I was asked by a colleague the other day: “can you name two examples of successful strategies used in investment banking to differentiate and win”.

My first reaction was to say that I could name several that were strategies to differentiate but lost, most of them with JPMorgan.

It was JPMorgan that came up with the strategies for Credit Default Swaps (CDS) that led to the subprime crisis (or so some say).

It was JPMorgan that allowed their London office to have a Whale of a time.

And it’s JPMorgan that has been fined more than any other bank over unsavoury practices ($25 billion in the last two years).

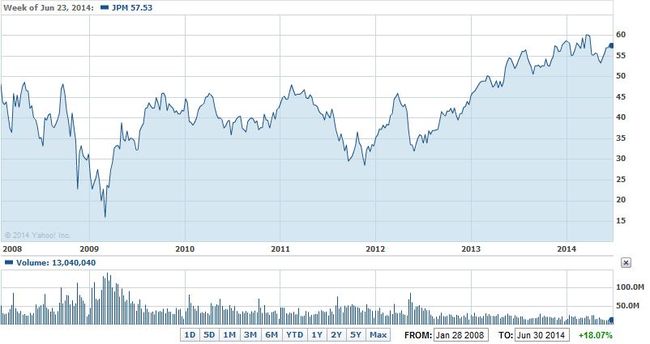

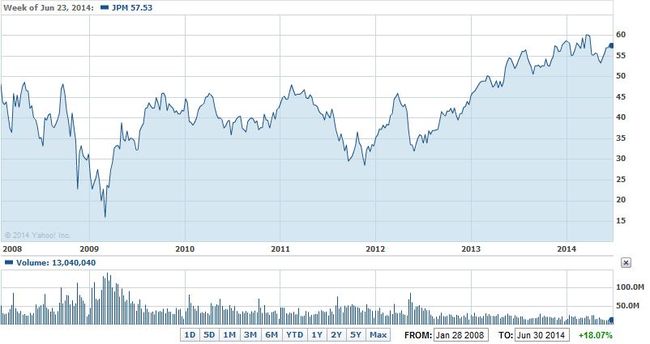

Nevertheless, their stock price is pretty resilient …

… surviving the global financial crisis well, even with the announcement of CEO Jamie Dimon’s throat cancer (which is treatable for most cases).

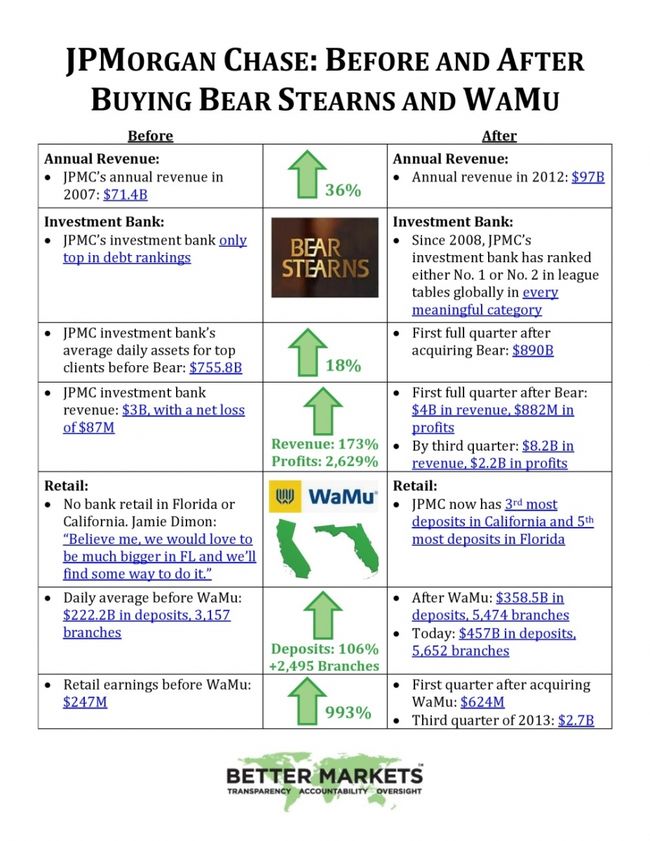

JPMorgan are an innovator in finance for certain – and have a great and diverse spread across retail, commercial and investment banking globally – but the real boost to the business was buying cheap assets in the downturn.

Remember they picked up Bear Stearns and Washington Mutual?

No?

Well, in case you forgot, JPMorgan took the distressed Bear Stearns under its wing in April 2008 and then hoovered up WaMu in September of that year.

Result?

Big change.

You only need to see this chart from Better Markets to see the change:

So, one way to innovate and win is to buy cheap and sell high (a basic tenet of banking and finance).

That’s what Goldman Sachs do and yes, they are my choice for the other investment bank strategy.

If you want an incumbent bank that stands out, then it always has to be Goldman Sachs.

The reason for Goldman is that if you think of the turbulent times we’ve been through:

- the loss of Bear Stearns and Lehmans (both Goldman like businesses);

- the collapse of the markets post-2008 followed by a regulatory tsunami causing the closure of commodities desks and proprietary trading;

- the avoidance of Whales like JPMorgan or rogue traders like UBS and SocGen;

- the ability to avoid meltdown through excellence in risk management;

- the use of technology to beat the competition by always exploiting the lowest latency alongside leadership in algorithmics;

Goldman ticks all the boxes.

Their business models have been massively impacted and changed, and yet Goldmans have steered through the crisis soundly and well, under leadership from one of the few unchanged CEOs in banking today: Lloyd Blankfein.

You may not like him or them, but that is because they are the bank to beat.

How have they survived so well?

I’ve explained that in many previous blogs, but perhaps best summed up by this line from February: Goldman Sachs has survived by being nimble and adaptive and having “a culture of extreme aggression, deep paranoia, long term orientation, individual ambition and robot like teamwork”.

Nevertheless, Goldman is not out of the woods.

Their ROE (Return on Equity) is a third of what it was pre-crisis and Morgan Stanley is doing a better job today of diversifying their business into wealth management and lending.

That si why they are embarking on a new strategy thanks to trading, Goldmans traditional strength, becoming a more barren wasteland.

It will be interesting to see which banks I would select ten years from now.

Oh, and on a final note, I do also give thumbs-up to new players like Chi-X (now BATS Chi-X) and Markit, who have both created successful models of business since the crisis hit.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...