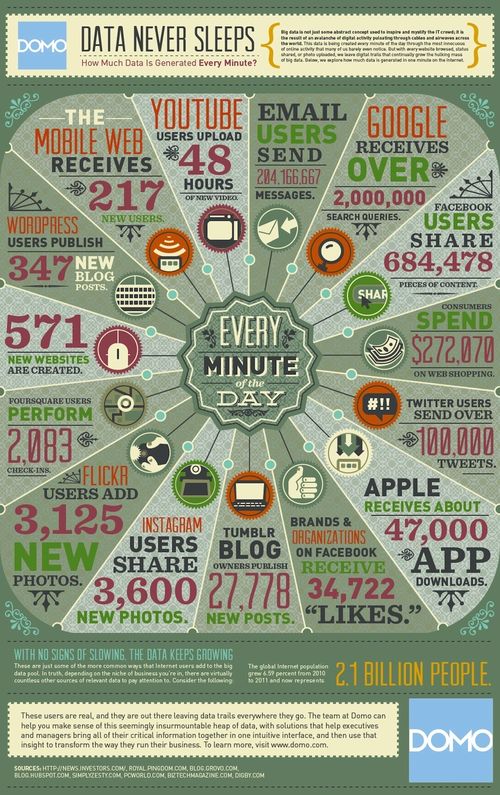

Today, we produce exabytes of data every hour. How much data? Well, it’s hard to quantify as the data

explosion of the last decade is so immense, but this slide gives you a good

idea:

This slide is taken from IDC’s research “Extracting Value from

Chaos”, sponsored by EMC,

and a presentation by Mary Meeker on key internet trends.

This slide shows that, from 2005 to 2011, the

amount of information being created and shared rose ten-fold to almost 2

zetabytes (2 trillion gigabytes), and is increasing every day.

Now not all of that

information is that critical. Some is

erroneous, some transient, some time dependent and so and so forth.

For example, and just

to put this in perspective:

- There

are 2.2 billion email users worldwide sending 144 billion emails every day of

which 61% are considered non-essential and 68.8% is spam;

- There

are now almost 1 billion websites with 87.8 million on Tumblr alone, and the average

web page became 35% bigger during 2012 (thanks to photos, videos, etc);

- There

are over a billion monthly active users on Facebook (posting monthly)

with Brazil the most dynamic country on Facebook, where 85,962

items are posted every month;

- Facebook

adds 7 petabytes of data every month for photo content alone;

- There

are over 200 million monthly active users on Twitter, posting 175

million tweets sent every day throughout 2012;

- There

are 6.7 billion mobile subscriptions and around 5 billion mobile phone users

generating 13% of global Internet traffic or around 1.3 exabytes of data each

month (59% of it is video).

Figures courtesy of

Pingdom

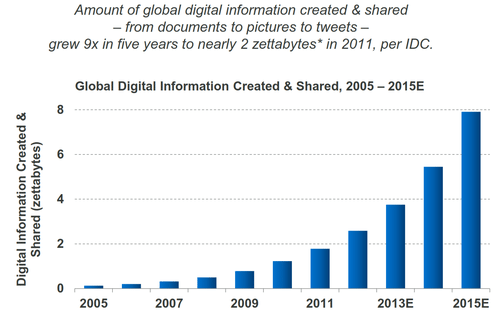

So I’m going to take a pop at this mountain of data and say

that data is increasing at around 2 zetabytes a year today, of which 65% is

redundant data, e.g. spam and transient.

That leaves around 665 exabytes that has some value.

Some of this is important but not critical, and some worthwhile

but not that important. Using the third

to two-thirds dynamic, this would mean that around 220 exabytes is important

and 70 exabytes critical.

It is this last category that may be leaked by Wikileaks, so

that’s the stuff that people want to secure.

It is here that banks can make their data vault offer.

Secure data with the bank and pay for that security.

You would probably find that although people may feel their

data needs to be secured because it’s critical, only a third would pay for that

security, so now we have our figure: 20 to 25 exabytes of data per year is the

sort of data that people would secure and pay for.

How much do they pay?

Well, what’s it worth to secure those photo albums you currently

post on Facebook of your child being born and its early years?

How much would you pay to backup your twitter account?

What is the value of those emails confirming your contracts

over the last year?

How much would you pay to keep your Bitcoin account secure?

All of this is data that currently relies on the organisation

or the individual to secure, but the bank could secure that data for a fee, as

much of the above has the same value as money for the individual or

organisation concerned.

And how would it work?

It would work by downloading a bank offered app that, once

installed, allows you to tag any data with a padlock (see bottom of photo, doubleclick to enlarge).

That padlock tag moves that data into the

bank vault, where it is secured. If you

ever then lose that data, your disk gets wiped, you accidently delete it, your

Facebook account is corrupted, your backup is destroyed … you can guarantee to

get it back from the bank vault.

That is the bank’s guarantee, and that has value.

How much?

That’s up to how much the individual wants to pay.

Like an insurance policy, if you value your data at £1 million,

then you pay the bank an insurance premium for the bank vault’s guarantee. Let’s say it’s around £250 ($400) a year for

secure, backed up and defended or £100 a year for secure and backed up.

£250 a year for a guarantee that the tweets, posts, updates,

blogs and stuff you produce is guaranteed to be secure and backed up, or secure

and defended. I imagine quite a few

folks would pay for that:

- Google averages 2 million searches per minute;

- Facebook users post 684,478 pieces of content

per minute; - Twitter users average over 100,000 tweets per

minute; and - $272,070 is spent online every minute.

Infographic stolen from

Mashable

Of course, a bank does not necessarily need to make this

offer of course. Google could. Or Facebook.

And, if they did, maybe they could offer to look after your money too.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...