I was lucky enough to visit with Metro Bank recently, and they gave me startling stats and insights to the emerging business.

Launched in June 2010, Metro Bank has rapidly grown to 27 branches today, with a plan for 32 by the end of this year and 48 by the end of next.

Initially, they disappointed me immensely by being a branch-based bank, rather than a digital bank, but they are doing some interesting stuff with digital.

For a start, Metro Bank is a reference sell for Microsoft’s Dynamics Customer Relationship Management engine …

… and the bank claims it is this use of data that is allowing them to create new account openings at a rapid rate (Metro Bank is now averaging 14,000 new account openings per month, and have increased from 275,000 customers to more than 350,000 during the first six months of 2014).

This is why the bank does not spend a great deal on advertising (they claim just £100,000 was spent on traditional advertising in the last year) but instead invests heavily in social media, with a team dedicated to engaging customers through social channels.

By way of example, one of the things that the bank has deployed is a twitter monitoring service that tracks the sentiments shared on Metro Bank and its competitors. This enables them to quickly engage with customers that are experiencing any problems.

That’s pretty clever, as is the idea of an account opening being completed in less than 15 minutes. The bank claims that once a customer sits down with one of their colleagues, 77 percent of new account openings are turned around in that time, and that includes issuance of a personalised debit and credit card, all enabled within any of their branches.

Add on to this that the popularity of the bank’s digital channels has seen a significant uplift, and you start to realise that Metro Bank is branch-based bank built upon a digital base.

That is why they offer customers two telephone numbers: one gets you through to their automated system to check balances etc, whilst the other connects you to a human.

It’s giving the customer choice of whether they want the digital engagement or the human one.

And they are focused upon humans, with only a few – four or five – product managers amongst their 1,400 staff. This is why the bank talks about service innovation and service development, rather than product innovation or product development, with most employees front-facing customer focused people, not internal product folks.

That is how they come up with new ideas like offering dog electronic micro-chipping for free, as a partnership with Battersea Dogs and Cats Home, or running family events and other services in their stores. They even ran a blood donor drive for one of the rotary clubs recently, when the village hall they were going to use got washed out through flooding.

The bank also takes on board neat ideas, such as a card block in their new app.

Y’know how it is.

You get home and find your card lost, but is lost or just mislaid?

Maybe you left it behind the bar on a Friday night and can’t collect until Monday morning, or maybe it’s just fallen down the back of the settee.

Regardless, it’s annoying to have to get a new card issued, but Metro Bank thought about this and now offer a simple block of the card in question, using their mobile app.

If you find the card later, you can then unblock it in the app too.

Alternatively, you can dive into the nearest Metro Bank store and get a new card issued there and then on the spot.

No waiting and no hanging around for the card in the mail.

Impressive?

Not yet. After all, the bank is making losses.

The bank lost £10.6 million in the first quarter of 2014, down from £10.8 million in the previous quarter. According to Chief Executive Craig Donaldson, the bank’s losses have now peaked and the bank should become profitable in the coming years as Metro Bank’s deposits increased to £1.6 billion at the end of Q1 2014, up 131 per cent year on year, and its total loans increased to £960 million, up 298 per cent in 12 months.

According to updated figures during my meeting with the bank, deposits are now near £2 billion in mid-2014, and loans have increased to over £1 billion as the bank grows its footprint.

19 of the 27 branches (or stores as they call them) are profitable, and each new store takes approximately 20 months from opening to move into profit.

As a result, the bank expects to be profitable by 2016.

Some pictures from my visit to add impact.

Entering the branch ...

... I noticed that open counters for customer dialogue ...

... and these doggie snacks on the counter surface (check lower centre oif last pic) ...

... this is because Metro Bank loves dogs ....

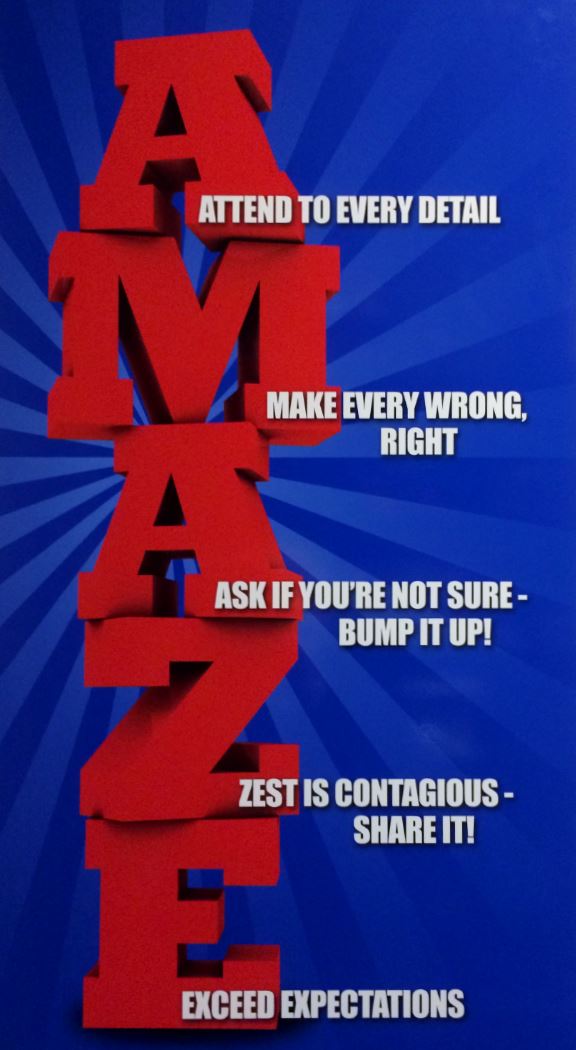

... and staff are trained to love customers too!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...