As the author of a book called Digital Bank, a headline that reads Brits embrace digital banking cannot be ignored.

Sure enough, it’s the publication of the British Banker’s Association’s report The Way We Bank Now, the second report analysing the move to phone and online banking by the great British public.

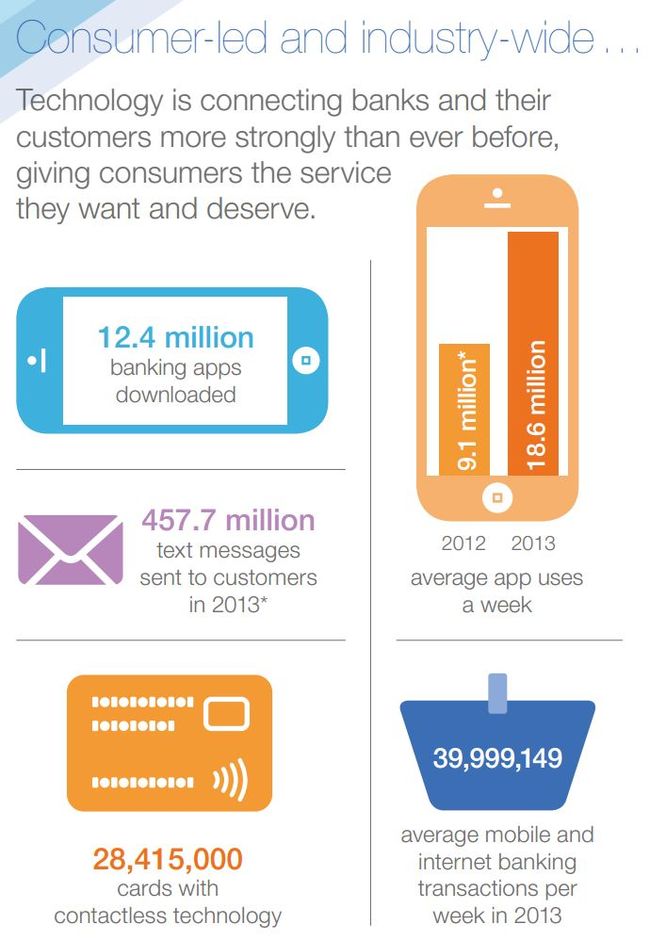

This year it shows some startling moves and stats:

- transactions carried out on smart phones and the internet account for almost £1 billion a day

- internet and mobile banking transactions worth £6.4 billion a week are being processed, up from £5.8 billion a year ago

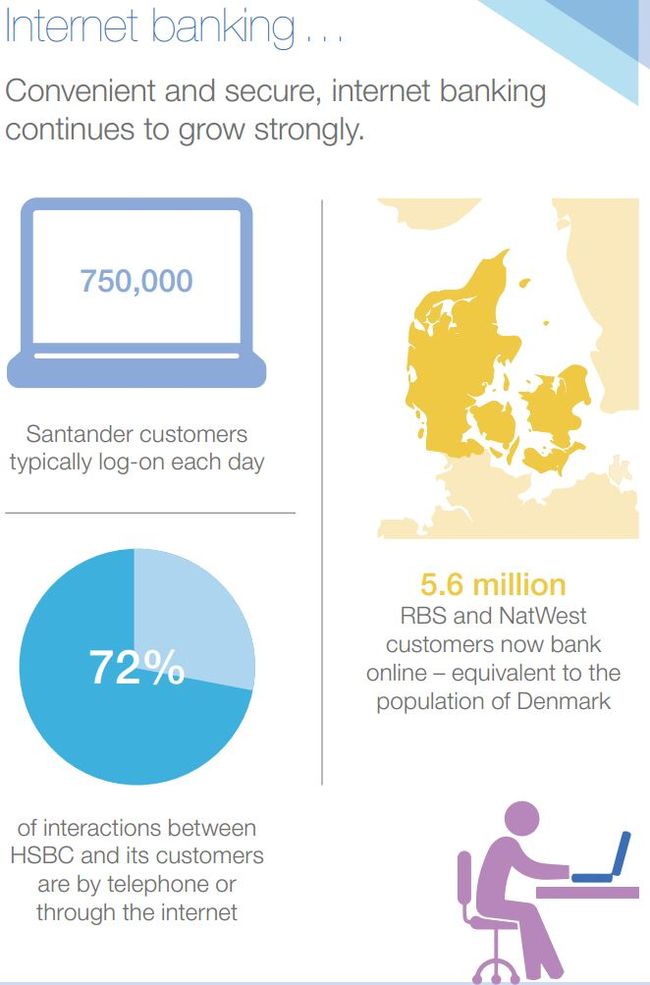

- Brits average 7 million log-ins a day into their internet banking service

- one in ten people log in for some form of internet banking service each day, with more than three in four people using online banking at least once a month

