Some of us know the numbers.

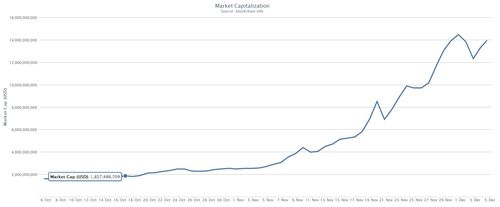

If you’d invested $1,000 in Bitcoins in summer 2011, you would be sitting on around $500,000 today.

That’s because we didn’t invest $1,000 in summer 2011.

Nevertheless, some of us did invest $1,000 in summer 2013 and by December, that investment is worth $10,000.

What is this benign conundrum Bitcoin?

Some claim it is the next generation currency that will dominate global trade for the next generation.

Some claim it is the displacement for national currencies.

Others claim it replaces Visa, MasterCard, PayPal and even the banking system.

I claim it is the Wikicoin for the Wikileaks Generation.

A generation who Occupy and are the 99 percent, and who were disgusted at the political puppeteering of Visa, MasterCard and PayPal when the American powers-that-be tried to shut down Wikileaks by squeezing their sources of funding.

The result was the near closure of Christmas 2010, and a mass movement to find a different way of doing things online.

Bitcoin is all a part of that movement and is essential a force as we see today in changing the dynamics of trade and finance.

That is not to say it will. More on that tomorrow.

Just to say that this, or something similar, is a fundamental change to our world of thinking about money and trade.

As Jon Matonis of the Bitcoin Foundation made clear at our Financial Services Club meeting in Vienna, the challenge is for authorities to realise that this change is taking place.

Governments need to find other ways to tax rather than income, and banks need to find other things to bank than money.

Banks should be banking Bitcoins.

After all, this is a value mechanism like no other.

The trouble is that today, it’s very technical. Again, more on this tomorrow.

Meantime, a few statistics.

Bitcoin has been a small economy for the past three years (it was launched in 2009).

This year, it’s taken off, especially in the last two months thanks to China adopting the currency, and America saying it may have some legitimacy.

As a result, the Bitcoin market capitalisation has hockey sticked in the last two months.

It is claimed that around 200,000 email addresses are linked to Bitcoin accounts, but that over half of all Bitcoins are linked to just 1,000 email accounts, so these are early days.

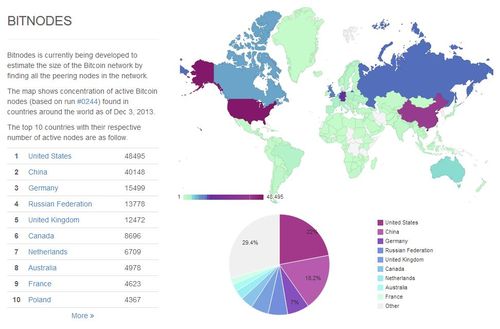

Nevertheless, it is intriguing to see who is trading in Bitcoins, with the US, China, Germany, Russia and UK being the main trading routes.

Some would say that this surely implies money laundering and tax evasion. Others would say it therefore fairly reflects the existing financial system!

Equally, it’s notable that Iran is #69 of the 193 countries that operate Bitcoin nodes.*

For more on Bitcoin, buy the book Digital Bank. There’s a whole chapter dedicated to it.

* An explanation of Bitcoin production

New Bitcoins are generated by a network node. A node is created each time a solution is found to a specific mathematical problem which then creates a new Bitcoin block. This math challenge is difficult to solve and requires a proof of work that is rewarded each time a node is created with 25 Bitcoins (currently worth around $30,000). Hence the term Bitcoin Mining, which is the process of solving the math challenges as they occur and owning a node, which rewards the solver with cash effectively.

This reward is automatically adjusted so that in the first 4 years of the Bitcoin network, 10,500,000 BTC will be created. The amount is halved each 4 years, so it will be 5,250,000 over years 4-8, 2,625,000 over years 8-12 and so on. Thus the total number of coins will approach 21 million over time, the total number that will ever be in circulation.

You can buy a fraction of Bitcoin though, so there will effectively be quadrillions of value available through the currency. Equally, the final 1 percent of Bitcoin nodes created will take 128 years to complete, as Bitcoin 20,790,000 will be produced in about 2032 and the 21 millionth in 2140!

There are just over 12 million Bitcoins out there today.

This is part of a three part series on Bitcoin this week:

Part One: The relationship between Bitcoin and Mount Everest

We were talking about Bitcoin yesterday at the Financial Services Club Vienna, and there was a great dialogue about the difficulties of buying and then using Bitcoins. I’ll talk more about the practicalities and details of that conversation later this...

Part Two: What is this thing called Bitcoin?

Some of us know the numbers. If you’d invested $1,000 in Bitcoins in summer 2011, you would be sitting on around $500,000 today. That’s because we didn’t invest $1,000 in summer 2011. Nevertheless, some of us did invest $1,000 in...

Part Three: Bitcoin: all hype and bluster or a brave new world

The biggest question about Bitcoin is whether it’s really important or just a bubble that’s about to burst. Advocates would obviously claim the former and critics the latter, and both have some substance. On the advocate’s side, the economy is...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...