I’m a fan of anything that makes life easier and, for me, PayPal is one of those things.

PayPal allows me to make cross-border payments easily.

Even better, it allows me to take cross-border payments easily.

I’ve sold quite a lot of stuff using the PayPal widget, and it makes an SME’s life simpler (although the fee rates are not great - 3.4% plus 20 pence per transaction on each sale).

This really hit home when I recently ran a couple of events to launch the new hardback release of Digital Bank with Marshall Cavendish.

The first was a private launch meeting at the Financial Services Club, and the second a public launch in the conference rooms of the British Bankers Association (BBA) in partnership with the Chartered Bankers Institute.

Both went very well, and one thing that cropped up about three days before the first meeting was an email saying would you like to sign up for PayPal Here?

PayPal Here is basically iZettle (or Square if you prefer) for the UK (and USA, Canada, Hong Kong and Australia).

To use it, you just download the app, order the card reader and off you go.

So I did just that and, because the book costs me a fair bit to order, I offered to take card payments at both book launches.

The first went swimmingly well, with lots of folks presenting their cards.

I duly turned on the card reader and linked it to the app via Bluetooth.

Then entered £20 on the terminal and the eager reader placed their card in the Chip & PIN.

All the way through, the app tells me what’s going on, so I ask the customer to enter their PIN.

Once confirmed, the app asks me whether they want a receipt sent via email, and that’s it.

Payment made.

Love it and can see this ease of making any phone inot a POS sweeping the world soon.

That was until the second book launch.

What happened?

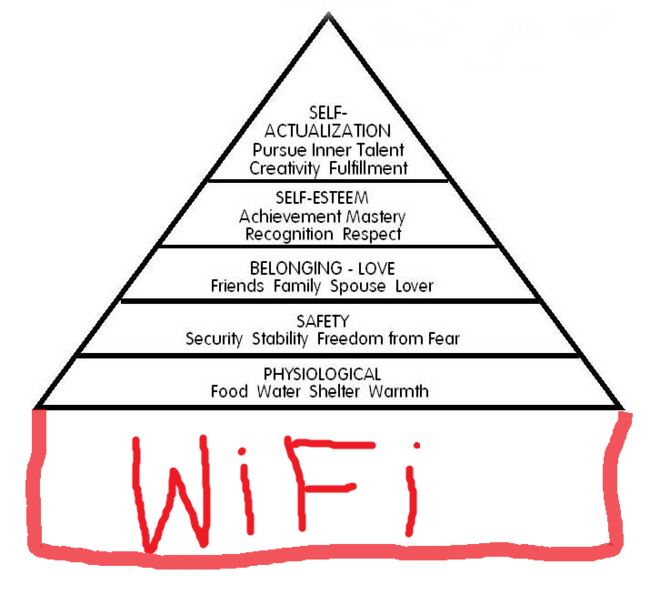

No wifi.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...