I recently had an epiphany. It was not painful, but it was enlightening.

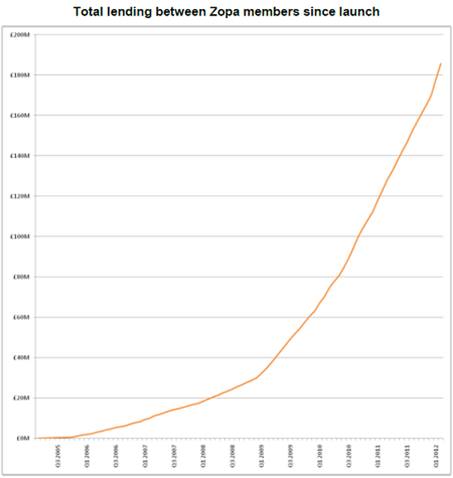

The realisation occurred to me as I looked at this chart from Zopa:

It’s an interesting chart, especially the hockey stick rise in funds transferred as the financial crisis hit, and relates to a recent headline in the Financial Times: “P2P group Zopa secures £15m investment from Arrowgrass Capital”.

The article included the following line:

“Lending Club, the largest P2P lender, has issued $3.5bn in loans since 2006 and reached a valuation of $2.3bn late last year. The company is considering a US stock offering expected later this year. Prosper, the next biggest US P2P, raised $25m from investors including BlackRock and Sequoia Capital in September ... [Zopa] has facilitated £455m of loans over the past nine years.”

OK, so these guys are growing.

Fuelled by a squeeze on lending facilities at traditional banks, the P2P lenders have found a niche and that niche is becoming a segment. Soon, if the innovator’s dilemma is to be believed, this segment will become mainstream lending.

In fact, it may already be mainstream as business lending grows through Funding Circle:

“Set up after a trio of Oxford University pals quit their jobs in August 2009, Funding Circle is lending £16 million a month to small businesses frustrated at not finding the finance they need from a bank. In just three-and-a-half years, it has doled out more than £200 million.”

And seeks to reach £1 billion a year of SME lending by 2016 (assisted by Santander).

Then there are the crowdfunders who have moved beyond kickstarter and into core bank services, such as mortgages as illustrated by firms such as The House Crowd:

So here’s my enlightenment, and it’s at the core of The Digital Bank.

Banks historically have married those people with money to those people who need money.

They acted as the intermediary between the investors and borrowers.

They enable the movement of funds from one to the other whilst managing the risks to ensure the money is not lost.

That is the basics of banking as brilliantly articulated in the movie It’s a wonderful life:

Facing a bank run George Bailey, the bank manager as played by James Stewart, says to his depositors:

You're thinking of this place all wrong. As if I had the money back in a safe. The money's not here. Well, your money's in Joe's house... that's right next to yours. And in the Kennedy House, and Mrs. Macklin's house, and, and a hundred others. Why, you're lending them the money to build, and then, they're going to pay it back to you as best they can. Now what are you going to do? Foreclose on them?

That is the core of banking.

Now, back in George’s day, he facilitated these transactions physically in the branch network. If George was part of a modern day global bank, the Kennedy’s House in Bedford Falls would be funded by depositors in branches everywhere.

But it would still be a physical transaction.

Now we move to the Digital World and that model is being disrupted by the Zopa, Lending Club, Funding Circle and House Crowd mob.

What these new guys realise is that you can marry money that needs to earn interest with money that needs to be borrowed through a global, remote relationship.

It does not need a physical overhead.

It does not need the George Bailey bricks and mortar to take the transaction from Mr. Kennedy to Mrs. Macklin.

It can be completely digitised.

In so doing, two things happen.

Mr. Kennedy’s house in Bedford Falls can be funded by Mr. Chukwumereije from Lagos.

In other words, any person anywhere on the planet can save or lend with any other person on the planet.

Second, the cost of enabling that transaction is virtually nothing because it is digitised.

The underwriting, credit checks, calculation of interest and marriage of the saver and lender is completely automated.

No human hand or head involved.

That is where the disruption occurs, as the banks evolve from their soup of bricks and mortar.

To fund their legacy, banks operate at 4, 5, 6 or even 8 or 10 basis points.

Digital disruptors operate at 2, 1 or even 0.5 basis points.

The lenders and savers in the digital world are getting a better deal.

Their borrowing costs less and their savings earn more.

That is thanks to the basis point change through digitisation.

And, as all that change takes place, the only thing that slows it down is customer inertia, or lack of knowledge or suspicions, and regulations.

Peer-to-peer lending to be regulated from April 2014, Wired, October 2013

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...