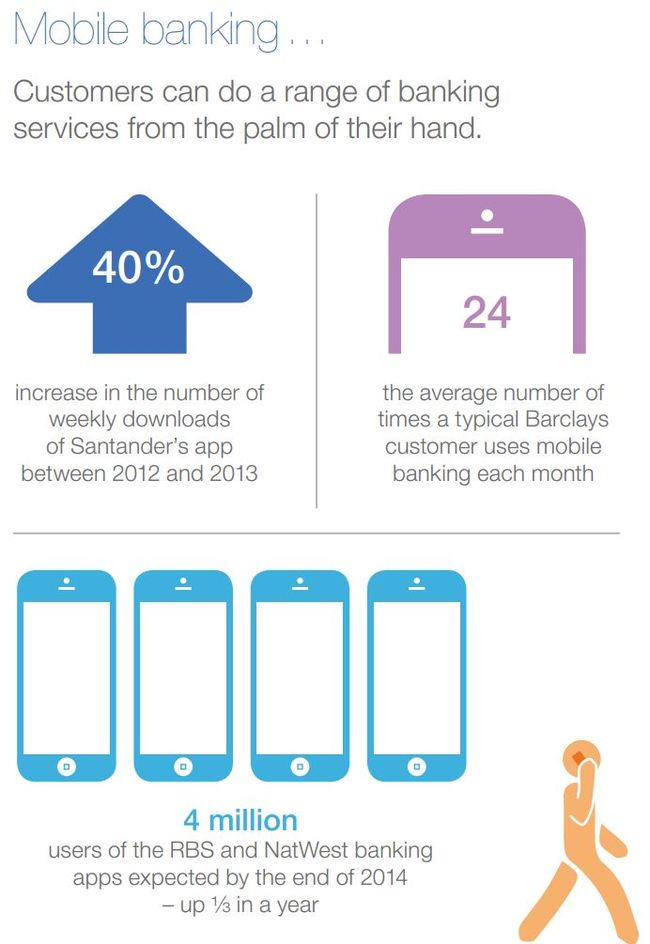

- 14.7 million banking 'apps’ have been downloaded, up by 2.3 million since January

- more than 15,000 people are downloading banking apps every day

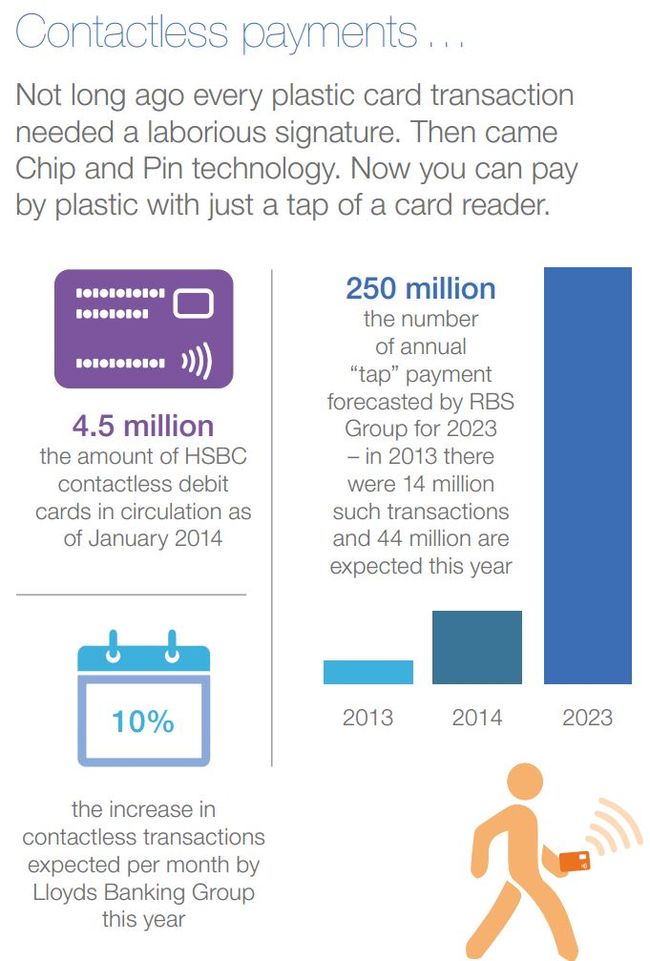

- spend on contactless debit cards expected to rise to £6.1 million a week, up from £3.2 million a week in 2013

- 2 million transactions were completed using in-branch iPads by Barclays customers last year

- only 10% of transactions take place in a branch (NatWest/RBS), compared to 25% four years ago

The full report can be downloaded if interested along with some interesting pics:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...