Someone is always wondering what the future job titles are going to be in banks.

Brett King recently presented about such, and had the top five titles as:

Data Scientist – the most sought-after banking job in five years, since they will be tasked to figure out “when, why, and how” consumers use bank products, using statistics and big data provided from bank products.

Storyteller (User Experience Designer) – A “storyteller” is actually a user experience designer, who will be tasked with understanding what products customers need and when they need them. They will also help make products available in a frictionless (and in terms of debt, and shame-free) way.

Behavioural Psychologist – A behavioural psychologist will try to understand consumers, and anticipate the relevancy of bank products for customers.

Algorithmic Risk Specialist – As technology improves, banks will be able to evaluate risk using highly complex formulas, and do it in real time. With data will come understanding of risk.

Community Advocacy Builder – This role is designed to foster good relations with customers, as banks and their products become more closely integrated with a consumer’s daily life

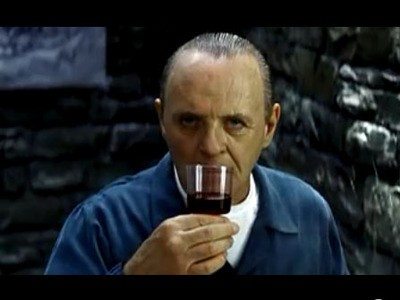

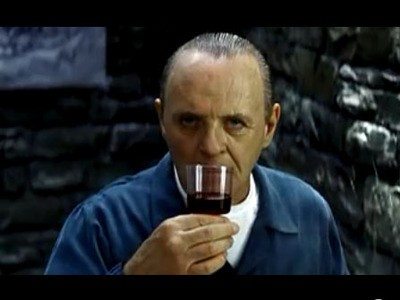

This list was curated from a longer list Brett gathered on the Next Bank Facebook page, but everybody missed the one title that will be the most important one in the future: the Chief Cannibal.

The Chief Cannibal runs the internal Cannibalization Department, a group with the one pure mission: destroy our business.

The focus of the cannibals is to look at every part of the bank and see if they could destroy it. Using technology, new structures, new thinking, new business models, the aim of the cannibals is to knock down the sacred cows within the bank, leap across the product silo’s and challenge every nuance of thinking.

Of course, the cannibals are really annoying – who wants to get eaten? – and they don’t necessarily appear on your doorstep every day but, when they do, prepare to be destroyed.

Now, why is this an important role?

Well I guess it’s obvious, isn’t it?

Most businesses, and banks are true of this more than most, exist on complacency. Funnily enough, when the non-banks like Virgin and Sainsbury, entered the UK banking markets back in the 1990s, they surveyed customers and found that most customers thought banks were ‘greedy’, ‘arrogant’ and ‘rude’ but, most of all , they thought they were ‘complacent’.

Now banks can afford to be complacent when there’s little changing and new competition find it difficult to break into the markets due to high barriers to entry. However, now, with fast cycle change, lowered barriers to entry and innovation occurring everywhere, banks are finding themselves being forced to respond faster and faster.

In order to do that, there can be no better qualification than having an internal unit that works first and foremost to destroy the tenets of the old banking model. This is in order that the bank can be alert to weakness or exposures far sooner than waiting for someone outside to find them.

That is why banks need an Internal Cannibalisation Unit and, if I could get that job, I would be happy to be nominated s the Chief Cannibal. In fact, it would be a pleasure, as I enjoy a bottle of Chianti.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...