PayPal was already eBay’s default money-transfer service when the online auction group bought it for $1.5 billion in 2002. Today, PayPal operates in more than 200 markets, manages more than 148 million accounts, and facilitates a variety of financial transactions in 26 currencies. In this interview with McKinsey’s Eric Hazan, PayPal’s vice president and general manager for Continental Europe, the Middle East, and Africa, Laurent Le Moal, discusses the company’s approach, the evolution of its customers, and its future. Le Moal joined PayPal in 2004 as its head of business development for the United Kingdom, moved to France in 2006 to lead the growth of its merchant-services activities, and became general manager of PayPal France in 2008. He assumed his current role in 2010.

McKinsey: Could you begin by sharing your perspective with us on PayPal’s position in the consumer landscape and the evolution of its role in e-commerce?

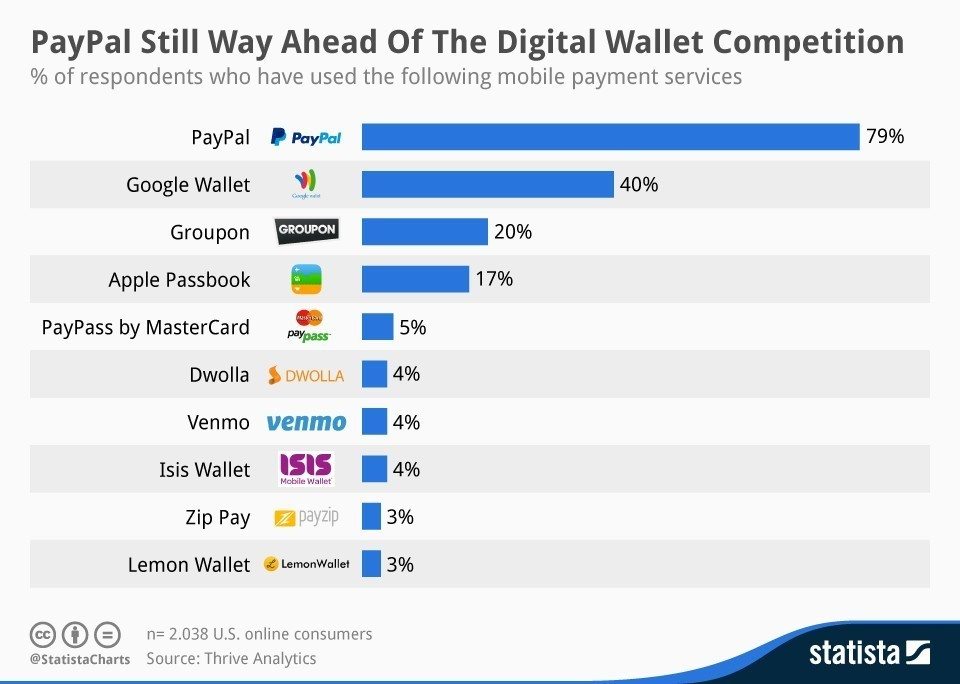

Laurent Le Moal: I think we have remained true to first being a company that is at the crossroads of the Internet and financial services; and as such, we are a company that has redefined payment as a function. Nine years ago, payment was not an area that anyone wanted to venture into. It wasn’t sexy. Now, I think it’s apparent—in terms of innovation and in the amount of venture capital being invested in the sector—that payments are truly key. This is because we have pioneered completely new models of monetizing the service.

Over the years, we’ve also seen geographical expansion. As this continues, I expect PayPal to be at the forefront of a new model as well. The classic playbook of American companies going to Europe—starting with the UK and then expanding into Germany and Southern Europe—doesn’t apply as widely anymore. When thinking about Brazil, Russia, India, and China along with the newer rapid-growth markets of Central Europe, Turkey, and Africa over the coming two years, we are taking a fresh look at where the new consumers will be coming from.

McKinsey: Thinking of the major consumer shifts over the past few years, which one has had the biggest impact on your business?

