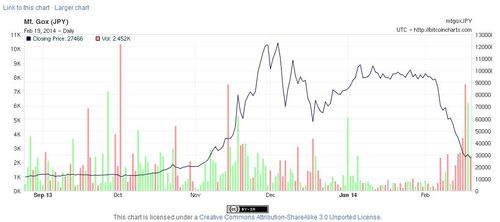

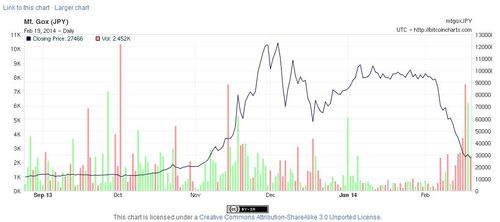

Bitcoin has been through another turbulent time lately, peaking at a value of near $1300 per bitcoin on MTGox Japan in December, only to see this drop to under $300 today.

Nevertheless, a year ago, bitcoins were trading on MTGox at $20 per bitcoin and went through a similar bubble and burst by April thanks to the issues in Cyprus.

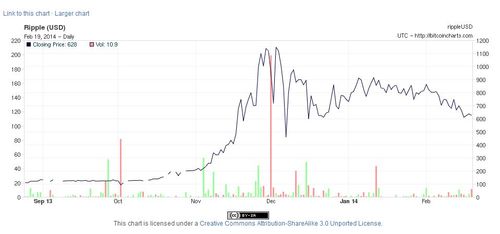

And it does all depend where you trade. For example, if you are buying and selling bitcoins on other exchanges, such as Ripple, the value of the virtual currency is almost 250% higher than that at MTGox.

Why?

It’s all about trust and confidence.

The trust and confidence in the Bitcoin system (Bitcoin with a capital B refers to the ecosystem whilst bitcoin in lower case refers to the unit of stored value) is easily boosted or burst by the media hype and the headlines.

All of China starts using bitcoins and the value increases rapidly. The value went from around $130 to $1300 in just six months last year because Chinese consumers started buying bitcoins big time (along with the rest). But bear in mind that this just means that a $1.3 billion economy grows to a $13 billion economy and then, as users remove their gains, the economy flat lines again.

Many Chinese removed their gains due to the Chinese government removing what appeared to be a tacit endorsement of the currency, saying that it’s ok if you want to buy them but the People’s Republic does not support the use of Bitcoin.

Then other exchanges, like MTGox, encounter technical and related issues that means customers cannot withdraw funds. Add on to these challenges the issues of Distributed Denial of Service (DDoS) attacks and the technical nature of Bitcoin itself, and this relegates the emerging currency to a technogeek world that most dare not or cannot enter.

These are the key factors that will make or break bitcoin and, for those who are watching its ecosystem grow, it’s obvious that these are the growing pains of a rebellious child.

Every time everyone gets hyped up about bitcoin, it gets into a bubble effect. Then everyone runs scared, and the bubble bursts.

I’ve seen the bitcoin price bubble burst at least five times in the last three years, and I am sure we will see more, but the core at all of this is: what does Bitcoin mean to banking, trade, finance and commerce?

To be honest, I keep coming back to the fact that, at its core, it offers a fundamental disruption to banking and payments.

A decentralised money without government that is digitised and exchanged globally with confidence is going to emerge. It’s been tried before, and will be tried again.

The real difference with Bitcoin is that it offers a number of major differences to other cryptocurrencies, such as being decentralised, encrypted, exchanged anywhere for no fee or charge and being 100% like cash (although not completely anonymous).

Whether Bitcoin survives to emerge as the cryptocurrency of the internet age is still questionable but, what is not questionable is whether a cryptocurrency will emerge.

There will be one.

Then everyone asks about what this means for money laundering and terrorism, and the answer is nothing,

The existence of a cryptocurrency for the internet age is not what drives money laundering and terrorism. What drives money laundering and terrorism are money launderers and terrorists.

These underworld tendencies will exist whether the cryptocurrency exists or not.

In fact, the idea of banning cryptocurrencies on the basis that they support money laundering and terrorism is a bit like saying let’s ban the internet because it supports paedophilia and child abuse.

Of course, a technology can support such activity, but it is not the technology itself that supports such activities but the people who create these capabilities through the abuse of that technology.

Do you ban the internet because criminals abuse it? No.

And the same will be true for bitcoin or its successor over time.

This is why banks are asking: should banks be banking bitcoins? (a question at the heart of last year’s SIBOS) and the answer is ‘yes’.

More fundamental is a different question: do bitcoin users want to bank their bitcoins with banks? and the answer may well be ‘no’. After all, why would @Anonymous and the wikileaks 99% want to #occupy the bank with their digital assets?

Maybe the more likely outcome will be that bitcoins will be banked with a new digital asset store, such as … Google? Amazon? Or a new store that has no government control called something else … whatever emerges is incredibly interesting and exciting and that is why banks should watch the Bitcoin space.

Meantime, we had a Financial Services Club meeting in Warsaw last week with Jon Matonis of the Bitcoin Foundation actively deflecting all the critique of the network to show why Bitcoin is a critical development.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...