I’ve written lots about USAA and First Direct as leaders in new media. Both are financial firms without branches and both are loved by their customers.

The key thing that differentiates both institutions is that they recognise they exist as a remote engagement and hence truly understand the art of creating digital relationships.

By way of example, and I use this example quite often, First Direct do not give their staff strict scripts for dealing with customers on the telephone. Instead, they allow them to think and respond as humans. As a result, First Direct has great remote human relationships.

One way to illustrate this is the story of a customer who left their handbag and purse on the train. They had their mobile phone and that was it. So they called the bank in distress, saying that they were stuck at the station and could not leave as they had no cash and no train ticket.

The station was Leeds, where First Direct is based, and so the call centre agent ran from the office to the station and paid for the customer’s ticket, gave them enough cash to get home and made sure their debit and credit cards were re-issued post haste.

That’s amazing customer service and is the reason why First Direct is regularly voted Britain’s best bank for customer service.

Both USAA and First Direct have also been leaders in creating a transparent social community on their own hosted platforms.

Back in 2009, both financial institutions launched curated online platforms to allow customers to air their views freely.

Interestingly, both banks have now removed their curated platforms to allow customers to talk freely via open social platforms: twitter, youtube and facebook.

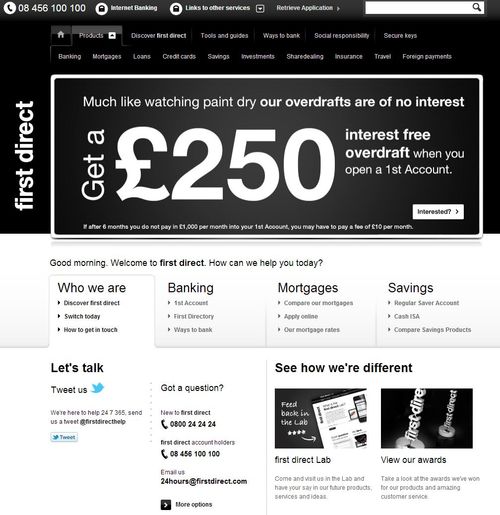

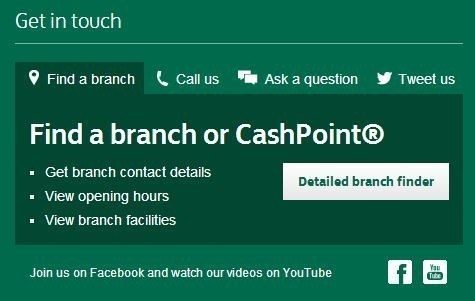

These are highlighted on their home pages, with First Direct giving a clear nod to twitter:

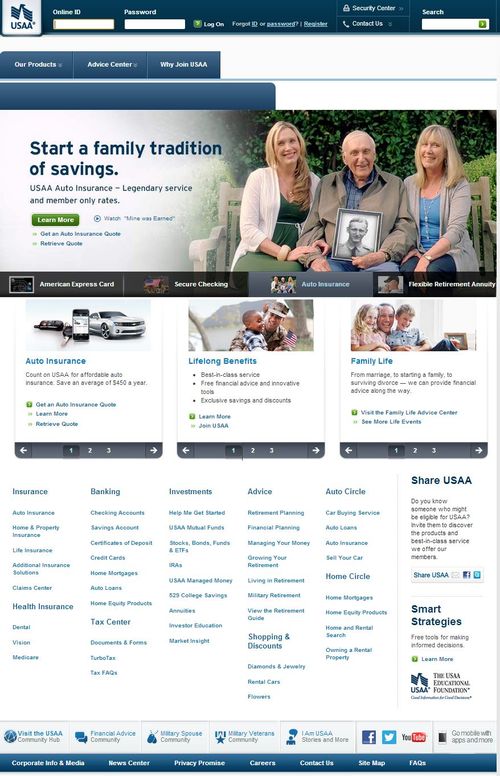

Although USAA have an upper hand by offering many specific advisory services via their home page also, such as communities for military spouses, veterans, financial advice and more.

USAA is also a tad larger, with over 637,000 likes on their Facebook page, compared with First Direct’s 29,000.

Comparing numbers this way is slightly unfair however, as the two operations are very different.

First Direct appeal to a higher net worth, higher credit rated segment of the UK retail bank market whilst USAA covers all armed force personnel in the USA.

The thing I do like about both however is that they are the ones usually pioneering at the front end of digital finance. For example, USAA were the first US financial firm to offer remote cheque deposits through a smartphone picture app and First Direct were the first UK bank on twitter.

Having said that, I was surprised to find that some of our mainstream banks are now becoming truly social too.

RBS have links to their Twitter and Facebook accounts on their home page as does NatWest (bottom right).

And NatWest surprised me to find that they have almost 150,000 likes on their Facebook page.

Lloyds also have links to social media on their homepage:

Although they lag behind NatWest on Facebook with 47,000 likes.

Surprisingly, Barclays website has no reference to their social media presence and I got this message on their site regularly this morning:

That is surprising as their Facebook page has almost half a million likes, the most of any UK bank.

As for HSBC … no links on the homepage and no Facebook presence.

Maybe they’re relying on First Direct to do their social work for them.

The key to all of this is that it is clear that banks have woken up to the idea of social media as a customer service tool. Maybe the next move should be to see how much service they are providing through these tools.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...