I talked yesterday about digital banks underpinning corporate digitisation, but corporate digitisation is being driven by consumers.

That’s a radical statement in itself with the most radical aspect being the consumerisation of technology. That is the real change here, and this theme comes up at every conference I go to.

This is because we all lament the good old days of centralised control, and slow change.

It used to be that we had computers for government purposes.

It was then developed for commercial usage.

Now, children are the ultimate consumer of technology change.

We used to know that communication was one-way and we didn’t have to listen.

Today, you must listen or you become irrelevant.

Back in the day, everything was offered in a one-size fits all.

Today, your offer must fit each individual specifically.

This trend has been a long-term trend for we were talking about these things a quarter of a century ago. The difference today is the speed of change, driven by the change of technology.

Technology has moved from the back office to the consumer.

Consumer expectations of service are now driven by access, control and usage, and that access, control and usage is constantly switched on in their pockets and purses.

In other words, we have no control over access and usage.

This is illustrated by slide after slide in conferences.

Everyone uses the one about 38 years to distribute telephones to 50 million people, compared with 35 days to distribute Angry Birds Space to 50 million people.

I use the one about Barclays took 13 years to get 2 million customers using internet banking; it took them just two months to get 2 million mobile banking users.

This is because the last quarter of a century has seen consumers not only become comfortable with the technology but, today, to demand it.

This was demonstrated by the conference I am attending today, where we are talking about payments innovation.

One presenter opened with a slide that had the lines:

"There are 6.8 billion people on the planet.

"4 billion have telephones.

"3.5 billion Have toothbrushes."

The mobile internet is driving everyone to expect everything, everywhere at no charge.

The distribution model of free is key.

You start with free and then add layers of value on top for which the consumers pays if they see the value.

My app is free, but if you want the full version, you pay.

We exchange payment for layers of extra value layer.

That is the model of today.

A bank account is free, and I pay for what I add to the account. This is because I am in control.

That is very different to the free account where the bank charges me for everything when I am out of control.

This is the critical change: the consumer is in control and the consumer is driving digital business, and digital business is driving digital banking.

The retailing need for real-time speed over the mobile internet is driving the wholesale need for changes to infrastructure such as Faster Payments and Zapp.

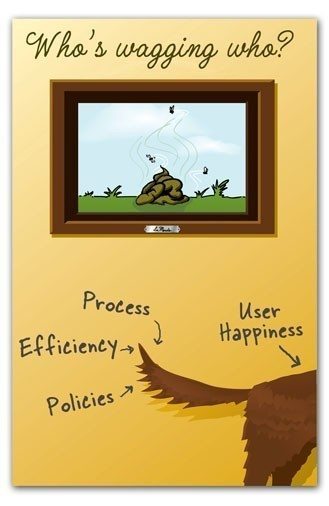

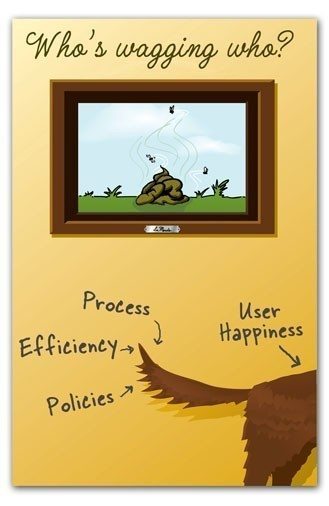

In other words, the retail tail is wagging the wholesale dog.

Get with it.

Picture taken from Creating Passionate Users blog

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...