Sounds like something to do with a toilet that doesn't work: the blockchain ... but no, it's all about cryptocurrencies and the future of money, our first innotribe session. It was a good meeting, with speakers including:

- Barry Silbert, Founder, Secondmarket and Creator, Bitcoin Investment Trust

- Jeremy Allaire, Founder and CEO, Circle Internet Financial

- Gottfried Leibbrandt, CEO, SWIFT

- Udayan Goyal, Founder, Anthemis Group

- Yoni Assia, CEO eToro and Board member Israel Bitcoin Association

- Chris Larsen, Co-founder and CEO, Ripple Labs

- Leander Bindewald, Researcher/Project Manager, Complementary Currencies, IFLAS / New Economics Foundation

- Jon Matonis, Executive Director & Board Member, Bitcoin Foundation

The session began with a chat between Gottfried Liebbrandt, CEO of SWIFT and Udayan Goyal, co-founder of Anthemis, about what had changed in the thinking since last year.

That led to a dialogue about the blockchain, and an interest in SWIFT in using such technology to manage transaction processing in the future (Gottfried seemed very much into this).

I must admit, that was all a bit early in the game for me as we first needed to explain what the blockchain and cryptocurrencies are all about.

So I asked the audience: do you understand cryptocurrencies? and most of the audience did not!

That was a surprise as we have discussed such things in innotribe for the past four years so either the audience were virgin innotribe attendees or the coffee hadn’t kicked in yet.

My job was to explain these things briefly, so I used just a few slides to explain.

First, that cryptocurrencies are not the same as digital or virtual currencies. Digital currencies are just a value exchange in a digital form, like airmiles. They’ve been around for years. Virtual currencies are similar, but typically used in gaming worlds where virtual life in Second Life and World of Warcraft. They have value but link that value to a virtual economy platform.

Cryptocurrencies are fully encrypted, coded exchange of value, in a digital form that might be used in a virtual economy, but the key difference therefore is that they are a fully secured value exchange.

Some of these are centralised, but the ones that excite are decentralised cryptocurrencies, such as bitcoin, but bitcoin is not it. There are many others, and a criticality of all is that they have features that make them radically different to what has gone before.

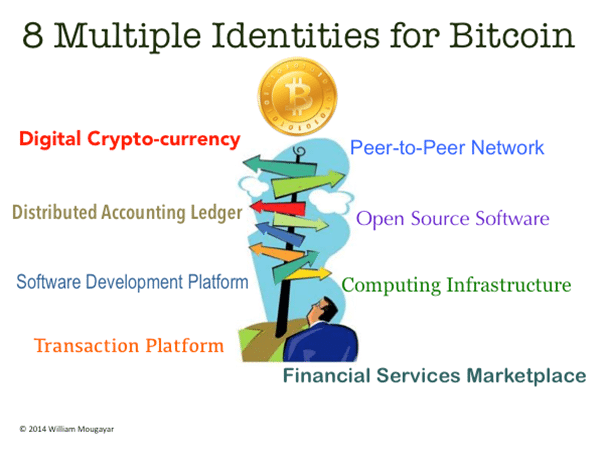

For example, bitcoin is a currency, but also a trading vehicle, a technology, a protocol and more.

Building upon this, Jon Matonis talked about the blockchain – the financial general ledger that is shared on a distributed basis across the internet – as a key part of the Bitcoin protocol, and this is the part that banks are looking to buy into.

A transparent, open sourced, transaction ledger is the core of the bitcoin structure, and could replace or augment SWIFT and other infrastructures, as a technology in the future. It is this part that some banks are investing time in, as it could become a key part of secure and encrypted banking transactions in the future but Jon made it clear that you cannot separate the blockchain from the bitcoin currency.

That’s not necessarily true, and other speakers such as Jeremy from Circle added to the debate with a different perspective.

Circle has just launched a proper bank service for bitcoin, and are advancing the agenda alongside PayPal to ensure that bitcoins are as easy to transact as dollars or euros.

One of the comments from the floor was that the losses on MtGox amounted to more than the total amount stolen in bank robberies over the last seven years.

“Ha!” said the bitcoin guys, “and it’s just a fraction of the amounts banks have been fined for breaching money laundering rules”.

Good answer.

We then talked a bit about Ripple, and Chris Larsen made it clear that Ripple is designed for banks with Fidor Bank moving as one of the first to accept and use Ripple for international transfers.

Ripple is an alternative to SWIFT: “fund transfers processed via Ripple will occur same-day, making the protocol in many cases several days faster than traditional international wires”, and this is an interesting development, especially at a SWIFT conference with Gottfried in the audience.

However, as one audience member remarked, the bitcoin protocol and Ripple are limited by bandwidth. They were critical of the scalability of these developments, which are constrained by the nodes on the network.

Again, that seems a strange comment when Bitcoin harnesses the power of the net, but there may be some elements of truth to the statement.

Leander Bindewald challenged the session eventually by asking two big questions:

1) Do we need banks for value exchange in the future; and

2) Isn’t all this discussion of the blockchain just tech-fuelled testosterone, as you need a community that wants this to make it work?

The questions remained in the air, along with several others that I asked, including:

1) Do you believe cryptocurrencies are important?

2) Will cryptocurrencies become mainstream?

3) Will banks be banking cryptocurrencies?

… and more.

In an audience of several hundred, they were asked to raise hands if they agreed with any of the above and, according to my reckoning, only a small smattering of hands were raised and most of those were from the speakers.

Hmmm … it appears that for all of our interest in cryptocurrencies, bitcoin and such like, the mainstream banking community are still dismissing it as pie in the sky.

If you are interested, here is a summary of the session (15 minutes):

Ah well, off to the Technology Forum for a more informed view of what bankers see as key tech trends.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...