Building on yesterday’s theme, one that I cover often, I was accused of being naïve when I say that banks should rip out and replace old infrastructures.

They tell me that you would not do that with historic houses. You just refresh and renew room by room, on an evolutionary basis.

But the metaphor does not work.

A house is a house. It has walls, windows and ceilings. The design principle has not changed for centuries.

A bank is not a bank anymore. A bank was a bank with walls, windows and ceilings and was for housing money. Today, it has a digital dimension for housing data.

That is the fundamental difference and it is frankly irritating to hear the guys who defend the old way.

If it isn’t broken, leave it alone.

Evolution, not revolution.

It still works, so what’s the problem?

The problem is that I would not have any digital asset today that was built for punch cards or magnetic tape in an era when the most sought after programmers were in PASCAL, FORTRAN and Assembler.

Those are not fit for purpose in this digital age.

Equally, I would not work with any organisation that felt 120 bytes and 12 character limitations to data were acceptable, or to have core systems processing in pre-decimalisation currencies (yes, it was confirmed to me last night that there are still banks processing transaction in pre-1971 pounds, shillings and pence).

Put it a different way.

If it were acceptable, then I would still be using the Intel 80386 laptop I bought in 1992 and the Motorola brick that went with it.

Equally, in an age of APIs, apps and plug-and-play, can we really live with conversion middleware that allows us to communicate with the deadbeat that sits at the heart of the bank.

Yes, the deadbeat system that holds us all back.

The system that no longer works on a bank to bank and bank to infrastructure basis.

To be honest, I find it distasteful and think I’m going to jump on ship with venture capitalist Marc Andreessen.

Andreessen is a guy who, a bit like Elon Musk who is a friend of his, can make things happen (Andreessen made millions from selling Netscape to AOL) and, as mentioned yesterday, if these VC’s with their deep pockets really wanted to shake the tree, they could.

For example, checkout these tweets about Bitcoin (Marc understands this space):

In wake of MtGox shutdown, BTC is trading at same level as it was... two months ago. (Up strongly since shutdown itself.) Markets work.

— Marc Andreessen (@pmarca) February 26, 2014

I will happily retweet all retractions and apologies from people who wrongly forecasted death of Bitcoin as result of MtGox collapse :-).

— Marc Andreessen (@pmarca) February 26, 2014

MtGox had to die for Bitcoin to thrive. Its former role from early Bitcoin days has been supplanted by better, stronger entities.

— Marc Andreessen (@pmarca) February 25, 2014

Then read this from QZ.com:

To disrupt banking, do you need to own the bank?

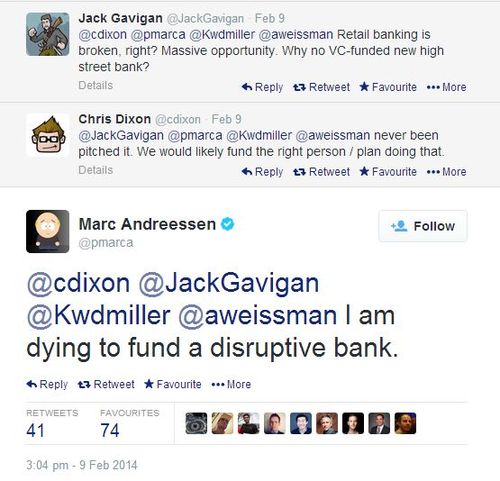

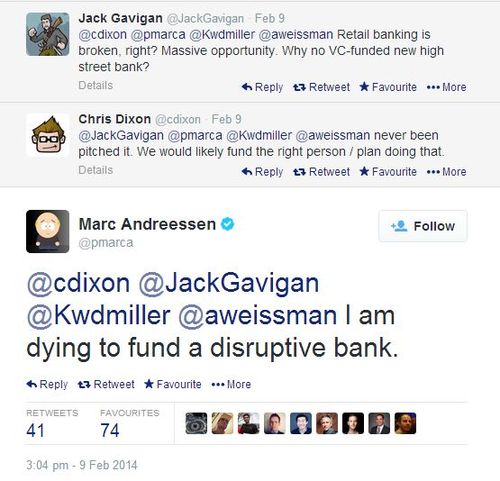

Some of the biggest names in Silicon Valley have been buzzing on Twitter over the last 24 hours about reinventing retail banking with better software.

“I am dying to fund a disruptive bank,” venture capitalist Marc Andreessen tweeted yesterday. Other Valley heavyweights chimed in, including Chris Dixon (a colleague at Andreessen Horowitz), Keith Rabois (Khosla Ventures), and Mo Kofyman (Spark Capital).

In his tweets, Andreessen mulled the importance of owning a bank itself compared to the benefits of an API (application programming interface) that could be used to access bank data and build services on top of it.

@maxrogo @rabois @cdixon I want the pure software bank w/no physical infrastructure, + a full API for financial apps on top.

— Marc Andreessen (@pmarca) February 10, 2014

That was the mission of a startup called Simple when it was founded in 2009. Butunable to overcome the financial and regulatory obstacles to obtaining a banking license, the company partnered with US Bancorp to provide the back-end for its online retail bank.

@fawceisfawce @mokoyfman Both approaches could be pursued. I think I'm more interested in the second.

— Marc Andreessen (@pmarca) February 10, 2014

Andreessen, however, may have the resources to make the full dream of owning the regulated bank, as well, a reality. Other existing startups in this general area include non-bank lenders such as CommonBond and Lending Club.

Eric Ries, a Silicon Valley entrepreneur and author of the The Lean Startup, has focused on another part of the financial system: the stock exchange. Ries has made the case that tech startups should ditch Wall Street and create their own long-term stock exchange. This exchange would have structural impediments to things like high-frequency trading. Ries retweeted Andreessen’s comments yesterday about the pure software bank.

Oh, and thanks to Mr. Andreessen for pointing me to this.

It's been a long time since I've seen a good "Hitler in the bunker" meme video :-) -- http://t.co/lg37mqRBh4 (h/t @toliro)

— Marc Andreessen (@pmarca) February 26, 2014

This is the second in a three-part series on why our technology and infrastructure is unfit for purpose:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...