Laurent Le Moal: I’ve worked in the Internet sector since 1997, and I would say that for more than the last ten years, we have talked about the mobile revolution. But over the past three years, we have seen the tipping point with mobile commerce truly becoming mainstream. Mainstream for me is when you have a market that goes in 12 months from being 2 percent of your transactions to 10 percent, then to 20 percent 2 years after that. That’s when you start paying attention. Smartphones have completely changed the way people connect and interact with the web, and tablets have dramatically changed the way people experience e-commerce. People come home, sit on their sofas, and use their tablets not only to consume content but to interact with e-commerce websites. This has given rise to an entirely new generation of users and forced us to completely change our product. The way people registered for PayPal five years ago is not the same as today. Now, we design our product starting from mobile and then develop it for a classic desktop. We also have special teams going after digital-goods merchants because this is an entirely new industry.

McKinsey: What is your strategic approach to this new group of digital-goods consumers?

Laurent Le Moal: That’s a big question that we’re still working on. I would say the classic approach we’ve always had was reach, frequency, and velocity in securing and attracting new consumers—all more driven by the number of transactions and the customer’s lifetime value. This involved looking at the percentage of the base engaged with the service and trying to understand what, where, and how often these people make purchases.

With the rise of digital goods, this approach no longer suffices. Such goods can generate ten times the number of transactions normally expected in traditional e-commerce, but the value is lower. Even if customers are much more engaged, they sometimes generate lower revenues. We still need to determine the marketing implications of this new interaction. And this is just one example of growing diversity. Entering new markets like Russia, Turkey, and Africa requires us to think more about customer segmentation in ways that are more nuanced than we have in the past. The devices these consumers use, the type of goods or services they consume—everything is different, including the way marketing targets them. E-mail marketing needs to evolve in a world where consumers expect high relevance and targeting but also widespread usage of social media. All this has completely changed the media mix—and we’ve brought new media into this mix by adding channels like Twitter and Facebook.

McKinsey: Are there other strategic matters you consider as you expand into new geographies?

Laurent Le Moal: The way we’ve done this has actually been very easy. We go from pure cross-border to the domestic market, and then we go from small to large in terms of addressable market size. Cross-border is defined as a country where people buy services and products from abroad because the internal supply is small and will remain small. A lot of these countries can be found in Africa, for instance. These become the markets in which a company can serve consumers without having to invest locally.

On the other side of the coin are big domestic markets like Russia. Five years ago, Russia was only cross-border—Russian consumers buying from abroad. A lot of investment, a lot of venture capital, a lot of very smart entrepreneurs, a booming market at 50 to 60 percent year-on-year growth. What do you find now? A domestic market where consumers can find the supply and the delivery service they want within their own country. In a market like this, we then allocate our resources to be present in these domestic markets. After this, we gauge the size of the addressable market. Russia is a very sizeable market. It’s the biggest market in terms of Internet users; thus it will be the biggest market in terms of Internet shoppers in a few years.

So, size definitely matters for us, especially when we have to allocate resources. There’s also the issue of regulation. I think Internet companies need to be aware that regulation will become an increasingly inevitable factor in growth or the limitation of it. For us specifically, this means understanding the laws regarding payment and the associated costs of compliance with those laws.

McKinsey: You mentioned social networking. How is PayPal using this medium to interact with current and prospective customers?

Laurent Le Moal: In the old world, if the website went down for a few minutes, a transaction was declined and a customer had a bad experience with the merchant. Then a call would come in from the customer, and the merchant could deal with the issue at his own pace. Now, if a customer has a bad experience, the first thing they will do is tweet about it or post it on Facebook. This not only forces us to respond much more quickly than before, but it has completely changed the way customer service interacts with customers. It means that we train, retrain, and allocate people who will deal solely with social-media channels.

It also means that we’ve needed to understand how social media changes the tone of our communication with customers. Social-media users are quick to pick up on unauthentic messages or falsely customer-centric messages. When we consider, for example, how we are going to make changes to our policies, the first thing we ask ourselves in our briefing meetings is: OK, so what’s the Twitter around this? Can we boil it down to 140 characters? What will be the post on Facebook, and how will people react to it? For us, these are the first questions we ask before we even go into the traditional press release.

