I’ve not been surprised by disruptions in industries like music, movies, books and travel. All of these things can be digitised and have been.

Music has been disrupted three times: first illegal downloads with Napster; then with legal downloads through iTunes; and now who needs downloads when you can stream with Spotify (which is why Apple’s just paid $3 billion for Beats)?

Movies are going through the same process (Amazon order to iTunes download to Netflix streaming), and I never book any hotel these days without getting TripAdvisor to tell me the best hotel at the lowest price.

Obviously, this is happening to banking too, and banks are responding slowly but surely.

But for a real indication of disruption, and one that did surprise me, I picked up Business Week this week because the front page was headlined: The Trouble with IBM.

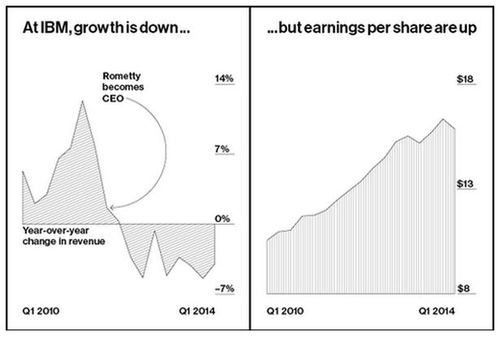

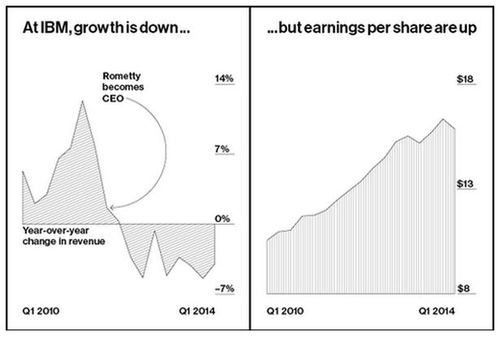

I didn’t realise IBM was in trouble, but the thrust of the review is that IBM’s lost its way by not being on the Cloud trail early enough whilst committing itself to $20 earnings per share by 2015 in 2010 in a vision called Roadmap 2015.

That vision is now being called Roadkill 2015, and the company has been dedicated to delivering on the $20 pledge by massive financial engineering, cost cuts and firesales.

The bit of the article that really made me sit up was the opening paragraphs:

In the summer of 2012, five American technology companies bid on a project for a demanding new client: the CIA. The spy agency was collecting so much information, its computers couldn’t keep up.

To deal with the onslaught of data, the CIA wanted to build its own private cloud computing system … whoever won the 10-year, $600 million contract could boast that its technology met the highest standards, with the tightest security, at the most competitive prices, at a time when customers of all kinds were beginning to spend more on data and analytics.

IBM was one of two finalists. The company would have been a logical, even obvious, choice. Big Blue had a decades-long history of contracting with the federal government, and many of the breakthroughs in distributed computing can be traced back to its labs. The cloud was a priority and a point of pride. In 2012, IBM’s new chief executive officer, Virginia Rometty, used her first speech to shareholders to describe big data as a “vast new natural resource” that would fuel the company’s growth for a decade.

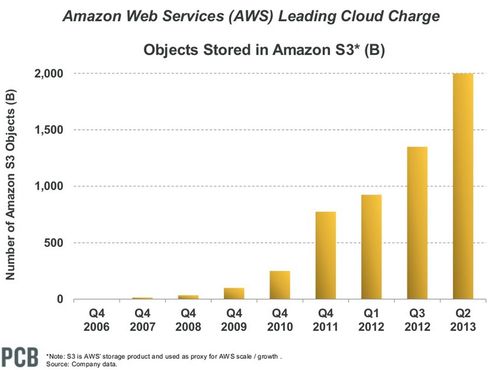

On Feb. 14, 2013, the CIA awarded the contract to Amazon.com ... Amazon beat IBM for a plum contract on something like its home turf, and it hadn’t done so simply by undercutting IBM on price. IBM learned that its bid was more than a third cheaper than Amazon’s and officially protested the CIA decision.

It would have been better to walk away. As the Government Accountability Office reviewed the award, documents showed the CIA’s opinion of IBM was tepid at best ... in a court filing, Amazon blasted the elder company as a “late entrant to the cloud computing market” with an “uncompetitive, materially deficient proposal.” A federal judge agreed, ruling in October that with the “overall inferiority of its proposal,” IBM “lacked any chance of winning” the contract.

This shows that IBM has yet again been danced around by nimble new competition.

The elephant that learnt to dance has to dance again, and is trying to do so by moving all of its server focus to Watson and buying cloud capabilities from Softlayer Technologies for billions.

But the point of this piece is not to pickup on the IBM bashing, but more to do with the speed and nature of change and disruption.

IBM was disrupted in the 1990s by the rapid movement from mainframe to client-server, as were many other companies.

I worked for one that went bankrupt (Wang) and these things happen quite quickly in technology industries. Just look at the challenges HP (move from PCs to tablets), Cisco (move from routers to something else) and others have been going through, as the net matures.

In fact, it made me really sit up and take note that the first 15 years of the internet was all about developed economies whilst the last 15 have been about developing economies.

In 2000, the top websites were mainly American:

Whereas today, half of the Top 20 websites are from China, India and Russia:

Pics from The Emerging Internet presentation by Yiibu

… and these are growing fast.

But hey, the big deal here is that IBM now compete with an online retailer.

Amazon is no longer a webstore. They are a solutions company that embraced the digital age first and continually innovate to stay at the forefront.

Pic from the latest Internet Trends presentation by Kleiner Perkins Caufield & Byers

That’s what I blogged about recently, and what amazes me about how things are developing.

For example, you think Google is a search engine?

Wrong.

Google is a digitizer of our planet, and their maps and cloud services are the real battle.

They also compete with IBM:

The cold-sweat scenario for IBM is that it does catch up to Amazon and other cloud providers—only to find that competition has driven margins toward zero. In March a price war broke out among Amazon, Google, and Microsoft, as each announced cuts of as much as 35 percent on computing; 65 percent on storage; and 85 percent on other services. (Ginni) Rometty (IBM’s CEO) has made two promises to investors: to lead corporate IT into the cloud and to deliver lustrously thick margins. Those goals may be irreconcilable, as long as IBM faces competitors willing to make the cloud a place of ever-diminishing returns. In a March 25 blog post that surely sent shivers through Armonk, Google declared that cloud pricing should follow Moore’s law, falling as the cost of hardware inevitably declines.

But they also compete with folks you might not expect, like BMW and Ford and Specsavers. Google are a Digital Giant, but they are also now a car manufacturer, a fashion store and more.

In other words, the Digital Giants (GAFA) are competing everywhere: books, music, movies, travel, entertainment, groceries, cars, clothing …

In fact, as the net matures (this is still early day), I wholly expect everything to be disrupted.

Everything.

Government, health, environment, society, wars, diplomacy, commerce, manufacturing … and if you really think banking won’t be impacted then you’re on another planet.

Oh, and don’t believe what Facebook says.

We're no threat, Facebook tells big banks

Facebook: Taking on PayPal with socially useful banking

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...