During my lifetime, two things have fundamentally changed the world: travel and technology.

As a boy, my life was connected locally. We had a local newsagent, pub, shops, garage and my friends all lived within a 15 mile radius.

My father worked in a city 12 miles from where we lived, and all of his friends were pretty local too.

The furthest points of our network were my grandparents who lived 200 miles away in Devon.

We visited them once a year, and the journey would take almost eight hours as the road network was limited to A- and B- roads. The fastest roads – motorways (interstates) were just being built.

It’s amazing that these memories sound like an era of the 19th century and yet I’m talking of a life less than half a century ago.

Back then, my father once visited Boston, America. I thought he had gone to the moon, as no-one travelled that far.

My first overseas holiday was in Spain, and my first flight was in 1973.

I thought I was an astronaut.

Now I travel non-stop.

Areas of the world that were discovered just a century ago by great explorers, are now as easy to get to as my grandparents were fifty years ago.

No part of the world is disconnected per se, except for those that choose to be through war (parts of Africa) or dictators (North Korea) or both (Syria).

Then you add to this mix Technology, and everything changes further as everyone is now connected one-to-one across the planet.

My friends are global, not local, and seven billion people (there were just three billion when I was born) can relate to each other directly via the social mobile web.

So it amazes me in this globally connected world that has been transformed by travel and technology that banking has not kept up with such changes.

By way of example, I received a cheque the other day.

That annoys me to begin with, as paper is so last century.

The cheque is for Canadian Dollars.

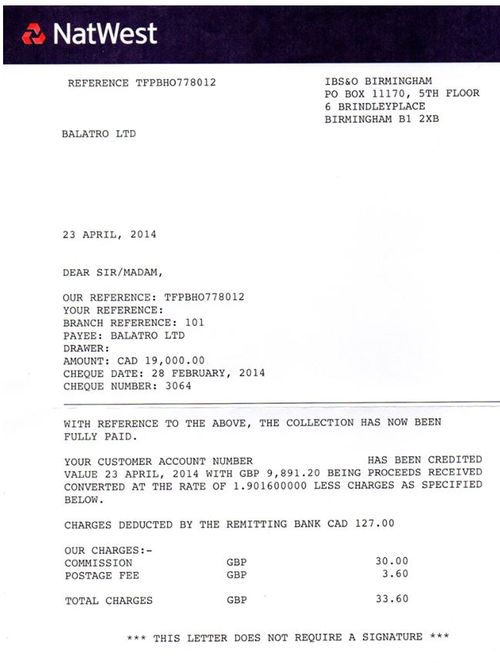

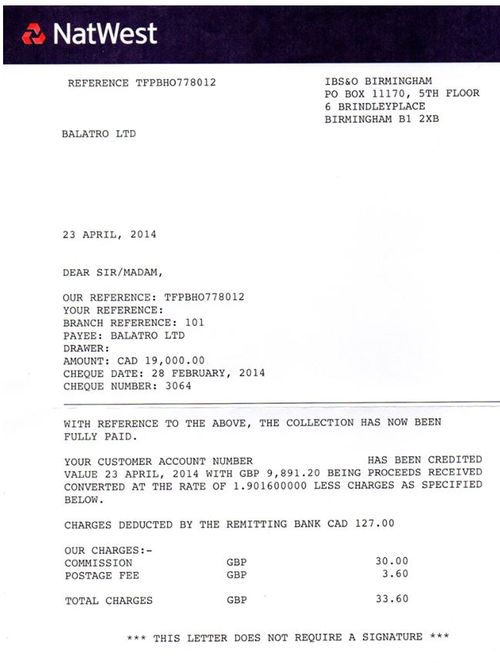

I pay it into my account and a week later I get a letter from the bank.

The letter states: “we received you deposit of a Canadian Dollar cheque which we have sent to be processed by the issuing bank. We cannot be sure how long this will take to process, and advise that it may be up to six weeks. Equally, any charges incurred in such processing will be deducted from the deposit amount."

No argument, a fait accompli, there you go.

Six weeks later, I get a note saying that the payment has been processed but the receiving bank charged me CAD$127 and my bank $50 for processing.

In other words, we live in a world transformed by technology that is globalised through travel and yet the banking network cannot even process a cheque without having to do this by moving paper across land-based mail networks involving lots of manual processing.

Now that really does sound like something from the 19th century.

This is Part One of a six-part series on being a Digital Bank:

Part One: Major parts of banking are stuck in the last century

During my lifetime, two things have fundamentally changed the world: travel and technology.

Part Two: Heidi Miller, Bitcoin and fitness for purpose

Building on yesterday’s theme about how a cheque from Canada has taken six weeks to process and had significant processing charges taken from the deposit as a result, reminds me of Heidi Miller’s speech from SIBOS 2004, which is still talked about today. What did Heidi say that was so compelling?

Part Three: We are not Borg, we are Human and dancing to a different tune

Building to the theme of the divide between the old world of finance and the new, and why (some) banks aren't fit for the 21st century, brings a few more points to mind, in particular about control and centralisation. Banks were built as control freaks. They need to own the complete end-to-end cycle of everything. They have to develop their own software, systems and services, which is why they end up with more developers than Microsoft as a result.

Part Four: You may be innovative today, but tomorrow you're just an incumbent

I’m going to give up on the discussions about banks dragging heels when it comes to the global net soon, but only after a few more pieces of debate. Today, it’s all about innovation.

Part Five: Please refer to the Digital Department

I have this cheesy line in my presentation about digital is a journey, not a destination. The destination comment is that most senior bank management think it’s a one-off project, like building a pyramid or a cathedral. You make the investment and it’s done. That’s not the case.

Part Six: Banking-as-a-Service, five years later

In a final note on the Digital Bank Transformation, I return to a theme I’ve explored a few times (from Banking-as-a-Service to APIs and apps). The core of the model of banking is represented in various ways, but I encapsulate it as three companies in one: a retailer that has customer intimacy; a processor that has operational excellence; and a manufacturer of products.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...