So that is the end of another SIBOS, and what a SIBOS it was! For me, it all flew by too fast, but maybe that’s because I was involved in too many things from cryptocurrencies in the innotribe to innovations in Poland, from Basel III intraday liquidity challenges to the threat of cyberattacks.

That’s the trouble with SIBOS – it’s too many conferences in one week.

You have the forums covering standards, compliance, investment managers, corporates, market infrastructures and technology, as well as innotribe and the new Sibos University. That’s eight subconferences under the SIBOS banner. Add on the exhibit hall, the plenaries, the open forums and vendor presentations, and it’s too much for any one person to cover. So you have to be selective, or go where the music takes you.

It was interesting to hear, for example, that the takeaway in the closing plenary was collaboration.

Past collaboration has been limited, because much of what we do was seen as competitive edge, but there's limited competitive edge in services that are commoditised. This is particularly true when you add on the many challenges banks face: resiliency, transparency, liquidity, capital adequacy, lower margins, new competition and the whole speed of change in technologies... all of these things are forcing collaboration and there are now concrete steps towards achieving this, such as the KYC registry from SWIFT.

All well and good, but I didn’t get the idea of collaboration in the seessions I attended. I got fear.

Yes, SIBOS atmosphere is far more optimisitic than in previous years, but there was a sense of fear of the reguators in the air. Bear in mind the number and size of bank fines this year (and that’s not just billions for breaching money laundering rules but billions for screwing customers over mortgage foreclosures too) and you can smell fear.

Stephan Zimmermann, Deputy Chairman of the SWIFT Board, mentioned in the closing ceremony that CEOs of banks were polled with the question: do you believe there will be another financial crisis in the next 5-20 years? and over 70% of those responding said yes.

Chris Church who heads up SWIFT America, summarised the week as being one where we now “know how to handle compliance and regulation effectively”.

I’m not so sure.

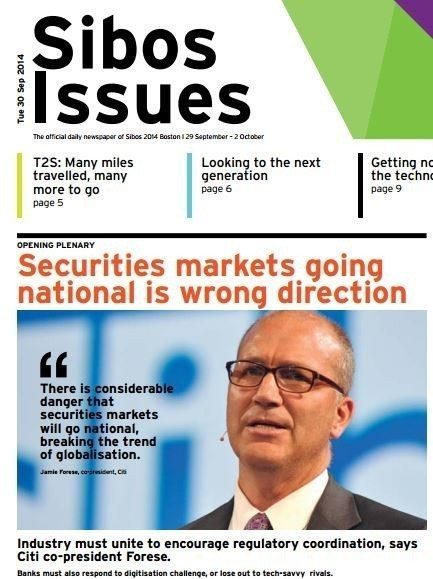

Take one example: Jamie Forese’s presentation at the opening plenary on Monday.

Jamie’s presentation was covered in the print version of Tuesday’s Sibos Issues with the headline: “Regulators going in wrong direction”.

I agree, but then Citi’s PR saw the front page and went ballistic, as this could light the regulator’s wrath. As a result, the front page of Sibos Issues in the online version now reads: “Securities market going national is wrong direction”.

Banks are afraid of the regulators. That is clear.

Maybe that’s a good thing after the too big to fail debacle, but it’s interesting that this subtext was not identified by any of the official media that I read.

Anyways, the SWIFT party was all American games themed (basketball, baseball, American football …) with burgers and beers. A great way to finish and now let’s look forward to next October in Singapore where the theme might be Hope.

See you there or somewhere.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...