It's almost a decade since the first UK P2P Lender Zopa launched, back in April 2005.

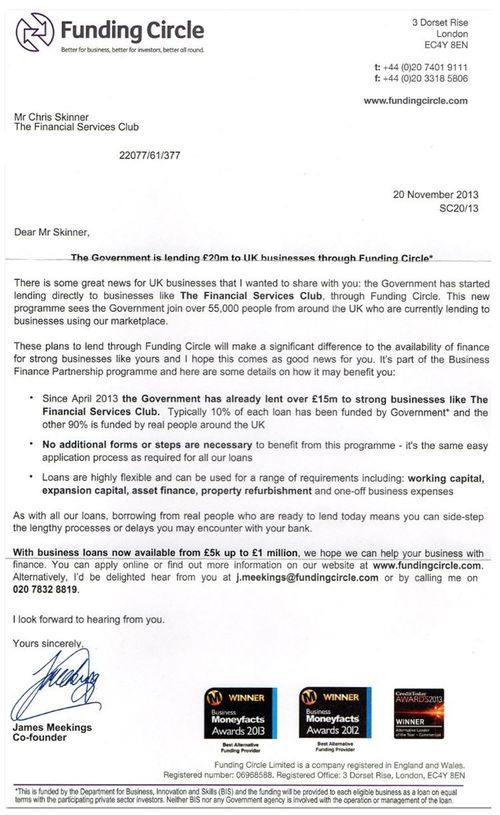

Today, I reckon the industry came of age as I received this letter in the post.

This was a letter that came out of the blue effectively saying that Funding Circle is offering £200 million of new funding to businesses that they have selected as worthy. 90% comes from crowdfunding and 10% from the government.

In other words, as the Royal Bank of Scotland squeeze small businesses out of business, Funding Circle gets the official government nod to allow anyone to fund viable companies direct.

The world is changing ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...