After years of indecision and procrastination, Apple finally announces what they are going to do in the payments space and the world goes wild.

All the media I read seems far more consumed with Apple Pay discussions, than about the iWatch or iPhone 6 with the bigger, flatter screen.

Even when PayPal announce far more interesting things, like processing payments in bitcoins, everyone wants to big up the Apple machine.

So is yesterday’s news important?

I guess so.

During the debate over will they or won’t they NFC, they did.

Having rolled out TouchID, iBeacon and Passbook, the announcements of Apple Pay also endorses the further erosion of banks at the front-end of banking. Banks are becoming back-end engines rather than front-end brands.

What I mean by this is that did anyone notice that it’s all the card companies (Visa, MasterCard, AMEX) and major US banks (Wells Fargo, Citi, JPMorgan, Bank of America) that were part of the announcement?* No, it’s APPLE PAY, not pay with your Apple via your bank.

Nevertheless, I did notice that on all the demonstrations of Apple Pay, it’s the JPMorgan logo that stands out.

So, if you haven’t already gathered what Apple Pay is all about, here’s the brief low-down (you can read more here).

In terms of features and functions, a good introudction comes from the Wall Street Journal:

Apple is plunging into the world of mobile payments, lending legitimacy to a field that has dashed hopes of some of the biggest technology companies.

The company's new Apple Pay service, integrated with the new iPhones and a digital watch announced Tuesday, is designed to allow users to buy merchandise, scan tickets and other actions by waving their mobile device in front of a reader.

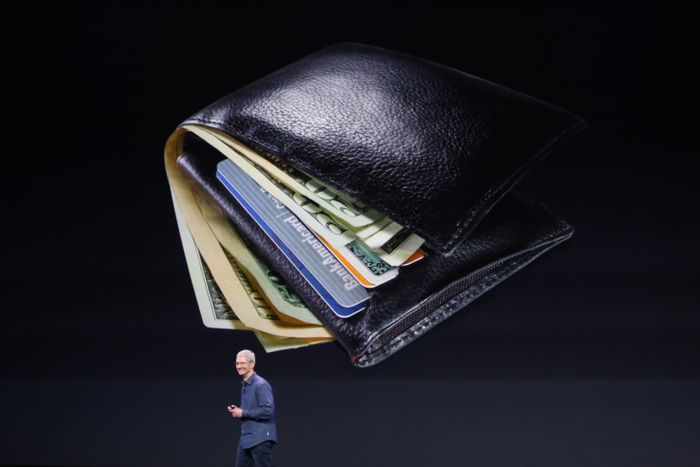

Apple said it hoped to speed up the checkout process and, ultimately, to replace physical wallets for U.S. consumers. The service uses a technology known as near-field communication that works by transmitting a radio signal between the device and a receiver, when the two are fractions of an inch apart or touching.

"Apple Pay will forever change the way we buy," boasted Chief Executive Tim Cook as he announced the service at a presentation in Cupertino, Calif., near the company's headquarters.

Apple also may have found a new revenue stream in rolling out the payments service.

The card-issuing banks have agreed to pay a per-transaction fee to Apple to be included on the phone, according to people familiar with the situation. While the amount of the fee couldn't be determined, banks believe that cost will be offset by the number of transactions that consumers make on the phone. The banks collect fees from merchants on every credit and debit-card transaction.

Apple is promising more-secure transactions than the plastic cards most consumers use today. That will be welcome news to consumers grown weary from a series of high-profile breaches at Target Corp., Home Depot Inc. and others that have potentially exposed tens of millions of accounts.

Apple will require a thumbprint scan on its new iPhone 6 smartphone to make the tap-and-go payments—meaning a stolen device can't be used for a shopping spree. It wasn't immediately clear how Apple would authenticate payments on the smartwatch.

To answer the last point, The Telegraph explains more about authentication and sign-up:

It uses NFC chips which can communicate securely and wirelessly, and uses the Touch ID fingerprint sensor to authenticate purchases … Using the iSight camera built-in to the new iPhone you can take a picture of your bank card and the details will automatically be added to the service, under an app called Passbook. From then on you can make payments in any compatible shop simply by tapping your phone and pressing your finger on the Touch ID sensor.

When you use the service Apple is not aware of what you bought, how much it cost or where you bought it from - that information passes directly to your bank. The shop also does not get to see your payment details. Apple claims that this makes it much more secure.

Moving along to another note, Forbes focuses specifically on the security and privacy areas of Apple Pay:

With Apple Pay, an iPhone 6 owner will be able to check out at a register by holding her phone up to a wireless pay terminal with her fingerprint on the sensor, activating Apple’s Touch ID technology.

“That’s it! That’s it!” said Apple CEO Tim Cook after the brief demonstration. “Would you like to see it one more time just in case you may have blinked and missed it?”

While such mobile payment technology has existed before, Apple Pay takes it to a new level of privacy.

“We don’t store your credit card number and we don’t give it to the merchant,” Eddy Cue, an Apple senior vice president, said during the keynote. “We create a device-only account number and we store it safely in the secure element [which encrypts your payment information], and each time you pay, we use a one-time payment number along with a dynamic security code, so you no longer have the static code on the back of your plastic card.” And if your iPhone is lost or stolen, you can suspend all of the payments from the device without cancelling your card.

In what might have been a dig at rival Google, Cue said, “Security is at the core of Apple Pay but so is privacy. We are not in the business of collecting your data so when you go to a physical location and use Apple Pay, Apple doesn’t know what you bought, where you bought it or how much you paid for it. The transaction is between you, the merchant and your bank.” (That stands in contrast to Google Wallet, which does store such information.)

