I was surprised the other day when Financial News named me as one of the top 40 most influential innovators in financial technology, alongside friends including Sean Park, Matteo Rizzi and Nektarios Liolios. It is gratifying to get recognition, and places me amongst 30 London-based influencers of note.

It is this latter point that is worthy of further debate.

There are plenty of innovations taking place in the world of finance and technology, and yet most appear to be London-based after the creation of the London fintech City.

The fintech City is all about building a hub of incubators, accelerators and innovators attached the financial community at the heart of the City, and this is resulting in some major steps forward.

For example, each year, we now have the FinTech50 list of the brightest new young things, alonside Finovate.

According to my friends who are investing in financial innovation, for every fintech innovator in Germany, there are 10 in the UK.

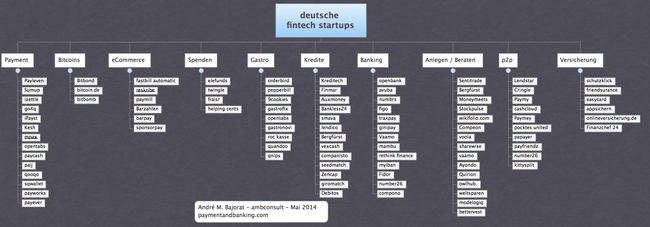

That’s astounding too as you only need to look at the chart below to see how many there are in Germany:

Picture sourced from PaymentandBanking.com

In fact Germany, Austria and Switzerland are a relative hotbed of fintech innovation too, as the FinTechForum.de demonstrates.

And it’s not just Frankfurt and London where these innovation hubs are appearing. You can see them all over Europe from Barcelona to Bilbao and Warsaw to Wien.

Why so many start-ups in banking innovation?

What’s going on?

The answer is: opportunity.

The time is ripe to change the banking model and most venture capitalists and technologists are seizing the day - carpe diem!!!

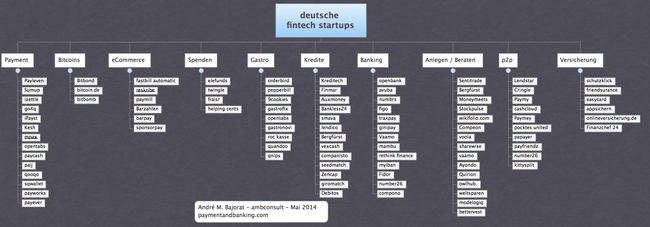

According to the figures I’ve seen, over $1 billion worth of new Fintech-focused funds were launched in 2013 alone, and there’s more to come.

You only need to look at this chart from FSClub friend Yann Ranchere to see how much is being invested by whom.

VC’s such as Marc Andreesen (the guy who launched Netscape and sold it for millions years ago to become one of the most influential silicon valley VCs) made everyone sit up and take note when he tweeted:

@cdixon @JackGavigan @Kwdmiller @aweissman I am dying to fund a disruptive bank.

— Marc Andreessen (@pmarca) February 9, 2014

recently.

Why?

Because it’s obvious that the banking market is the one area that needs to change, can be changed and will be changed by technology innovation.

This does not mean it should worry the banks.

Most are investing in this innovation wave.

However, if you are a bank that is not investing in the next generation of technologies and fintech start-ups, maybe you should be worried.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...