In a final note on the Digital Bank Transformation, I return to a theme I’ve explored a few times (from Banking-as-a-Service to APIs and apps).

The core of the model of banking is represented in various ways, but I encapsulate it as three companies in one:

- a retailer that has customer intimacy;

- a processor that has operational excellence; and

- a manufacturer of products.

This is simplicity itself and is represented in many management books from Michael Treacy and Fred Wiersema’s the Disciplines of Market Leaders, where he proposes that firms can only be good at one of the above three, to James Champy and Michael Hammer’s Re-engineering the Corporation, where companies are boiled down to people, process and technology.

My own boilerplate is customers, channels and products, and so we have a banking model:

- a retailer = customers and people;

- a processor = process and channel; and

- a manufacturer = product.

and the view that a bank will only be excellent in one of these discipline areas.

Traditionally, banks have owned all three spaces and tightly coupled them, but this is where the traditional bank model is being attacked.

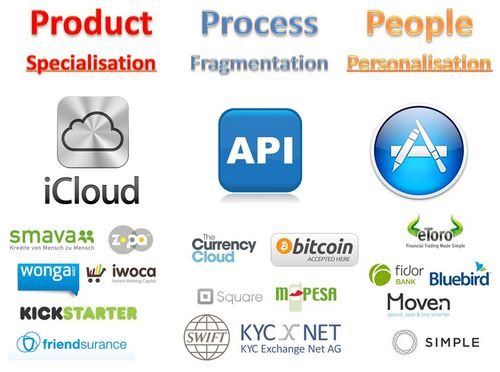

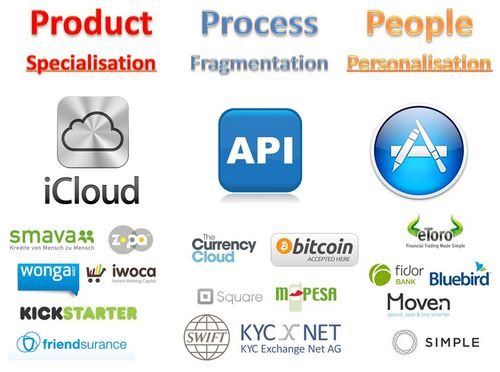

New entrants are trying to come up with better front-end user experiences through apps; they are trying to create easy to plug-and-play APIs (Application Program Interfaces) to allow anything to be processed anywhere by anyone; and they are re-inventing products by offering cloud-based delivery of services.

Across these, I can then bind my own offers.

I can integrate FX, mobile and payments cloud products through APIs into a great customer app.

In other words, my skill now becomes that of the integrator and identifier of the components that offer the best structure for my financial lifestyle.

Now I can try and do that, or I can buy the service and have someone else do it.

And this is what banking is becoming: an assembler of financial management tools, delivered in the way that works best for their clients.

No longer do banks need to build and control the components. They can just source them.

This is already happening.

Fidor allows customers to access loans through P2P social lending service Smava on their bank platform; Barclays is inviting Credit Unions to offer payday loans through their brnaches to stop the payday firms charging high interest; ICICI Bank use SmartyPig to offer iWishes to their millions of customers as social savings; and the list goes on.

What is actually happening is that we are finally seeing that componentisation of banking to which I referred five years ago as Banking-as-a-Service.

Like the car industry, banks are being broken apart to provide assemblage of service rather than creating it all.

In the old days, cars were manufactured uniquely by each company; they were then assembled in plants and distributed through car showrooms. The car showroom would offer service and maintenance of the car, and management of the whole end-to-end process.

That’s pretty much how banks are today but, like car manufacturing, the network is breaking it apart.

Like cars, components are now produced by specialists; service, maintenance and road worthiness are checked by specialists; and replacement parts are managed by specialists.

These specialists recognise that they can manufacture or process pieces of the supply chain more effectively than the generic, vertical integrator.

Tyres, windscreens, exhausts (mufflers) are all dealt with by fast and nimble firms.

In the same way banks will do the same.

Banks will become showrooms of assembled pieces, delivered as an integrated whole to the customer who cannot be bothered going out and doing it all by themselves.

These parts cover the three main circles of value:

- a retailer that has customer intimacy (the app);

- a processor that has operational excellence (the API); and

- a manufacturer of products (Cloud).

Across this whole scheme are pieces of process that small, nimble specialists can do far better than large, slow generalists; but the large, slow generalist has the customer traction and brand to be more than capable at bringing together the best parts of the net for their customers.

This dance of assemblage is on the way and growing every day.

Dance or get tranced.

This is Part Six of a six-part series on being a Digital Bank:

Part One: Major parts of banking are stuck in the last century

During my lifetime, two things have fundamentally changed the world: travel and technology.

Part Two: Heidi Miller, Bitcoin and fitness for purpose

Building on yesterday’s theme about how a cheque from Canada has taken six weeks to process and had significant processing charges taken from the deposit as a result, reminds me of Heidi Miller’s speech from SIBOS 2004, which is still talked about today. What did Heidi say that was so compelling?

Part Three: We are not Borg, we are Human and dancing to a different tune

Building to the theme of the divide between the old world of finance and the new, and why (some) banks aren't fit for the 21st century, brings a few more points to mind, in particular about control and centralisation. Banks were built as control freaks. They need to own the complete end-to-end cycle of everything. They have to develop their own software, systems and services, which is why they end up with more developers than Microsoft as a result.

Part Four: You may be innovative today, but tomorrow you're just an incumbent

I’m going to give up on the discussions about banks dragging heels when it comes to the global net soon, but only after a few more pieces of debate. Today, it’s all about innovation.

Part Five: Please refer to the Digital Department

I have this cheesy line in my presentation about digital is a journey, not a destination. The destination comment is that most senior bank management think it’s a one-off project, like building a pyramid or a cathedral. You make the investment and it’s done. That’s not the case.

Part Six: Banking-as-a-Service, five years later

In a final note on the Digital Bank Transformation, I return to a theme I’ve explored a few times (from Banking-as-a-Service to APIs and apps). The core of the model of banking is represented in various ways, but I encapsulate it as three companies in one: a retailer that has customer intimacy; a processor that has operational excellence; and a manufacturer of products.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...