I was reflecting on the number of new companies starting new ventures in financial services, and wanted to quantify the numbers somehow.

This cropped up because almost everywhere I go, there’s a fintech start-up or start-up challenge.

Barclays has The Accelerator, SWIFT has The Start-up Challenge, Finovate highlights the hot new guys, Sberbank and Santander have funds for start-ups, BBVA challenge them all to show their capabilities and so on.

It implies that this is a market ripe for disruption, but what are the numbers? Is there a real change here, or just an emerging trend of trial (and error).

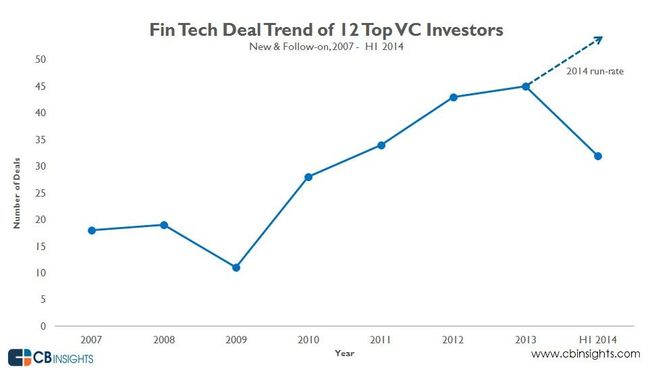

Well, the first numbers that may startle are that over $10 billion has been invested in fintech start-ups since 2009, according to Silicon Valley Bank. This amount has been spread across over 2,000 start-ups. This makes it one of the top 10 investment areas for funds globally.

Chart from CB Insights

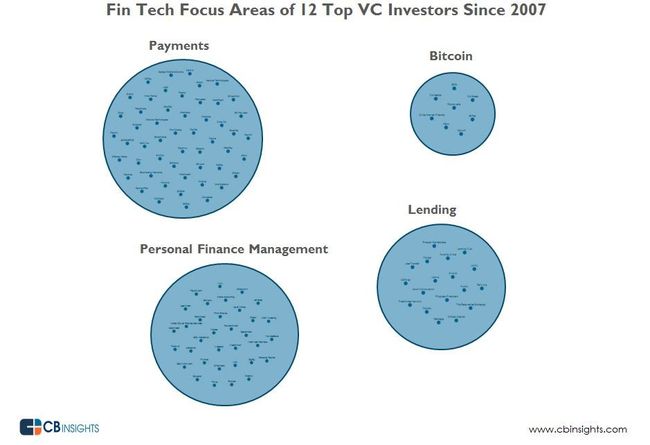

This analysis is echoed by Accenture, who note that 2013 saw private Fin Tech companies raise nearly $3 billion – more than tripling the $930 million invested globally in Fin Tech in 2008.

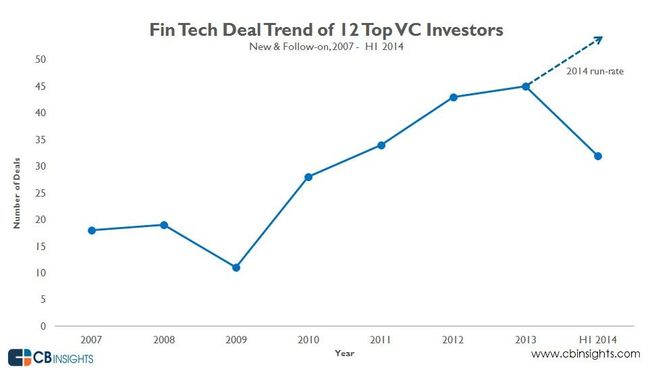

According to Financial News, payment processing companies, financial software and businesses that provide big data systems to banks proved particularly popular, with 14 of those businesses raising €166 million during Q1 2014.

Chart from CB Insights

It’s also an area that is being changed by technology itself.

For example, crowdfunding plays an important role. According to Wired, investments in financial technology start-ups grew to just over $2 billion for 2013, a 480% rise, where crowdfunding platforms have been a key component of developing financial tech.

So there’s a big deal here with finance, money and banking seen as the hot space for change through technology.

What is even more interesting is that the place where all this development is taking place is … LONDON.

Accenture’s analysis of European fin tech data reveals that since 2004 the lion’s share of Europe’s Fin Tech deals and financing have taken place in UK and primarily London. In 2013, UK and Ireland represented more than half (53%) of Europe’s Fin Tech deals and more than two-thirds of Europe’s Fin tech funding (69%).

Having said that, it’s not just London.

It’s also Silicon Valley.

In 2013, nearly 1 of every 3 Fin Tech dollars and 1 of every 5 deals went to Silicon Valley-based companies. Europe, meanwhile, accounted for 13% of all Fin Tech funding globally in 2013 and 15% of deals. However as the chart below highlights, London’s five-year growth trajectory in Fin Tech investments has outpaced Silicon Valley.

With such frenetic activity, banks are waking up to the opportunity to disrupt themselves, as I blogged recently. That’s why Fortune magazine reports that banks are the biggest investors in fintech start-ups, with $8 billion of seed funding by 2018.

Many of the largest banks are creating corporate venture capital firms.

According to Bank Innovation News, BBVA, Sberbank, American Express, Citibank, Visa and others have been very active in the startup space this year.

SBT Ventures — the venture capital arm of Sberbank, the largest bank in Russia — led the $8 million seed round for Moven, as part of its $100 million investment fund.

HSBC’s fund runs at $200 million and Santander’s fintech fund has $100 million in capital.

UBS has been involved in “innovation spaces,” with the Wall Street Journal saying that it has “dedicated funds to finance their operations”.

The size of the deals from bank funded venture capital groups are increasing too.

Amex Ventures, along with Northwestern Mutual and Accel Partners, financed LearnVest’s Series D $28 million investment earlier this year, which brought LearnVest’s total funding to $69 million.

Citi Ventures has two big investments this year: a $32 million Series C round in Betterment and a $38 million Series C investment in Platfora.

Finally, BBVA (the bank, not the VC group) acquired digital bank Simple for $117 million, which is another example of the money big banks are willing to spend on FinTech startups.

All in all, this is a hot space to be in ... welcome!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...