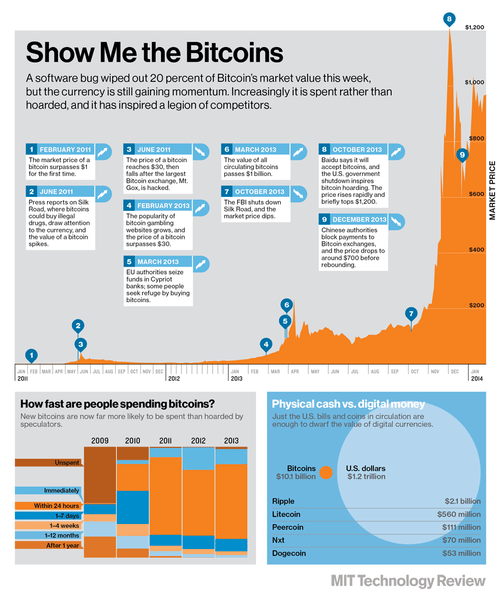

Everyone thinks bitcoins are worth buying as they keep going up in value. From $2 in October 2011 to $20 in January 2013 to $266 in April to $100 in May to $1300 in December to anywhere between $250 and $600 today, dependent upon where you trade them.

In other words it is a highly volatile marketplace, as discussed yesterday.

The thing is that if you think that bitcoins are an investment instrument, you would be wrong.

Bitcoins are for buying things.

This is the result of a recent MIT study, published in last week’s MIT Technology Review (where there’s a load of other good stuff about Bitcoin).

This research shows that bitcoins are being spent, not hoarded.

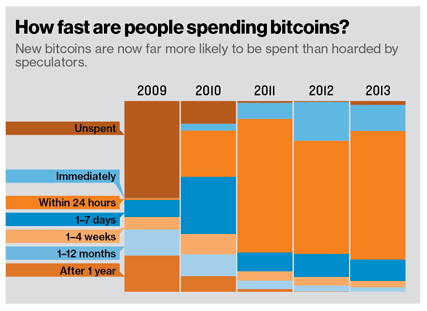

The hoarding idea was something that started back in 2009, when the coins first emerged. Of course, back then, there wasn’t much you could buy with a bitcoin so most of them were unspent for over a year.

As a result, we all thought folks were hoarding them.

That’s not the case as, today, most bitcoins are spent within 24 hours of purchase as illustrated by this chart from MIT:

The findings from the MIT report, which analysed a variety of sources* provide evidence that bitcoin is evolving as a currency and that, whilst far from mass adoption, liquidity is on the rise in the system. Though, no formal definition of “spending” was given to fully clarify the data.

This is important as hoarding bitcoins would mean that the virtual currency would never become mainstream. As Wired Magazine stated in November 2013:

“… hoarding leaves many questioning the future of the currency. If economic incentives encourage people to hoard their bitcoins rather than spend them, the thinking goes, the currency will never fulfill the extravagant promises laid down by the biggest believers, who say it will streamline monetary transactions, free the world from the financial manipulation of big government and big banks, breakdown the financial walls between nations, and, well, remake the worldwide economy.”

Therefore if, as is reported in MIT, the coins are being spent rapidly, the question that is unanswered is: what are they spending it on?

Just checkout this Huffington Post write up:

Looking to buy some tickets to a Sacramento Kings game? You can buy them with Bitcoin. Ready to reserve your seat on Branson's Virgin Galactic flight to space? They accept Bitcoin. How about pay your tuition to St. George's University of London? Bitcoin is legal tender there too. Even Amazon and Google are considering adding Bitcoin as a payment option.

Oh dear. If Amazon starts taking bitcoins for goods and services, would eBay and Apple follow? And if they did, would Alibaba and Taobao and the rest?

And if they did, could this become a trillion-dollar economy.

And, if it was, what would that mean?

You'll find out tomorrow when I post an interview with Jon Matonis, Executive Director with the Bitcoin Foundation.

Postnote: useful to see the whole chart MIT published btw:

* Sarah Meiklejohn, one of the most well-known block chain analysts, compiled the data which was drawn from many sources including bitcoin wallet provider Blockchain, Bitcoin Charts, Coinmarketcap and bitcoin exchange Mt. Gox.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...