After the announcement last week of job losses at Barclays, I was reflecting on this and two other news headlines.

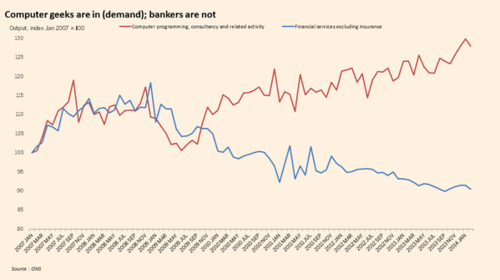

One from Reuters states that the boom time for trading has gone whilst the other, from the Financial Times, shows that traders are no longer what banks are looking for - instead they're hiring computer programmers.

The Reuters article is particularly interesting:

Revenue from FICC and equity trading, which critics sometimes dub "casino banking" and distinguish from traditional investment banking services like underwriting share issues or arranging mergers and acquisitions, still accounts for over 70 percent of banks' overall income from investment banking, according to research by Freeman Consulting.

FICC and equity trading income at Goldman Sachs last year was 72 percent of the bank's overall revenue from investment banking, compared with 82 percent in 2010. Morgan Stanley's FICC and equity trading revenue was 70 percent of its total investment banking revenue, well down from 82 percent in 2003.

The FICC share of these trading revenues is shrinking. In 2007 around 70 percent of Goldman's $22.89 billion overall trading revenue came from FICC. Last year, barely half its $15.72 billion of such revenue was from FICC, according to Freeman.

In 2006 FICC income accounted for just over 60 percent of Morgan Stanley's $15.9 billion overall trading revenue, compared to just 35 percent of the $10.1 billion pie last year, the consultancy said.

As new regulation bites and extraordinary monetary and economic policies smother extreme market swings, the trading volumes and price volatility that middlemen banking traders thrive off has ebbed.

And it looks like a structural shift rather than a cyclical or temporary lull.

"The revenues have gone. The world has changed from 2007, 2008," said Grant Peterkin, head of absolute bond returns at Lombard Odier in Geneva.

"The regulatory aspect is the biggest aspect."

Regulation after the 2007-08 crisis such as 'Dodd-Frank' and 'Volcker Rule' legislation in the United States and Basel III banking reforms globally, effectively restrict banks' ability to hold, trade and speculate on fixed income and derivatives.

This reduces liquidity, but other traditional liquidity providers like hedge funds have been unable to fill the gap because their businesses are also under pressure.

Add this to the discussions of high frequency trading (HFT) that I highlighted last week.

In that discussion, there is a key paragraph from a Bloomberg review of HFT which shows that market has also plateaued:

In 2009 the entire HFT industry made around $5 billion trading stocks. Last year it made closer to $1 billion. The “profits have collapsed,” says Mark Gorton, the founder of Tower Research Capital, one of the largest and fastest high-frequency trading firms.

So the bottom line appears to be that the regulators have gotten their way.

Investment banks can no longer make profits from easy pickings, and their trading desks are handcuffed by regulation.

From my own perspective, i think this is a natural outcome of the global financial crisis.

Back in 2008, we saw risk explode in the form of lack of access to capital and a major liquidity squeeze.

The investment bankers had got it wrong and everyone was screaming for their heads.

“Casino bankers raking in fat bonuses whilst taxpayers paid the price”, was the mantra we all heard back then and still do today, but what the media miss is that a lot has changed.

Proprietary trading is being shut down by the Volcker Rule.

Bonuses are limited in Europe and a Financial Transaction Tax is still likely,

OTC Derivatives are no longer over-the-counter but are now electronically routed on exchanges.

High frequency trading alongside direct market access is giving more power to the buy-side to do what they want without a sell-side involved.

And yes, underlying all of this, we have the move from pits to screens.

Everything is automated and integrated, and no human hand involved.

The utopian dream of Straight Through Processing (STP) may not yet be 100% there, but we are getting closer.

A lot closer.

So all of this means far less reliance on the human form of trading, and far more reliance on the digital form.

It does not mean that the whole market runs on a chip, as there still needs to be intelligence behind the chip and that intelligence is human, but what it does mean is that we don't need nearly as many humans in the process.

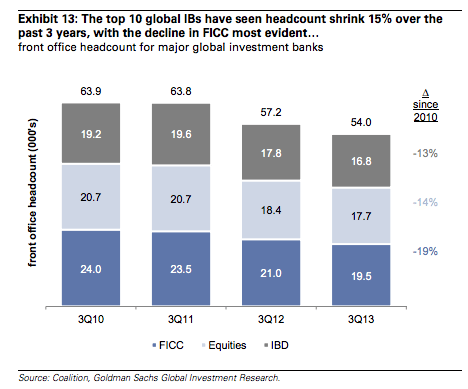

Taking a look at the job count headcount in banks over the years therefore makes for interesting analytics of the trends.

As mentioned we have the FT chart, which shows clearly that banks no longer want bankers but need computer geeks:

but we also have several others.

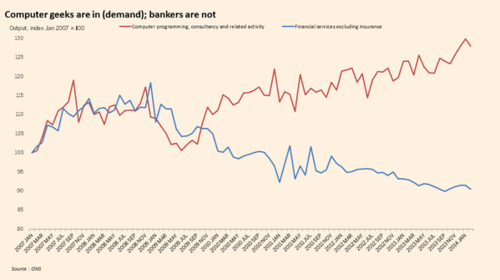

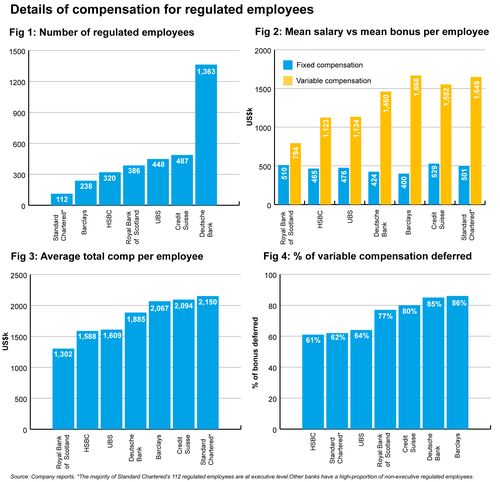

These two from eFinancial Careers tell a story:

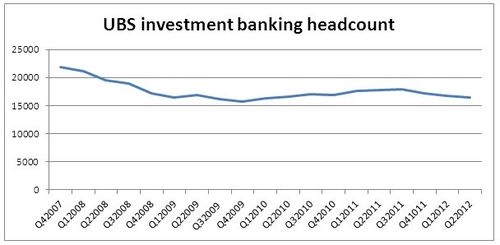

As does this one from the Daily Kos:

Add on to these charts the job losses in retail and you can pretty much expect to find that banks long-term will not be the place to work, as they won't be hiring.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...