Building to the theme of the divide between the old world of finance and the new, and why (some) banks aren't fit for the 21st century, brings a few more points to mind, in particular about control and centralisation.

Banks were built as control freaks.

They need to own the complete end-to-end cycle of everything.

This is why they are reluctant to outsource, and build their own data centres rather than using Amazon's or others.

They have to develop their own software, systems and services, which is why they end up with more developers than Microsoft as a result.

They don't trust shared services or other ventures, and so everything becomes point-to-point counterparty-to-counterparty.

That's all well and good for a world of physicality but in this age of cloud-based distributed services, it doesn’t work.

In fact, as blogged about before, the whole vertical end-to-end processing of finance is fundamentally flawed.

Equally, the structure of banking is fundamentally flawed for today's world because it was built in a structure of physicality.

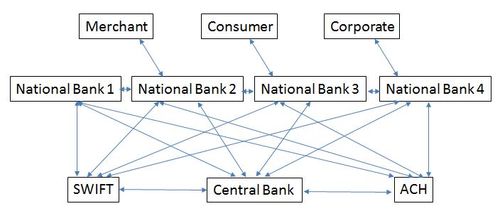

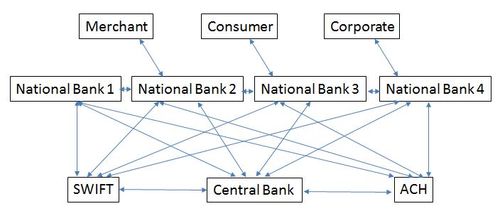

Local banks served local people through local branches, reporting centrally to a central body that is typically the country's central bank.

Excuse quality of picture but, as I'm just using PowerPoint, it'll do ...

It is precisely this old structure that has caused all of the struggles with SEPA.

Payment structures used central clearing houses that were operated by the country’s banking collegiate and regulated by the central bank.

Now there is no country or central bank, just a world and a worldwide web.

Hence the point-to-point counterparty model of the last century, built for national operations is fatally flawed in a world of decentralisation, and makes the whole reason for Bitcoin even more compelling.

Put it in another context.

Broadcasting.

In the old age of control and centralisation, entertainment was provided by just a few national channels and programmed for the masses.

The programming was all local language and focused upon local and national content.

The channels had a central base, usually in the country’s capital city, and could command high earnings from advertising as the consumer could only consume.

Now, we broadcast from our bedrooms to the world.

People share whilst sitting in cafes and are their own media.

They both create and consume, and the media they consume is global.

Language and borders are no longer barriers.

Banks have tried to maintain this structure, and have been able to do so as the business model of a viable alternative has proven too elusive.

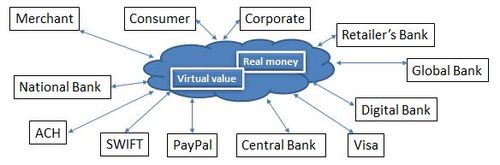

And yet a business model of a viable alternative is emerging: crypto currencies and virtual value stores.

As they emerge, banks will find customers creating their own financial ecosystem that suits their lifestyles and all that centralised control will crumble overnight as decentralised control takes over.

It will be particularly interesting to see how this destroys the structure of the local bank serving local needs via point-to-point counterparty structures.

A final thought.

Back in 1988, we talked about the power of the network.

In the 2000s, a book came out about The Wealth of Networks.

In 2014, the network is finally hitting the banking system hard.

The power and wealth of the network is all about interactivity.

Interactivity disrupts and decentralises, as everyone has a voice that can be heard.

This is what we are seeing with social media - Molly Katchpole, Mohammed Bouzzazi - and what we are seeing with entertainment and value: the decentralisation of control.

The network says that for every addition to the network, it has a squared effect.

In the old days of broadcast, add a television and its one more TV on the net.

The structure is still controlled and centralised as every point device is being added to access a central hub: the broadcaster.

In the new ways of broadcast, add another device to the internet and it's squared the interaction.

Two devices on the network = 4 ways of communicating.

Three = nine.

Four = sixteen.

This is why it is so disruptive, as everything talks to everything rather than the central hub broadcasting to the hive.

We are not Borg or Droids.

We are human.

And humanity is dancing to its own digital tune that no broadcaster OR BANK can control.

This is Part Three of a six-part series on being a Digital Bank:

Part One: Major parts of banking are stuck in the last century

During my lifetime, two things have fundamentally changed the world: travel and technology.

Part Two: Heidi Miller, Bitcoin and fitness for purpose

Building on yesterday’s theme about how a cheque from Canada has taken six weeks to process and had significant processing charges taken from the deposit as a result, reminds me of Heidi Miller’s speech from SIBOS 2004, which is still talked about today. What did Heidi say that was so compelling?

Part Three: We are not Borg, we are Human and dancing to a different tune

Building to the theme of the divide between the old world of finance and the new, and why (some) banks aren't fit for the 21st century, brings a few more points to mind, in particular about control and centralisation. Banks were built as control freaks. They need to own the complete end-to-end cycle of everything. They have to develop their own software, systems and services, which is why they end up with more developers than Microsoft as a result.

Part Four: You may be innovative today, but tomorrow you're just an incumbent

I’m going to give up on the discussions about banks dragging heels when it comes to the global net soon, but only after a few more pieces of debate. Today, it’s all about innovation.

Part Five: Please refer to the Digital Department

I have this cheesy line in my presentation about digital is a journey, not a destination. The destination comment is that most senior bank management think it’s a one-off project, like building a pyramid or a cathedral. You make the investment and it’s done. That’s not the case.

Part Six: Banking-as-a-Service, five years later

In a final note on the Digital Bank Transformation, I return to a theme I’ve explored a few times (from Banking-as-a-Service to APIs and apps). The core of the model of banking is represented in various ways, but I encapsulate it as three companies in one: a retailer that has customer intimacy; a processor that has operational excellence; and a manufacturer of products.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...