I blogged a bit already about account switching, and how customer lethargy meant that it wasn’t really happening.

Account switching rules came into force on 16th September, and the new rules mean that it takes just seven days to move accounts and all incoming and outgoing payments have to switch with the account automatically. If there are any problems, the new bank account provider is held responsible.

Sounds good, but I asked whether people were bothered as research shows that 98% fo consumers couldn’t care.

I then found a fascinating tracker of account switching stats from TNS Global that may prove me a little bit wrong.

Their research, based upon over 38,000 interviews with current account holders, found that the number of people switching since the rules applied have increased by 8%, from 35% switching in Q4 versus 27% the previous quarter.

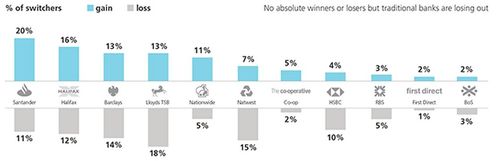

TNS Global are tracking account switching and which banks are winners and losers in the process, and it looks like Santander is doing a pretty good job of convincing people to change.

Meanwhile, the traditional high street banks are losers, especially HSBC, Lloyds, NatWest and Barclays.

What is particularly interesting is the graphs.

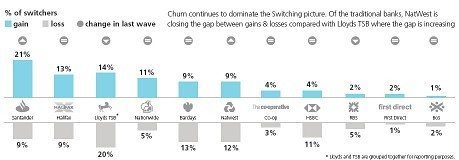

Here are the charts for November:

Santander net gain of 12% whilst HSBC net loss of 7%, Lloyds 6%, Barclays 4% and NatWest 3%.

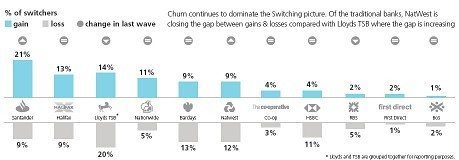

October:

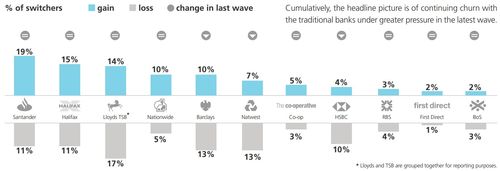

And September:

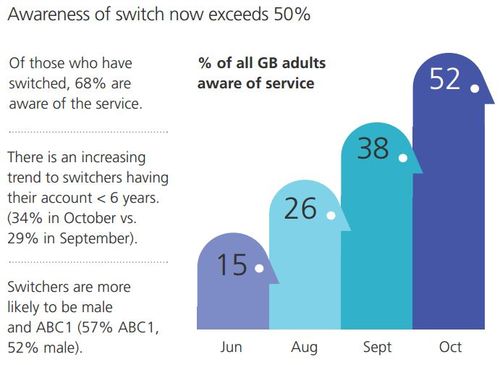

A key part of the change is the awareness of people about the new rules for switching:

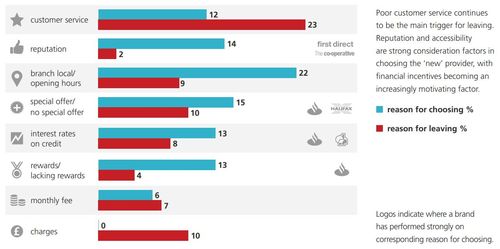

And the fact that if you are fed up with poor customer service, then that’s a very good reason for leaving or joining a bank.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...