A valid point but, what with iCloud revealing sexy pictures of stars such as Jennifer Lawrence and Kate Upton, will consumers really trust Apple to manage their most valuable information?

It’s a good question to ask and will remain to be seen in the take-up of Apple Pay from its US launch.

For example, in another note on Forbes, it is noteworthy that:

According to a new survey from CreditCards.com, 62% of Americans “never” or “hardly ever” use their phones to make a purchase, and many say that they will never, ever use their phone to pay for something: 49% of adults ages 50 to 64 don’t plan on it and (unsurprisingly) 64% of adults 65 or older have no interest in swapping their wallet for their smartphone. Even in the youngest, tech-savvy set — the millennial generation — 30% of respondents said they wouldn’t use their phone to make a purchase.

This is interesting but not a massive hurdle. After all, most consumers probably don’t think they make m-payments but they do make in-app purchases. That’s an m-payment, so ask a consumer what they want and they won’t tell you. You need to give it to them when it makes sense, and mpayments and mbanking or rather, chip-based internet of things payments and banking, does make sense I believe.

Anyways, here are the four things that I think are worth noting in the above.

First, Apple Pay is only available in the USA but has most of the major retailers and banks on board. The fact that the banks are paying a fee to Apple per transaction is interesting, and consumers should expect such costs to be passed along. The fact that this is a USA-only launch makes this of limited interest to the rest of the world and, if it means that Apple will have to do deals with retailers and banks in every country of Apple Pay operation, expect it to take a long time to get to your backyard.

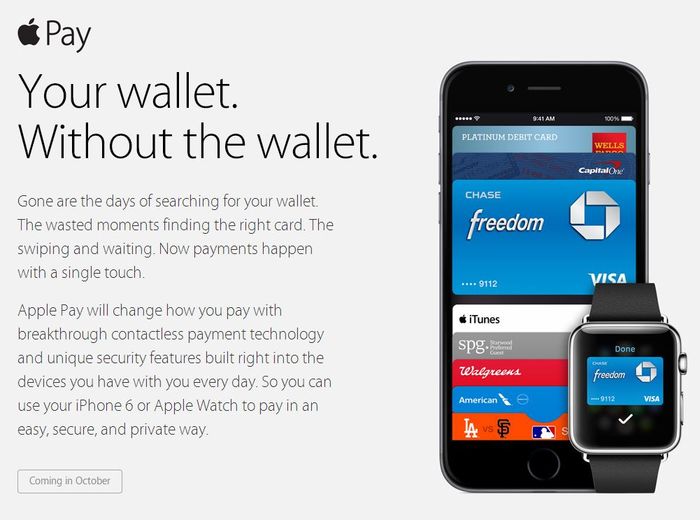

Second, it is NFC based and yet NFC is past its prime? As the WSJ article notes later, payments using NFC technology will nearly double this year to $8.2 billion, but still make up just 2.5% of total mobile payments, according to market researcher Gartner. Similarly, Time Magazine makes special mention of this as a barrier to success:

As CEO Tim Cook acknowledged during Apple’s announcement, only 220,000 stores will work with Apple Pay out of the gate. That’s about 2.4% of the roughly 7 million to 9 million merchants in the U.S. that accept credit cards. The remaining 97.6% of business do not have point-of-sale systems that work with near-field communication (NFC), the technology Apple Pay relies on. Merchants will have to upgrade their checkout process for Apple’s service to catch on, and the expense of such an endeavour has—thus far—left many businesses reluctant to do so.

As most of you know, I’m far more of an advocate of app and internet-of-things for proximity-based payments than I am of NFC, so surely Apple will focus upon getting more inclusion in the app-based payments using iBeacon through Starbucks et al, than forcing customers to make contact-based payments (which is what NFC is, it’s not contactless).

Third, Apple is not trying to disintermediate the banks but, what they have done (as has PayPal and others) is laid a front-end wrap around banking to reduce the friction and the relationship. What this means to me is that, like Starbucks and Uber apps, banks will be wrapped in layers of processing through APIs and apps by others, gradually reducing the visibility of banking to a pure utility status.

We have known this for years, but Apple Pay’s announcements should send a few shudders down the corridors of high office in the banking world as we are now paying to be included in something that diminishes our status.

There is nothing wrong with this, but it is a mighty step from the old integrated vertical model to one where we just exist as a piece of the components that make a technology brand, a digital entity, even more powerful.

And here’s the final rider in this discussion: it’s not disrupting banking.

Nothing has disrupted banking.

Nothing in the last century.

Nothing.

Not ATMs, not internet banking, not mobile banking, not supermarket banking, not Virgin Banking, not even Google banking (which they haven’t done yet).

Instead, all of these developments have overlaid banking with additional services.

They are wrap-arounds of banking, not replacements for banking.

That’s what Apple announced yesterday. It’s what Google and PayPal do; it’s what Square and Starbucks do; it’s what Simple and Moven are doing; and it’s no doubt what Facebook, Amazon and any number of others will do.

Nothing replaces banking because banking is licenced.

The only thing that could replace banking is bitcoin but, after MtGox, bitcoins will be banked too.

So get with it.

The new form of banking is the same as the old, but now it’s just with a much sexier front-end interface.

* A bunch of alliances with retailers were also in the annocument including Bloomingdales, Panera, Sephora, Groupon, Subway, Disney, Target, McDonald's, Whole Foods, Macy's, and Walgreens.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...