I’m just preparing a presentation in Canada and realised that, like most countries, the competitive landscape of Canadian banking has not changed much in the last century.

Sure, there’s been some M&A and sure, the big banks are competing hard with each other but, outside that …

Here’s the issue: the major banks in most countries were determined decades ago and they have changed hardly at all since.

Why am I talking about this?

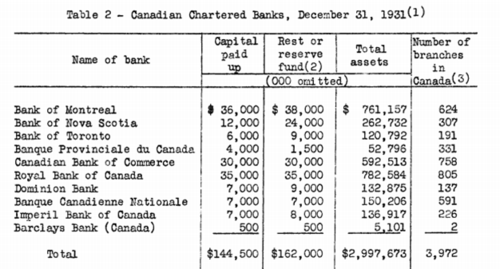

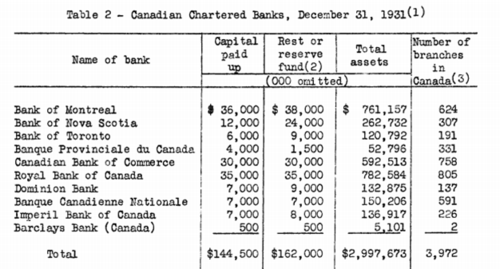

Because of this chart:

This chart comes from this report: Branch Banking in Canada, prepared by the Federal Reserve Committee on Branch, Group, and Chain Banking, back in the 1930s.

As you can see, some things have changed.

For example, in 1932 Canada had 10 million people and near 4,000 branches. Today, Canada has 35 million people and over 10,000 branches.

However, the names have not changed much.

Today, the biggest bank in Canada is Toronto-Dominion (TD), closely followed by Royal Bank of Canada, Bank of Montreal, Bank of Nova Scotia (Scotiabank) and Canadian Imperial Bank of Commerce (CIBC). These are collectively called the Big Five.

We have a Big Five in the UK too: HSBC, Barclays, Royal Bank of Scotland (NatWest), Lloyds and Santander. Santander is a new bank in the UK but are an old bank in Spain (founded in 1857), and represents an amalgam of failed UK banks acquired in the last decade including Abbey, Alliance & Leicester and Bradford & Bingley.

Strangely enough, Spain has three big banks: Banco Santander, CaixaBank and BBVA, which collectively hold a 70% market share after the restructuring of the Spanish financial sector.

In fact, anywhere around the world you look, you can probably identify three, four or five massive banks and the rest are small or nowhere.

Why is this?

Because the biggest barrier to banking is regulation.

Regulators are keen to ensure that there are only a few major banks in each country.

They don’t want competition: it’s too difficult to regulate a lot of banks.

Equally, by having only a small number it controls the flow of money through the economy.

This is why banking licenses are rarely provided and, even when they are, it is even rarer to find a new bank able to compete with the Big Few, as it takes an awful lot of capital to compete.

Think Basel III, Capital Requirements Directive IV, Tier 1 Capital Ratios and all that stuff.

Competing with the Big Few is too tough.

It always reminds me of the good old days when, back in the 1990s, I visited Australia as they were in the grip of a regulatory overhaul.

The overhaul was known as the Wallis Reforms and the outline of the inquiry can be found summarised below:

The Treasurer announced on 30 May 1996 the establishment of an Inquiry into the Australian financial system, to report to him by 31 March 1997.

The Inquiry is directed to provide a stocktake of the results arising from the financial deregulation of the Australian financial system since the early 1980s. The forces driving further change will be analysed, in particular, technological development. The Inquiry will make recommendations on the nature of the regulatory arrangements that will best ensure an efficient, responsive, competitive and flexible financial system to underpin stronger economic performance, consistent with financial stability, prudence, integrity and fairness.

The Inquiry is chaired by Australian businessman, Mr Stan Wallis and will be supported by a full time secretariat. The Secretary will be Mr Greg Smith who has been seconded from the Treasury. The secretariat will be responsible exclusively to the Inquiry and will include staff from the private sector and staff seconded from other agencies.

At the time I visited the Aussie banks and they were all quaking in their boots thinking that the inquiry wold result in far more bank competition and a break-up of the Big Four: Australia and New Zealand Bank (ANZ), Commonwealth Bank of Australia (CBA), National Australia Bank (NAB) and Westpac,

You can read the full report here if you want, and also should note that Australia is right now in the midst of the “Son of Wallis” review.

The real point here is that the main terms of reference of the original review were to recommend regulatory and other changes which would:

- deliver more efficiency at lower cost to increase competition; and

- protect the safety and stability of the financial system.

Now, that’s where the banking system has its core issue, as these two factors work against each other. To have safety and stability, you need to have high requirements for capital and governance of the institution. That blocks new entrants and so you cannot increase competition. Without increased competition, you only have a few banks and, if a bank is to grow, it can only grow through acquisition meaning you then have fewer banks.

That is why most countries have banks that are centuries old and have emerged through a lengthy period of acquisitive growth to become one of the Big Few left in each country.

In fact, to conclude, we know that America’s biggest banks are Bank of America, Citigroup, JPMorgan and Wells Fargo.

If you want to know how they became so big, just look at the history of each bank. They’re all massive thanks to integration of banks like Washington Mutual, Chase Manhattan and Bear Stearns to form JPMorgan or Travellers, Salomon Smith Barney and Banamex to create Citigroup.

Perhaps the best example of such an acquisitive growth is the Bank of America. Although established in 1930, its roots date back to the Bank of Italy in San Francisco, founded in 1904, and beyond to the Massachusetts Bank, which opened in 1784. Over the years, BoA has acquired and merged with many banks, most notably:

- NCNB/Nationsbank

- Bankers Trust

- First Republic Bank

- C&S/Sovran

- MNC Financial

- Barnett Bank

- Boatmen’s Bank

- BankAmerica Corp

- Fleet Boston

- MBNA

- US Trust

- LaSalle Bank

- Countrywide Financial

- Merrill Lynch

As can be seen, big banks just get bigger until there are just a Big Few left and, when you’re down to a Big Few, those Big Few keep all the rest out either by competing with them into the ground or by acquiring them.

That is why every country has just a Big Few banks, and I don’t see that changing much from hereon in.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...