The year ahead of commercial banking is also a challenging one, as corporate needs are changing and technology is impacting their value and supply chains, as much as banks and, in some cases, if not more. I don’t think 3D Printing will be the big ticket change this year, although this is on the horizon for the future in collapsing supply and manufacturing cycles, but other areas are key.

First, there is the need to continue growth of transaction banking services and I guess that much of the focus of this blog entry will be on transaction banking rather than the wider sphere of commercial banking, as transactions is where I focus.

In this context, the role of SWIFT will be further queried and reviewed, as banks look to three specific issues that need to be locked down: money laundering, cybercrime and Know Your Client (KYC).

These were all discussed at SIBOS in Dubai last year, but the worries of commercial banks in being caught up in an unforeseen sanctions bust due to poor KYC controls is top of mind still, especially when the world’s global local bank HSBC was caught out in this storm.

The initial reaction of HSBC has been to close down accounts that are potentially liable, such as diplomatic accounts in the UK of countries they might see as laundering enablers, and getting out of countries that cause such issues. To be honest, that’s a scattergun approach that is poorly targeted and purely implemented to avoid further fines and sanctions.

What is needed is a finely targeted scalpel to dealing with Politically Exposed Persons (PEPs), anti-money laundering (AML) and KYC. You would think this would have happened already, but it hasn’t as each bank runs its own AML and KYC program independent of all others. I suspect that will change this year.

2014 sees the start of real KYC shared utilities.

This is something we’re talking about at the BAFT-IFSA Global Annual Meeting in London, January 19-21, and will prove an interesting test ground for a wider dialogue, as all of this strikes to the heart of identity management.

Intriguingly, this is something that’s been bubbling around for almost two decades with IdenTrust being a case in point. Created in the 1990s as a SWIFT-style development for shared identity management, it is an area that has struggled to be solved as banks are reluctant to outsource this key requirement of transaction processing, so to speak.

With KYC we see the same. This may change in 2014 however, as SWIFT announced a KYC shared utility service for corporate information at SIBOS and, equally, the KYC Exchange is gaining some traction in this space.

Something to watch.

This leads to the other side of the KYC AML equation: crime and fraud. Commercial banks are worried about security more than any other, as we are talking high value accounts and transactions, and online crime and cyberattacks are increasing.

Bullet-proofing processing security is even more critical.

We’re not saying there are holes in security, but there are many layers to bank processing and each has its own defences and controls. Processing via SWIFT, EBA, VocaLink, Visa, MasterCard and other shared infrastructures are first layer defences. Should these be breached, then the industry has a big issue.

The banks themselves are actually less affected, as they are the second level defence rather than first, but banks’ security fears have been heightened ever since the Stuxnet malware wormed its way into Iran’s defences, and corporate cyberattacks and cyberdefences are critical to banking in 2014.

Alongside these related concerns of fraud and money laundering are then the opportunities for growth.

Growth in particular is represented by the Renminbi. As Gottfried Leibbrandt underscored at the Financial Services Club dinner in December, Chinese currency is now the second largest trade finance currency behind the dollar and China, along with Asia in general, is a core market for growth.

Therefore commercial and transaction banks are focusing upon becoming de facto Renminbi processing hubs, and this will the priority in 2014.

Becoming a Renminbi / Asian processing hub is key for transaction banks

This is even more underscored by the news today that China has overtaken America as the top global trading nation over the past year (according to China). We originally thought that would happen around 2040 ten years ago. Amazing how fast this has taken place.

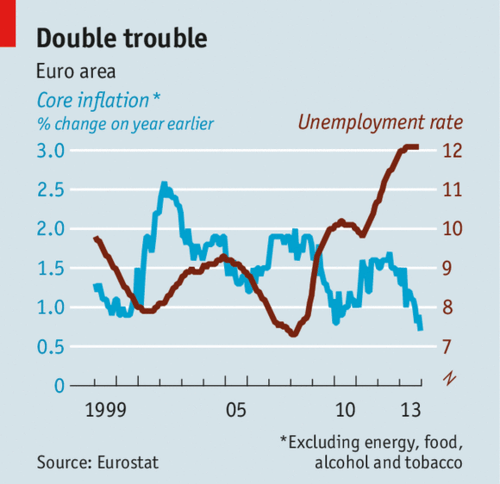

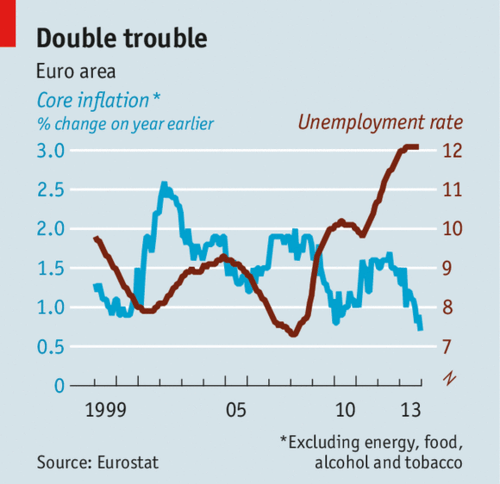

Meanwhile, the bottom-scraping Eurozone continues to float in the doldrums, as highlighted by the Economist this week:

I know that I’m stirring up a mess of discussion, but the issues the Eurozone and Europe face in general from an economic viewpoint makes things like SEPA end-dates seem fairly irrelevant. Of course, they’re not to the regulators, but Banking Union and Basel III are taking higher priority for most than a notional requirement to comply with Euro processing.

That’s why the European Commission announced a six month transition for SEPA yesterday, rather than rigorously enforcing the end-date requirement of 1st February. Or maybe it’s because most corporates are still going: who cares?

The final top of mind requirement in commercial banking is to innovate. What innovation is the question? Innovation in real-time is the answer.

Real-time innovations will become noticeable in 2014

Most commercial banks seek to differentiate their services through innovation and a great example is Barclays. Barclays introduced Pingit as a consumer P2P payment service, but it is in the corporate space that you see the real innovation. Using QR codes to automate the procure-to-pay cycle within Pingit; introducing QR purchases for a corporate to offer sales from any point and any media with Pingit; and Checkout with Pingit which offers an Amazon style checkout for any corporate; are all things that show how to use simple changes – mobile, apps and real-time – to add first move innovations.

Again, there are many other things I could talk about here, but time does not allow today. More next week on investment banking and then into the year itself.

Happy New Year!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...