What amazes me about the banking system is that the banking system does not believe it needs to change.

It does not believe it is being disrupted by technology.

It is dismissive of many new start-ups and innovators.

And it points to past performance for the reasons why.

There has been no major disruption in banking for the past century, apart from the issues the industry created for itself (debt fuelled crises) and by the regulators who then have to fix the mess.

The banking system is integrated and entwined with the economic system, and the economic system determines the elections of politicians.

Hence, the politicians work closely with their financiers to ensure it all works in the best interest of the nation.

That is why each nation only has just three or four large banks, and why there is no competition in banking because regulation is the greatest barrier to entry.

Or that is the view within the industry.

The banking licence issued to banks protects them from competitive threats and so the only competition they face is each other.

Then, through mergers and acquisitions, they aspire to become Number 1, 2 or 3 in their markets, and then look overseas for expansion.

But what is interesting is the innovator’s dilemma, and the view that new competition from outside can be dismissed because it appears irrelevant.

Many of the rumoured competitors are probably not competitive threats at all.

Google, Amazon, Facebook and Apple (GAFA) are all good names to throw around but, twenty years ago, it was Microsoft becoming a bank.

They never did and it is likely that GAFA never will. That is in part because their focus is on dominance in the digital space, rather than the financial space, and that barrier to entry into core banking: the licence.

And when firm’s do start to shake the banking tree, as Alibaba did recently in China, then the banks start applying pressure on the regulator and the government to shut such services down.

But what if something was on the radar but such a tiny buzz that you flick it away like a fly?

What if something was building that would totally reshape the industry but, because it seems so irrelevant, it’s ignored?

What if there was no need to use banks at all, and the system could be circumvented?

What if you could create a new value exchange that had no regulator, apart from the community that use it?

What if you could move funds globally, for no fee and with no SWIFT involved?

That is what Bitcoin is trying to achieve and is why I keep blogging about it.

I do believe it will end up being regulated, but the major players in the Bitcoin ecosystem do not currently include a single bank.

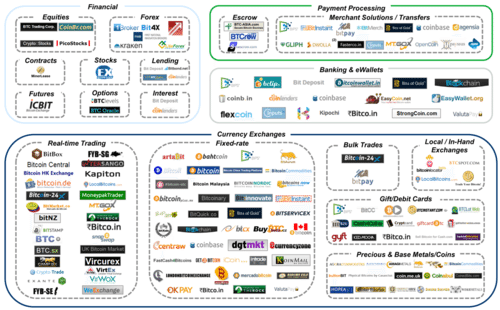

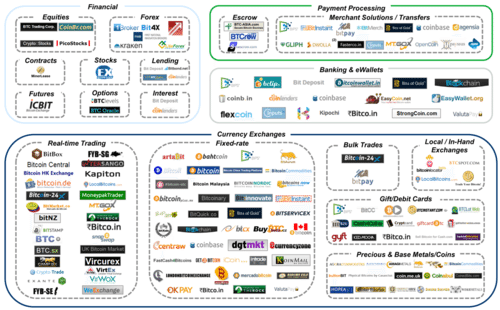

Therefore, if it does go mainstream sometime in the near future, there will be a completely different group of players to deal with (double-click image to enlarge):

We do live in interesting times.

And finally, if you don't believe that Bitcoin is threat to banking, then how come all the people who are passionate about Bitcoin worked in payments and banking before?

From last week's Economist:

Bitcoin in Hong Kong

Inside the world’s first Bitcoin store in Hong Kong, a visitor from Tokyo hands over a wad of thousand-dollar bills and waits for a clerk to process the transaction on a laptop. Moments later, a notification on his phone shows that bitcoins have been added to his “digital wallet”, one more transaction in a city that has become a regional hub for the crypto-currency.

Entrepreneurs in Hong Kong are scrambling to offer new services for bitcoin investors and enthusiasts in the region, despite a dip in confidence after the collapse of Mt Gox, a Japanese online exchange. The former British territory’s status has been enhanced by mainland China making it hard for the Bitcoin business—banning financial institutions from dealing in bitcoins and closing the bank accounts of online trading platforms.

Hong Kong, on the other hand, continues to be run under the “one country, two systems” set-up, agreed before it was handed back from British to Chinese sovereignty. So it has its own monetary authority and its own British-style legal system. A slew of startups are racing to lay out a network of Bitcoin ATM machines (where you pay money in to obtain bitcoins) and to open exchanges for online buying and selling, while a handful of bricks-and-mortar businesses are starting to accept payments in bitcoins.

As in so many areas, straightforward regulations and high-quality local talent have been the key to Hong Kong’s early success. Promising ventures have found no shortage of capital in the city. Li Ka-shing, a Hong Kong tycoon and Asia’s richest man, was an early investor in BitPay, a Bitcoin payment technology.

Still, the industry is experiencing growing pains, too. Two of the city’s first Bitcoin ATMs stopped working soon after being set up in March. Aurélian Menant, a former investment banker who left his job last year to start Gatecoin, a digital-currencies exchange website, waited nine months for his company to be granted a licence as a money-service operator.

Yet in spite of the teething problems, many observers believe Hong Kong’s transparent legal framework and its position on China’s doorstep can make it a leading global centre for Bitcoin, just as it has been for many other commodities. Authorities in the city have made their position clear. John Tsang, Hong Kong’s financial secretary, told a room of teenagers recently: “Bitcoin is not a currency. Just like your armour in World of Warcraft, since we don’t regulate those, we won’t be regulating Bitcoin.” In addition, any assets gained from the buying and selling of bitcoins are subject to the city’s attractive low flat-tax rate.

Some think the key for Bitcoin startups is to attract capital from flush mainland Chinese investors. The problem for David Shin, a Hong Kong banker who launched Cryptomex, a Bitcoin crowdfunding investment platform, is that investors in China “like to hoard their bitcoins”. Mr Shin hopes his venture could coax them to invest in startups, and that those businesses would in turn improve the security of transactions and earn digital currencies wider legitimacy.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...