McKinsey: What about PayPal’s offline efforts?

Laurent Le Moal: Well, this is an extension of the customer-segmentation challenge. Those who think they have a good understanding of what their customers do with them online and on mobile, and then they go offline. They go into the physical world, and then they’re lost. The classic example would be a big retailer with a physical presence and a big online presence. That company knows who their top online buyers are, and they can serve these customers with customized home-page products. Yet customers enter the shop, and the retailer does not know who they are. Our key challenge for the next three to five years is accessing the same high levels of information offline and sharing it with the retailer in a nonintrusive way for the consumer—and being nonintrusive is extremely important. How can we find the right balance of soliciting no more information than the customer is comfortable sharing but enough for them to benefit from better service? This must be very explicit in the relationship with consumers and merchants; otherwise, expect a backlash.

On the other side of the process, our objective is to address pain points that merchants experience. McDonald’s, for example, has an app that is downloaded by millions of people. They wanted to leverage that app to allow customers to order ahead, come to a restaurant, and be served in less than three minutes. We were able to help by embedding the PayPal interface in their app.

McKinsey: Are there also merchant-side challenges in making PayPal just as much a tool for offline transactions?

Laurent Le Moal: In the past, when people just looked at payments, they were looking only at how the process could be made faster—for instance, all the debate around near-field communication. That’s not the problem anymore. Now the challenge is adaptability. How can we work with any form factor that makes sense for the merchants and their customers? What it means for us is not being prescriptive when it comes to the technology or requiring form factors to use PayPal. If it makes sense to integrate with a vendor’s point of sale, we will do that—using what already exists and not asking the merchants to completely change their hardware. If it makes sense for the consumer to use his phone to type in a code, we can also do that—as opposed to using a card to make a transaction. This also means going into the hardware business. PayPal has a device that attaches to a phone or a tablet to accept card payments—and this has been one of the ways to gain entry into these new services and control the entire end-to-end experience.

McKinsey: E-commerce remains merely 5 to 7 percent of all retail in Europe. How do you think it will evolve?

Laurent Le Moal: Speaking with retailers, the number-one item on their agendas is multichannel. It took them a few years to move from pure retail to online, treating online as a separate channel. The second phase was then to blend the two, to really have online become part of their retailing strategy. Now, the third phase will be that the distinction between online and offline will disappear. Consumers today start the experience from a phone or a tablet, then go to their laptops, and conclude the transaction in the shop. Or they actually begin the transaction on their mobile devices, then expect to have the item delivered to the shop for pickup. So, for them, it’s a continuum, and they also expect the same level of interaction across these different touch points.

In several years, I am not sure that we will even be able to truly specify e-commerce as a percentage of total retail sales, because even when the final transaction is not made online, some element of the purchase process will have happened online. Consumers are already primed for this, but it’s still a challenge for the retailer. It’s possible to go to an Apple store and buy a device costing €700 without having to go to a cash register, but buying food in a grocery store means waiting in line for 15 minutes. Retailers will need to consider shop redesign and IT-platform integration to enable this new customer experience.

McKinsey: What’s on PayPal’s five- to ten-year horizon?

Laurent Le Moal: Our CEO, John Donahoe, has laid out a very clear and compelling vision for us as a company—across all of the corporate assets—that’s one of building connected commerce. The objective is to level the playing field and create opportunities for all merchants around the world to connect with consumers all around the world. It’s a very bold vision. It means that we need to leverage all of the assets we have—eBay as a marketplace, PayPal for the payments, eBay Enterprise to serve the big brands—and bring them together so that we can serve big multinationals as well as small individual sellers from the US to Russia. This mission goes well beyond payments and online shopping. It’s the whole notion of using a set of assets globally to create opportunities for everyone. It will take us a few years, but we’ll get there.

Laurent Le Moal is PayPal’s vice president and general manager for Continental Europe, the Middle East, and Africa. Eric Hazan is a principal in McKinsey’s Paris office.